No fooling – a silver lining for investors

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

For lack of a better word, the fixed-income mantra is getting stale. Interest rates have peaked, and they remain at elevated levels, allowing investors to take advantage of higher income and ample cash flow opportunities. Before boredom influences investment behavior and dismisses this opportunity in hand, digest the positive long-term potential effect that this carries. It has been nearly two decades since investors have had the opportunity to capitalize on yields at these levels, yet questions abound as to the timing of implementing such a strategy. The perplexity is amplified by the resounding projection from economists and pundits alike, that conditions exist to suggest interest rates are likely to decline over the next year. In addition to all this is the fact that an average investor might have roughly 40 years (ages ~25 to ~65) to optimize the dollars put aside for investing in a lasting retirement plan.

The lack of confidence to implement a fixed income strategy may center around the present-day elongated economic cycle. The bond market has failed dramatically to comply with a society shaped by instant gratification. The Fed was already supposed to have cut interest rates, inflation should have diffused back toward 2%, consumers should have run dry of disposable income, corporate earnings should have retracted, and unemployment ought to be sharply higher by now. Since none of these events have met their hurried timeline, the economic cycle “must” be off tilt, so consumers doubt that the economic cycle will play out. All is fine and will remain fine?

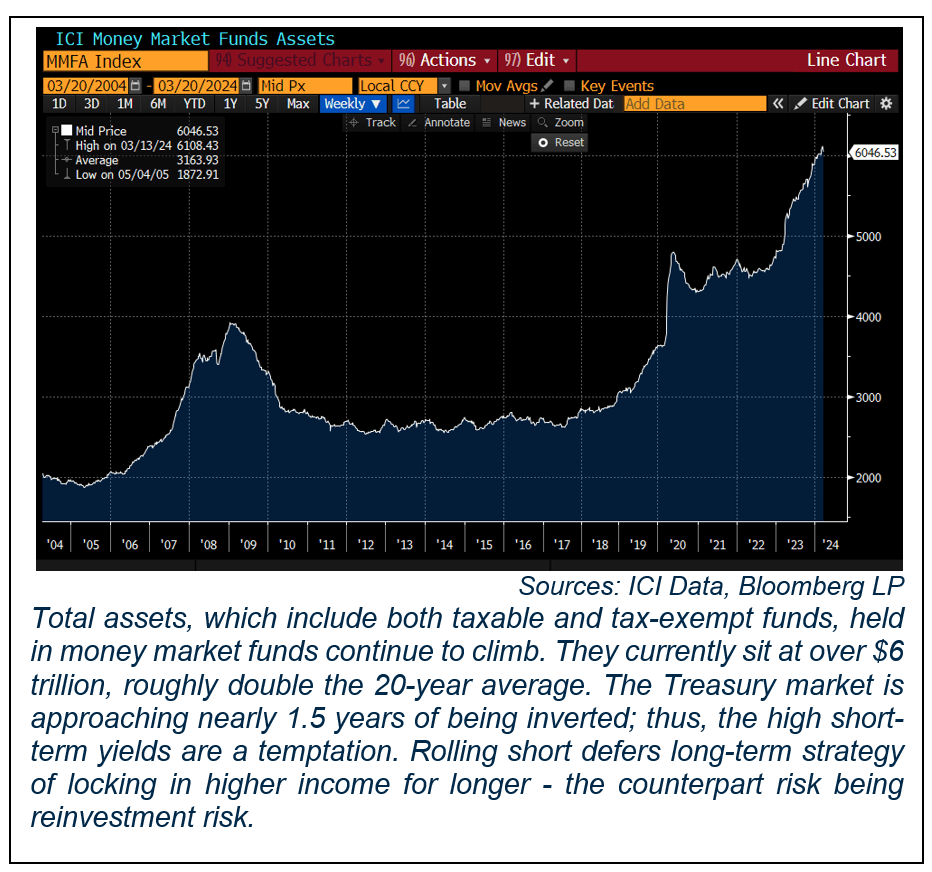

A more likely reality is that intervention and grossly understated liquidity stockpiles have helped to lengthen our current economic cycle. Despite growing debt, increasing consumer interest payments, and diminishing savings, sidelined cash has pushed stocks to historic highs monopolizing consumer attention and overweighting growth allocations. Stocks have continued to soar during a period when inflation is proving to be sticky, yet consumers continue to spend, and employment is considered full. The Fed has not needed to change policy while individuals have paychecks to spend and the economy sneaks forward. Even the most pessimistic analysts must pause at the robust liquidity.

