Interest rates are poised to tip lower

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The Fed will cut rates twice to support growth

- Interest rates are poised to tip lower

- The equity market should keep climbing longer term

Let’s go Team USA! The opening ceremonies for the Paris Summer Olympics are less than a month away (July 26). For the first time since the pandemic, fans will cheer for their favorite sports events in person. But that’s not all, there are other firsts – an opening ceremony held outside a stadium, an unusual mascot and medals infused with a piece of the Eiffel tower. So we borrow from the Summer Olympics for our quarterly theme. But rather than using some of the most popular sporting events (swimming and gymnastics) to convey our views, we use the lesser-followed sports, such as surfing, beach volleyball and breakdancing. Yes, breakdancing makes its debut at these Olympics! For more insights on our quarterly outlook, join our Quarterly Coordinates webinar on Monday, July 8 at 4 p.m. In the meantime, here’s a sneak peek:

- Economy has been ‘riding a wave’ of strength | Despite the most aggressive tightening cycle in four decades, the economy has been riding the wave of consumer strength since the post-COVID recovery. But with the consumer showing signs of fatigue (e.g. rising delinquencies, slower discretionary spending, fewer splurges), the labor market starting to slow and inflation taking its toll (particularly for lower-income consumers), the Fed needs to start dialing back some of its policy restraint to keep the recovery going. The Fed’s trick will be to cut interest rates in time to avoid an economic wipeout (aka recession) without further stoking inflation pressures. We think there is an opening to keep the surf up with two rate cuts by year end and some additional easing in 2025. This should keep GDP growth near trend at 2.1% in 2024 and 2.0% in 2025.

- Interest rates are poised to ‘tip’ lower | The bond market is guided by two key dynamics – growth and inflation. But just as beach volleyball brings new challenges for the players (sand, sun and unpredictable weather), the bond market is facing its own set of challenges – record government debt issuance, the Fed’s balance sheet and demand unease. With inflation and the economy set to cool for the remainder of the year, interest rates should tip lower. In fact, we expect the 10-year Treasury yield to fall to 4.0% by year-end and 3.75% over the next twelve months. Cash remains an attractive alternative with yields still hovering above 5.0%, but that is unlikely to last. Therefore, slowly locking in duration ahead of the Fed’s easing cycle appears prudent. Areas to consider: intermediate Treasury’s, high-quality corporates and longer-maturity municipals.

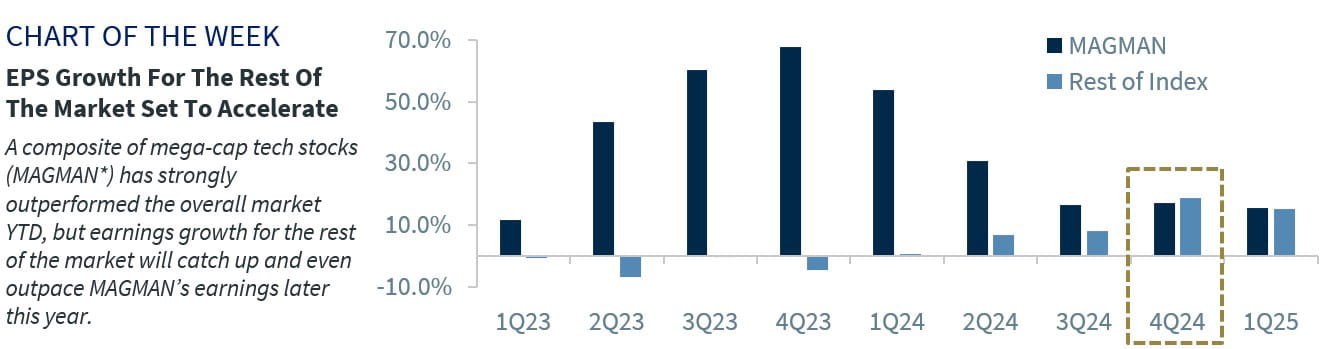

- Equities should keep ‘climbing’ | The S&P 500 has scaled to new heights in 2024 (31 record highs YTD), despite climbing a wall of worry – successfully navigating recession fears, elevated valuations and higher-for-longer interest rates. But just like in sports climbing, where the courses get harder the further you go, the equity market may encounter more volatility in the months ahead – particularly as growth slows, earnings enter a more challenging environment, and as the Presidential election nears. Despite some near-term uncertainty, we remain optimistic longer-term. And with Fed rate cuts and lower rates on the horizon, the equity market should keep climbing! In fact, we have set our year-end and 12-month target for the S&P 500 at 5,400 ($245 EPS, 22x multiple) and 5,700, respectively. Performance should broaden beyond just tech, as the rest of the index and smaller company earnings start to accelerate. Sectors we prefer include Technology, Industrials, Energy and Health Care.

- U.S. dominates on the international stage | U.S. equities have long been a standout on the world stage, outperforming the international equities (both developed and emerging) by a significant margin over the last 16 years. And just like the U.S. women’s basketball team has dominated in the Olympics, we expect tech-related companies to lead the way towards another gold medal for U.S. equity markets! Sure, the U.S. has had superior economic and earnings growth, but the U.S. remaining on top is no longer a slam dunk as the competition heats up. The biggest competitors to U.S. equity dominance are: first, Japan, where strong corporate governance, domestic inflows, and a strengthening yen could bolster performance; and, second, emerging markets, where attractive valuations, healthy earnings growth, and easing central bank policy should help.

- The ‘wrestling’ in politics has already begun | With less than five months to go until the election, the Presidential race remains too close to call. Much like the last election, the six battleground states are likely to determine the winner. Our base case calls for a divided government, with the House and Senate flipping, but would not underestimate the chance for a full sweep. As the election draws near, expect volatility to pick up over the summer and into the early fall. We’ll be keeping an eye on trade, immigration and tax policy – which could have market implications depending on the election outcome.

For a more in-depth discussion of our outlook and key insights from our quarterly Investment Strategy Survey, please register for our July 10 webinar using this link. Follow my Twitter and LinkedIn accounts for the replay or check RJNet.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.