Taper Talk

Chief Economist Scott Brown discusses current economic conditions.

According to the minutes of the July 27-28 Federal Open Market Committee meeting, “most” participants judged that “it could be appropriate to start reducing the pace of asset purchases this year,” provided that the economy were to evolve broadly as anticipated. However, “several others indicated that a reduction in the pace of asset purchases was more likely to become appropriate early next year,” because labor market conditions were seen as not being close to meeting the FOMC’s standard of “substantial further progress.” None of this should have been a surprise. Fed officials have expressed a range of views on tapering in recent weeks, with some wanting to move sooner (and faster) than others. In his Jackson Hole speech, Chair Powell is unlikely to give any specifics on tapering. No decisions have been made. That may come at the September 21-22 policy meeting.

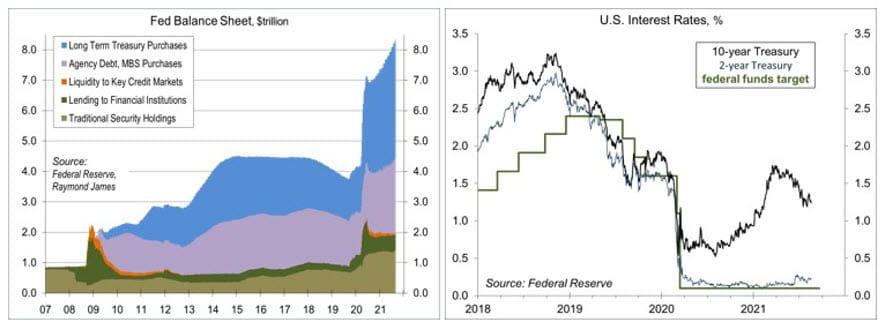

Traditionally, the Fed conducted monetary policy by raising or lowering the federal funds rate (the overnight lending rate that banks charge each other for borrowing excess reserves). However, during the financial crisis, the Fed hit the effective lower bound (0%). Large-Scale Asset Purchases (LSAP, or what is commonly called quantitative easing) became an important tool, one that was (and still is) expected to be temporary. The size of the Fed’s balance sheet has doubled since the pandemic started (to $8.3 trillion), and the Fed is adding $120 billion per month.

In his July press conference, Chair Powell noted that the Fed’s asset purchases “helped preserve financial stability and market functioning early in the pandemic and since then have helped foster accommodative financial conditions to support the economy.” Powell indicated that “in coming meetings, the Committee will again assess the economy’s progress toward our goals, and the timing of any change in the pace of our asset purchases will depend on the incoming data.” All along, Powell has indicated that the Fed will give plenty of advance notice before tapering.

Some may view the Fed’s asset purchases as contributing to the recent pickup in inflation. Granted, these asset purchases have increased aggregate demand. However, in the current environment, production bottlenecks and materials shortages are more indicative of supply constraints. Tightening policy (raising rates or reducing asset purchases) won’t help to bring on additional supply. More likely, Fed asset purchases have fueled inflation in financial assets. If so, the trick will be to let the air out easy.

The Fed is currently debating when to start tapering, how fast, and for how long. There is a range of early opinions, but a consensus should gel in the next couple of policy meetings. Note that there are 18 “participants” at FOMC meetings (six Fed governors and 12 district bank presidents), but 11 vote (the governors, the NY Fed president, and four other district bank presidents). Some of the district bank presidents tend to be more hawkish (preferring to raise rate sooner rather than later). The governors, who have more sway in the voting, tend to be more pragmatic. Hence, tapering may be more likely to start in early 2022, than this year.

The Fed’s tapering decision will depend on the economy, and the impact of the current delta wave. Still, any increase in short-term interest rates is still a long way off.

