Key takeaways as earnings season winds down

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- S&P 500 companies experienced tepid sales growth

- Many companies report the consumer is starting to pull back

- Fundamentals support mega-cap tech’s strong gains

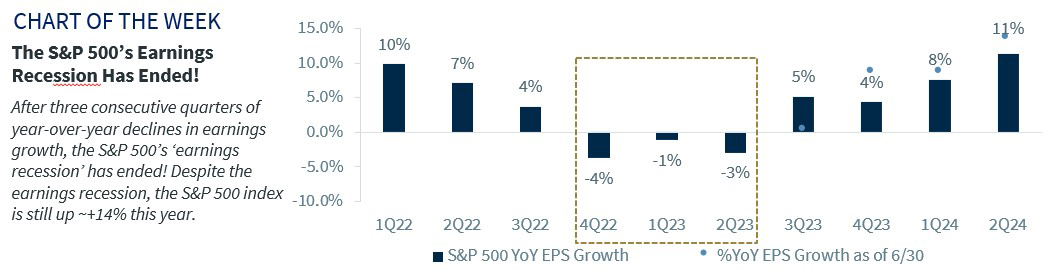

Good news – the earnings recession is over! After three consecutive quarters of negative earnings growth, 3Q S&P 500 earnings are on pace to climb 5% YoY. If sustained, this would be the best quarter of earnings growth since 2Q22. For the most part, 3Q’s earnings results have been relatively solid. The magnitude of earnings beats (~80%) and the number of positive earnings surprises (~7%) this quarter have come in above their ten-year averages. However, sales results have been less than stellar. While next week brings the “unofficial end” to 3Q earnings season, all eyes will be on several big retailers (i.e., Walmart, Target and Home Depot) for insights into the health of the consumer, guidance on the upcoming holiday shopping season and whether retailers are still destocking inventories. With the earnings season drawing to a close, here are five key takeaways:

- Tepid sales growth | Sales growth underwhelmed in 3Q, rising ~2% – the second consecutive quarter that sales growth was below the ten-year average of 5.6%. The percentage of companies beating top-line estimates (~61%) and the magnitude of beats (0.3%) were also below average. Going forward, we expect sales growth to remain under pressure for two reasons. First, sales growth is highly correlated to nominal GDP. And with our expectation that the economy will experience a mild recession in the first half of next year, consumer and business demand is likely to be suppressed. Second, the inflationary environment allowed businesses to pass cost increases on to consumers, but company pricing power appears to be coming to an end. With inflation decelerating and demand starting to wane, companies may find it more difficult to increase their revenue growth. This means that volume growth will need to be the driver of sales, which is unlikely in a recessionary (even if it is mild) environment.

- Moderating consumer | While consumers are still spending, the 3Q earnings calls were peppered with anecdotal evidence of a slowing and more discerning consumer. On a bright note, consumers have continued to prioritize travel – which was echoed in earnings reports from select air and cruise lines which reported that future bookings remain strong. However, many other companies are seeing the consumer starting to pull back. For example, Harley Davidson and Malibu Boats reported weakening demand for big ticket items, largely due to higher borrowing costs and reduced affordability. Appliance maker Whirlpool has had to return to promotional activities to boost sales. And consumers are not just pulling back on big-ticket items, they are also cutting back on non-discretionary spending and starting to trade down to private (e.g., generic) labels. In fact, Target mentioned that consumers have become more judicious with their food and beverage spend and Amazon pointed out that consumers are shopping around for more deals. And with credit companies, such as Equifax, reporting that delinquencies for lower-income consumers are rising, it does suggest that the consumer will be less of a driver of growth going forward.

- Mega-cap tech steals the show | The outperformance of the mega-cap tech companies YTD has dominated media headlines. This is understandable given a composite of Microsoft, Apple, Alphabet, Meta, Amazon and NVIDIA (or MAGMAN) has climbed ~60% YTD, while the rest of the constituents in the S&P 500 were flat. However, the 3Q results help justify why MAGMAN has outperformed. For example, the earnings growth of MAGMAN climbed ~55% YoY in 3Q and is expected to be up ~35% in 2023. However, when you strip MAGMAN out of the Index, the rest of the S&P 500 actually saw an earnings decline of ~1% in 3Q! Additionally, MAGMAN beat estimates by ~20% in 3Q – nearly triple the beat of the S&P 500. So, while MAGMAN has seen robust performance, third quarter earnings season results suggest that the outperformance is backed up by healthy fundamentals.

- Solid financials | Concerns about the health of the Financials sector have lingered following the regional banking crisis earlier this year. However, the 3Q earnings results suggest that the Financials sector remains on solid footing. Financial sector earnings rose nearly 18% YoY—its best growth rate since the 4Q21. In fact, the sector’s earnings were over 3x the S&P 500’s ~5% YoY growth rate. Also of note, bank CEOs highlighted stabilizing deposit outflows and moderating loan loss provisions – suggesting that credit losses are not accelerating. This is consistent with the Senior Loan Officer Opinion Survey (SLOOS), which highlighted weakening loan demand amid tightening lending standards and higher interest rates, but in aggregate, still healthy fundamentals overall.

- Waning shareholder friendly activity | Shareholder-friendly activity has been a significant tailwind for the equity market over recent years. However, buybacks have become more challenged, dipping below the previous ten-year average for the first time since 4Q20 this quarter. In fact, buybacks have slowed for three consecutive quarters, now ~50% below their 1Q22 peak. With the economic outlook likely to be more challenged and interest rates at multi-year highs, buyback activity will likely shrink further.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.