Bond market perspective

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

The volatility experienced across the bond market over the past several months is a good reminder of two important truths: 1) things can change quickly, and 2) there is no guarantee of a return to yesterday. Discounting or ignoring these somewhat basic statements could potentially affect portfolio returns long into the future in a negative way. Let’s dig a little deeper.

Things Can Change Quickly…

Yields are at some of their highest levels in well over a decade across the fixed income landscape. The ability to lock in yields at these attractive levels for years to come is an extraordinary opportunity for fixed income investors. Yet, the amount of time that this window will be open is unknown and could disappear quickly and potentially not return for another decade or more. The past several months are a reminder that yield opportunities can disappear quickly. “Strike while the iron is hot” is a cliché that comes to mind.

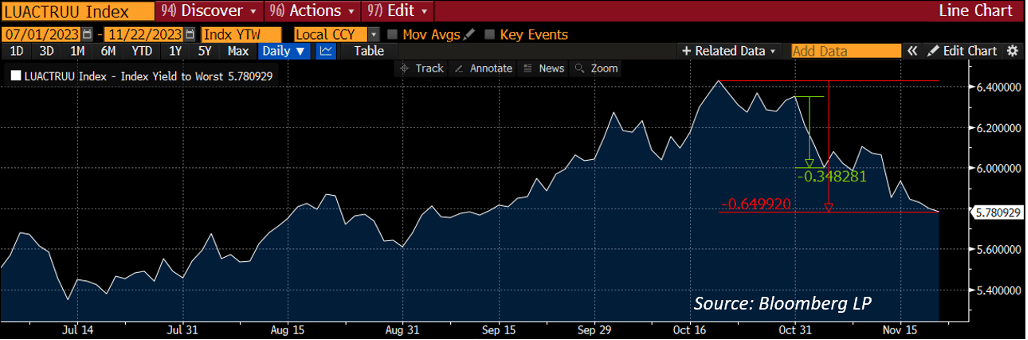

The chart below shows the yield of the Bloomberg US Corporate Bond Index over the past few months and highlights how quickly things can change. The green arrow highlights a ~35 basis point decrease in yield over the span of just a few days, from 10/31 to 11/3. Stretching out the window from mid-October to now (11/22) and we see a ~65 basis point decrease in yield in just over a month. So hypothetically, a corporate bond portfolio that yielded 6.43% a month ago is yielding 5.78% today. That is a fairly sharp decrease in yield opportunity over a relatively short period of time.

A Return To Yesterday Is Not Guaranteed…

Just because something was available yesterday, or a month ago, does not mean that it will be obtainable again. Want to buy Apple stock at $5 a share? That ship has sailed. In the same manner, thinking that yields must return to their levels of yesterday could be a huge error in judgment with negative long-term consequences to a portfolio. Using the yield of the corporate bond index highlighted above as an example, just because a yield of over 6% was available very recently does not mean that a return to a 6% yield is guaranteed in the future. Could it happen? Absolutely, but there is also the chance that yields could continue to move lower and the missed opportunity caused by hoping of a return to yesterday could prevent an investor from locking in today’s available yields. From a historical perspective, yields are still extremely attractive relative to the past 15+ years. Anchoring to yield level in the past or basing investment decisions on predictions about the future can create misallocations and missed opportunities. If the opportunities available in today’s market can satisfy an investor’s personal needs and position your portfolio for success, take advantage and lock it in.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.