Why are earnings estimates like New Year’s resolutions?

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Earnings growth likely to remain below average in 4Q

- Downward revisions to 2024 estimates to come

- Tech-related sectors a standout in 4Q

The start of a new year brings the annual tradition of setting a new goal. Whether you choose to commit to a family, finance, health or personal goal is a matter of choice, but the promise of becoming a better version of yourself entices all of us. While enthusiasm about sticking to a New Year’s resolution is greatest at the start of the year, it often fades as the year progresses. Which got me thinking, New Year’s resolutions are like earnings estimates—they start strong at the beginning of the year as analysts are most optimistic, but typically move lower over the course of the year. Historically, over the last fifteen years, S&P 500 earnings have been revised lower throughout the year by ~4%. As 4Q23 earnings season kicks off this week and 2024 earnings come into focus, here are some of our initial thoughts.

- Positive, but muted earnings growth | Currently, consensus earnings growth is expected to be 1.3% YoY for the fourth quarter, which would mark a deceleration from 3Q (+6.1%). However, it is worth noting that if earnings ‘beat’ estimates at their historical magnitude (~4 to 5%), they may outpace the growth rate seen in third quarter. Even if it does, EPS growth will likely remain below the 10-year average (+8.6%), which is consistent with the weaker economic environment we are experiencing. Stripping out the Energy sector provides a slightly more optimistic picture, with S&P 500 earnings ex-Energy expected to rise ~5%. The top-line tells a similar picture of moderate growth, with sales growth expected to rise only 3.4% in 4Q.

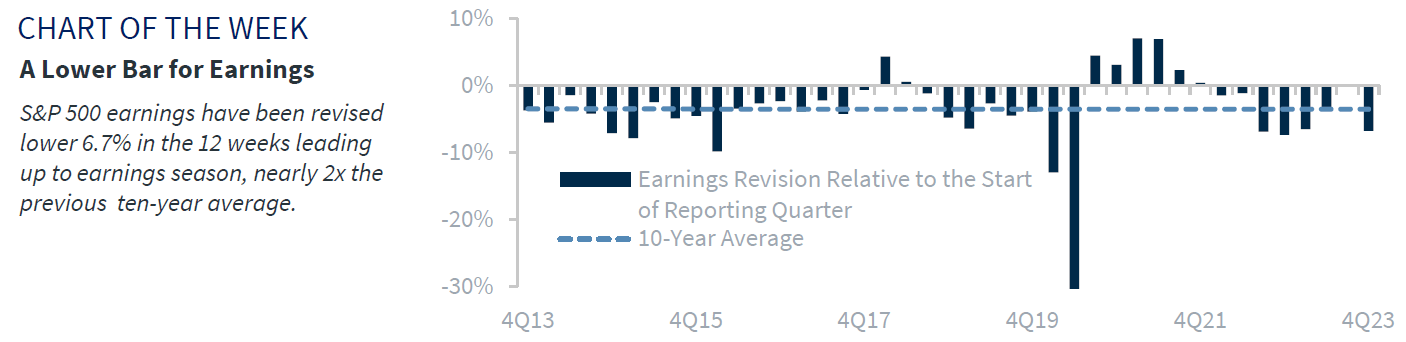

- Low bar after downward revisions could increase volatility | Despite resilient economic activity and the best quarterly return of the S&P 500 (+11.7% in 4Q23) since 4Q20, 4Q S&P 500 earnings estimates have seen sharper downward revisions relative to history. In fact, in the 12-weeks leading up to 4Q earnings season, the S&P 500’s quarterly earnings have been revised down ~6.7%—that’s nearly double the previous ten-year average and sets up a very low bar to ‘beat.’ As a result, with valuations already trending near the upper end of their historical range, any earnings misses or disappointing outlooks for 2024 are likely to lead to negative price volatility over the next few weeks. Case in point: some of the early reporters that provided weaker guidance (e.g., Fedex, Nike) significantly underperformed the broader market in the three days following reporting results.

- Downward revisions to 2024 EPS to come | In comparison, 2024 S&P 500 estimates have held relatively steady, with earnings estimates only ~1% lower over the last three months – less than half the typical revision that occurs during this period. And with the market growing more optimistic about a soft landing, consensus earnings have remained near $245/share. However, our call for a mild recession tempers our earnings forecast. We expect downward revisions to pick up as we move through earnings season, with EPS likely to end the year at $225/share (~2% EPS growth vs. 2023).

- Tech to remain a standout | AI and tech-related investments were key investment themes in 4Q and 2023. This led to a significant outperformance for Tech-related sectors over those time periods. While some investors may worry that Tech-related sectors are too expensive, its outperformance is backed by fundamentals. Tech-related sectors should be a standout from an earnings perspective in the fourth quarter. While the broader market will likely experience muted top and bottom-line growth, both Tech (+16% YoY EPS, +6.1% YoY Sales) and Communication Services (+43% YoY EPS, +5% YoY Sales) should be nearly double the estimates of the broader market. We expect this earnings momentum to continue over the next 12 months, which supports our long-term favorable view of the sector. In fact, Gartner** expects IT spending to increase 8% in 2024 (vs. 3.5% in 2023).

- Margins set to ease | Elevated margins have been a significant driver of earnings growth in the post-COVID environment. In fact, S&P 500 net margins have remained above the previous 10-year historical average for 14 consecutive quarters. But as businesses experience waning pricing power as supply/demand dynamics normalize, margins are likely to compress for the fourth consecutive quarter to the lowest level (11.2%) since 2Q20. However, moving forward, margins should stabilize, as a hyper focus on operating efficiencies, cost cutting and easing input costs should help alleviate the recent margin pressures on businesses.

- Keeping a close eye on the consumer | Since 2019, consumer spending has been a driver of the economy – rising at a ~3% annualized rate over that time period. As a result, Consumer Discretionary earnings have risen ~40% during that same time period. While Consumer Discretionary earnings are expected to be up 23.4% YoY, there is a significant amount of dispersion beneath the surface and not all industries will be winners. In fact, while broadline retail (driven primarily by e-commerce names such as Amazon) and hotels, restaurants and leisure earnings are expected to be up ~700% and 140% respectively, all other discretionary industries are expected to be negative on a YoY basis. This is consistent with our view that consumer spending is weakening and will likely continue to weaken over the next 12 months. Guidance will be instrumental in shaping our views.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.