Recent Economic Data

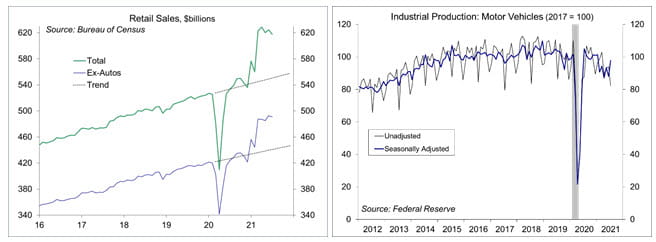

Retail sales fell 1.1% in July (+21.1% y/y), while figures for May and June were revised higher. Sales remain around 12% above the pre-pandemic trend (that’s a lot). Motor vehicle sales fell 3.9% (+28.1% y/y). Ex-autos, sales fell 0.4% (+19.3% y/y). Sales at restaurants and bars rose 1.7% (+5.9% before seasonal adjustment) — up 9.3% from two years ago. Non-store retailers (includes internet and mail order) fell 3.1% (-3.7% before adjustment, up 32.6% from two years ago.

Industrial production rose 0.9% in July (+6.6% y/y), partly reflecting a seasonal quirk in autos. Seasonal plant closings were more limited this July, resulting in an 11.2% jump in motor vehicle output (down 12.5% before seasonal adjustment). Auto output was down 5.6% from two years ago (reflecting the semiconductor shortage). Ex-autos, factory output rose 0.7% (+8.6% y/y, but up just 1.0% from two years earlier).

Single-family building permits fell 1.7% in July, to a 1.048 million seasonally adjusted annual rate (+5.5%). Multi-family permits, which tend to be choppy, rose 11.2%. Housing starts, which are erratic, fell 7.0% (+2.5% y/y), with single-family starts down 4.5% (+11.7% y/y).

Homebuilder sentiment (the National Association of Home Builders’ Housing Market Index) fell five points (to 75) in August, still strong by historical standards, but the lowest since July of last year. The drop reflecting ongoing supply constraints and affordability issues (that is, high home prices).

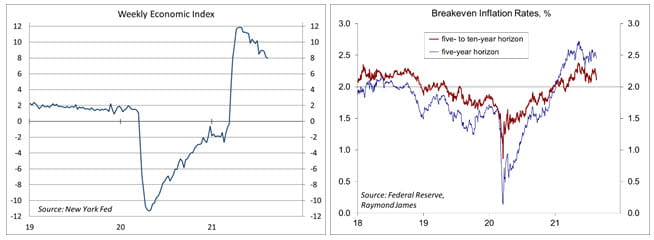

Gauging the Recovery

The New York Fed’s Weekly Economic Index fell to +7.96% for the week ending July 31, vs. +8.11% a week earlier (revised from +7.63%), as a decrease in rail traffic more than offset increases in tax withholding, fuel sales, and electricity output. The WEI is scaled to y/y GDP growth (- 9.1% y/y in 2Q20 and +12.2% y/y in 2Q21).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations, but close enough) continue to suggest a moderately higher near-term inflation outlook. The 5- to 10-year outlook remains consistent with the Fed’s long-term goal of 2%.

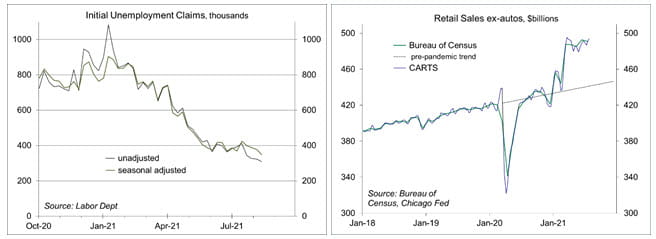

Jobless claims fell by 29,000, to 348,000 (a new pandemic low, but still high by historical standards) in the week ending July 31. Seasonally adjusted figures have been trending about flat in the last several weeks. Unadjusted claims are normally low in August and September.

In the fourth week in July, the Chicago Fed Advance Retail Trade Summary (CARTS) index (a composite of multiple retail gauges) showed a 0.6% increase in retail sales (ex-autos), following a 0.9% rise in the previous week. July retail sales (ex-autos) were projected to be up 0.2% from June.

The University of Michigan’s Consumer Sentiment Index fell to 70.2 (below the April 2020 low of 71.8) in the mid-month assessment for August (the survey covered July 28 to August 11), vs. 81.2 in July and 85.5 in June. Expectations sank to 65.2, from 79.0, reflecting concerns about the delta surge.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.