Inflation remains on a downward path

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Economic slowdown is becoming more evident

- Inflation remains on a downward path

- It’s all about the Fed’s dot plots

The Federal Reserve (Fed) meets for its final meeting of the year next week – the last major economic event of 2023. While rate hikes are off the table, the Fed will provide its quarterly update on its outlook for the economy and rates. The meeting comes after some explosive moves in the equity and bond markets, which were fueled by dovish commentary and speeches from a few Fed members and the market’s growing optimism that the Fed will cut rates aggressively next year. Financial markets will be closely monitoring what Chair Powell has to say in his press conference, which has the potential to up-end markets after some sizeable gains in recent weeks. While we do believe the next move in policy rates is lower as a mild recession early next year remains our base case, we worry that markets have gotten a bit ahead of themselves. Here’s a brief update on our outlook for the economy and the Fed.

- Economic slowdown becoming more evident | Investors are beginning to price in a ‘soft landing’ as the base case over the next 12 months. This is evident across a number of indicators. For example, the number of Google searches for ‘recession’ are at the lowest level since February 2022. Consensus GDP forecasts for 2023 have been revised up to 2.4% (an upward revision of 1.8% since the start of the year – its largest upward revision since the late 1990s). And 2024 estimates (1.7%) have also moved higher. We still view a mild recession beginning in 2Q24 as the most likely scenario as economic activity is beginning to slow. The labor market is loosening, with initial and continuing jobless claims increasing, the six-month moving average slowing to a two-year low (particularly with more cyclical areas, such as temporary help and trucking rolling over) and job openings at the lowest level in March 2021. Consumer confidence remains weak with mixed messages on spending (e.g., online spending strong, but Mastercard data suggest flat spending on an inflation adjusted YoY basis) stemming from the holiday shopping season thus far. And the Atlanta Fed GDPNow currently expects 4Q growth to slow to 1.2% (down from 5.2% in 3Q), the slowest pace of growth since 2Q22.

- Inflation remains on a downward path | After peaking at the highest level (+5.6%) since the mid-1980s, core PCE inflation has decelerated to the slowest pace in 2.5 years, falling for nine consecutive months – the longest stretch since 1990. And that trend is likely to continue. First, with real-time indictors such as Zillow and rent.com suggesting that rents are falling on a year-over-year basis, shelter prices (which have remained stubbornly high) should decline in coming months. Second, crude oil prices have fallen to their lowest level in five months. Third, auto production (which encapsulated the supply chain issues in the post-COVID environment) has normalized, putting downward pressure on both new and used vehicles. In fact, an alternative measure of Used Vehicles prices (the Manheim Used Vehicle Index) shows that used vehicle prices declined ~6% YoY in November. Fourth, our forecasted economic growth slowdown should further reduce demand and thereby push prices lower. Fifth, discounting and promotional activity on goods has been prevalent during the holiday shopping season. So, while inflation is not quite at the Fed’s 2% target, the Fed should feel comfortable that inflation is on a sustainable downward path to achieve its goal.

- It’s all about the Fed’s dot plots | The Fed’s updated dot plot projections will be released at the FOMC meeting next week. In their September update, policymakers signaled a more hawkish stance – raising the growth outlook, lowering the unemployment forecast and removing two rate cuts – driving home the message that rates would remain higher for longer. However, with growth decelerating and inflation cooling, the lagged impact of the Fed’s interest rate hikes are being felt. We expect downward revisions to 2024 GDP forecasts, an upward revision to the unemployment rate and unchanged inflation projections. However, with a December rate hike now firmly off the table, the Fed’s 2024 rate projections (5.1%) are likely to be revised lower to maintain the two 25 basis points rate cuts penciled in last quarter. While the primary focus is on what the Fed will do in 2024, focus should also be placed on where the Fed ultimately sees the long-term ‘neutral’ fed funds rate. For now, the Fed is penciling in that rates will eventually glide down to a 2.5%, which is significantly lower than the current fed funds rate.

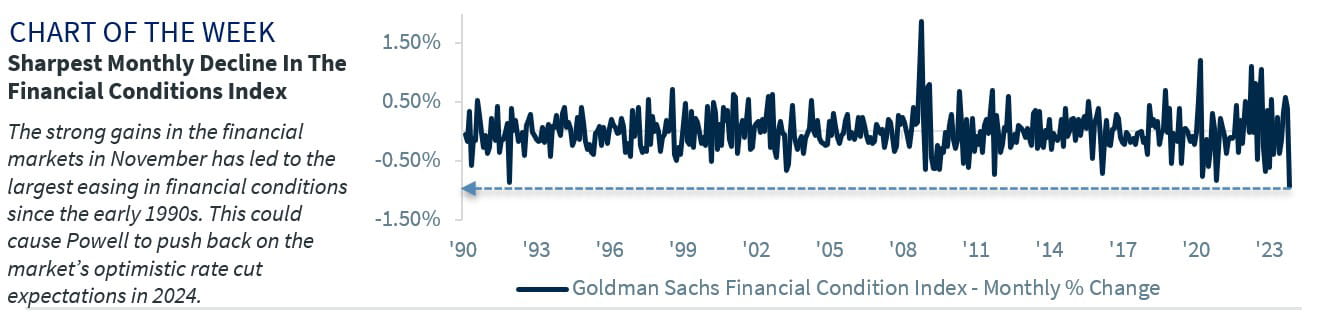

- Watch for push back from Powell | Dovish comments from a few policymakers and further disinflation signs fueled a major market repricing of Fed expectations since the last FOMC meeting. The market currently expects five 25 basis point rate cuts by year-end 2024 versus only two signaled by the Fed last September. This major disconnect is likely to be in focus when Powell takes the podium next week at his press conference. Why? Because Powell is likely to use the press conference as an opportunity to push back against the market’s growing magnitude of rate cuts in 2024 and beyond—particularly given that the ‘everything rally’ in November that helped produce the sharpest monthly decline (i.e., loosening) in Goldman Sachs Financial Conditions Index (a measure of how tight or loose the monetary policy stance is) since the 1990s. If Chair Powell is more hawkish than market perception, it could lead to a pullback in asset prices after last month’s strong gains in both the equity and fixed income markets.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.