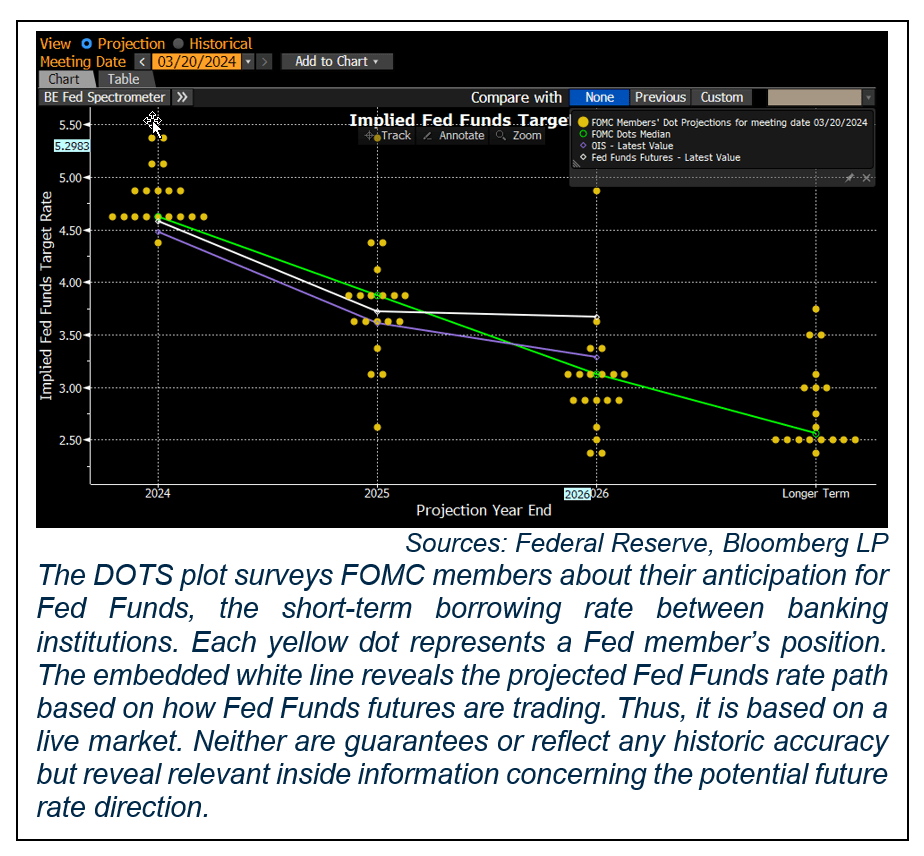

The window for Fed policy change may be constricting. As things stand, the Fed is not motivated to move while the economy and markets cooperate. Additionally, as we approach the U.S. presidential election, they may be hesitant to make a policy move for fear of interfering with election sentiment. Regardless of the latest predictions for three Fed rate cuts in 2024, the longer the economic backdrop stays the same, the less likely the Fed will change monetary policy at all this year.

Although this slow-moving economic cycle may resist the experts’ prognosticating pace, there are many indications that history will repeat itself – albeit slowly. Consumption is the major component of U.S. GDP and even hidden liquidity is finite. Inverted yield curves have consistently preceded recessions and growing consumer and government debt will not disappear. However, this will take even more time to play out and filter through the economic data. In the interim, investors can reap the benefits of higher interest rates for longer.

The 10-year U.S. Treasury may stay range-bound through this year (3.75% – 4.50%) despite interim volatility. Liquidity investors continue to benefit from the inverted curve providing higher income streams for short-term investments. Long-term investors can optimize returns through various fixed income opportunities. The corporate curve is flat, yet elevated. High-quality investment-grade credits boast near two-decade high income levels. Longer-term municipal yields benefit from a vastly upward-sloping curve from 15 to 30 years in maturity, providing attractive taxable-equivalent yields for high earners.

If interest rates fall, investors may benefit from increased total returns through price appreciation on holdings. The scenario of lost opportunity may be in a rising interest rate environment, which, most pundits deem unlikely. Even at that, investors keep collecting their elevated income streams through locked-in cash flows. Although the mantra may be getting stale, locking in longer to solid credit-quality, high-income bond opportunities will never get old. Circumstances have extended the window by creating a higher-yield-for-longer environment.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.