Advantageous timing in fixed income?

By Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

I want to start with the conclusion so that there is no confusion. To be clear, growth assets are necessary to grow wealth (call me Mr. Obvious). Protective assets typically provide less return but also less risk and, yes you guessed it, protect wealth. Neither are good substitutes for each other despite plenty of commentary and marketing challenging this assertion, I would opine that appropriate allocation to each is an essential investment portfolio strategy. In other words, having the appropriate growth assets and protective assets should usually be practiced regardless of where interest rates are or if one is more in vogue versus the other at a moment in time. Overweighting discretionary assets is different than sacrificing protection when rates are low or sacrificing growth when rates are higher… like now. What I do want to point out is that we are in a window of opportunity for individual bonds with their protective properties and perhaps this is the time to overweight by means of the discretionary assets within your portfolio. Here’s why:

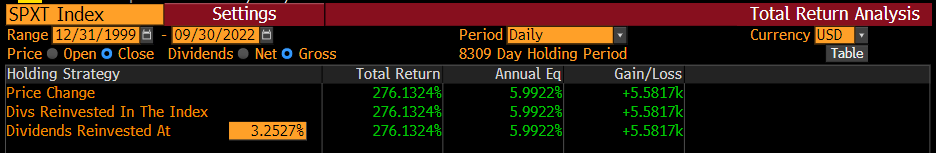

Analysts, strategists and economists alike, can easily be tempted to view data within a timeframe that helps to make their point. At the risk of doing this, I want to share some data over various periods to mitigate any misrepresentation. Since the turn of the century (12/31/1999-10/3/2022), the S&P Total Return Index has averaged an annualized return of 5.99%. This is nearly 22 years of data but it does include our current bear market plunge. Going back to 1979, I calculated 20 year averages every 5 years to reflect an overall annual average return of 9.47% for the S&P Index. According to Shiller data, since 1971, the average annualized return is ~10.5%. Clearly, “when” you enter the market and for “how long” can produce meaningful differences in return. Perhaps of equal importance is the idea of longevity in the market.

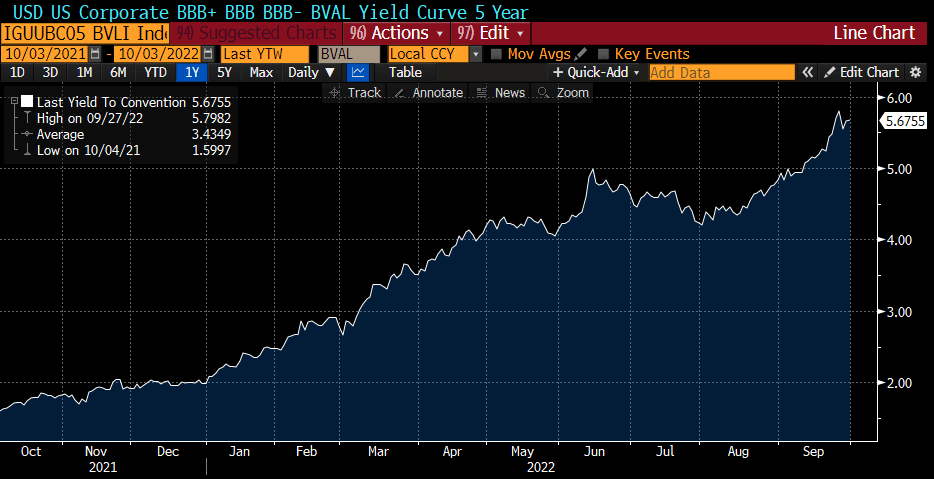

Let’s just say it is reasonable to conclude that with our riskier growth allocation, we acquire somewhere between 5.99% and 10.5% return when investing over a long period of time. Right now we can obtain similar returns with less risky high quality individual bonds. Let me emphasize we do not condone wavering from an appropriate growth/protection allocation but are excited about the significant yield opportunities that are currently available. Twenty year tax free municipal bonds offer investors in the highest tax brackets taxable equivalent yields 6.0% to even 8.0% plus. Taxable investment grade bonds can be 5.5% to 7.0% plus yields. The U.S. 5 Year Corporate BBB BVAL Index is 5.68% and the 10 year 6.04% (see charts on the following page).

If you are not having these discussions with your Raymond James financial advisor, I would suggest exploring what may be advantageous to your situation. The market is providing promising choices for nearly all investors regardless of short or long term needs and planning.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.