Certainty vs. Growth

“After 28 years at this post, and 22 years before this in money management, I can sum up whatever wisdom I have accumulated this way: The trick is not to be the hottest stock-picker, the winning forecaster, or the developer of the neatest model; such victories are transient. The trick is to survive. Performing that trick requires a strong stomach for being wrong, because we are all going to be wrong more often than we expect. The future is not ours to know. But it helps to know that being wrong is inevitable and normal, not some terrible tragedy, not some awful failing in reasoning, not even bad luck in most instances. Being wrong comes with the franchise of an activity whose outcome depends on an unknown future (maybe the real trick is persuading clients of that inexorable truth). Look around at the long-term survivors at this business and think of the much larger number of colorful characters who were once in the headlines, but who have since disappeared from the scene.”

. . . Peter Bernstein, author, historian, economist (2001)

Looking around, we don’t see many people who used to be in this business. Maybe they just couldn’t take being wrong. Or, maybe their clients couldn’t take their claiming they were always right. Or, maybe they got tired of issuing lots of predictions while, at the same time, watching the stock market going nowhere this year. One of the things my father drilled into my head goes like this:

“Son, if you think the stock market is going up, be bullish. If you think it is going down, be bearish. But for gosh sakes, make a ‘call’, because there are too many people in this business that talk out of both sides of their mouths so that, no matter what the market does, they can say, ‘See, I told you that was going to happen.’ And, if you make ‘calls’, you are going to be wrong. The real trick for a successful investor, or trader, is to be wrong quickly for a de minimis loss of capital.”

Being wrong and admitting it is a good strategy, yet very few pundits on Wall Street actually admit to being wrong. To that point, we did not see the current decline coming, and neither did our models. If fact, the models continue to favor the upside with a full charge of internal energy. This is probably because the recent pullback came on surprise news and not weakening fundamentals. As we wrote late last week:

“The preopening futures are sharply lower as the arrest of Huawei’s CFO in Canada has added to uncertainty on U.S./China trade talks, while oil is down sharply due to OPEC disappointment. Huawei is a giant Chinese telecom company, and its CFO, Meng Wanzhou, was arrested in Canada. How she could be arrested on December 1, and we are not told about it until 12-5-18, is a mystery to us, but there you have it. Indeed, they don’t call them surprises because you expect them, and yesterday’s CFO arrest was a total surprise! How it is going to effect the trade negations is a mystery, but obviously the equity markets think it is going to be impactful.”

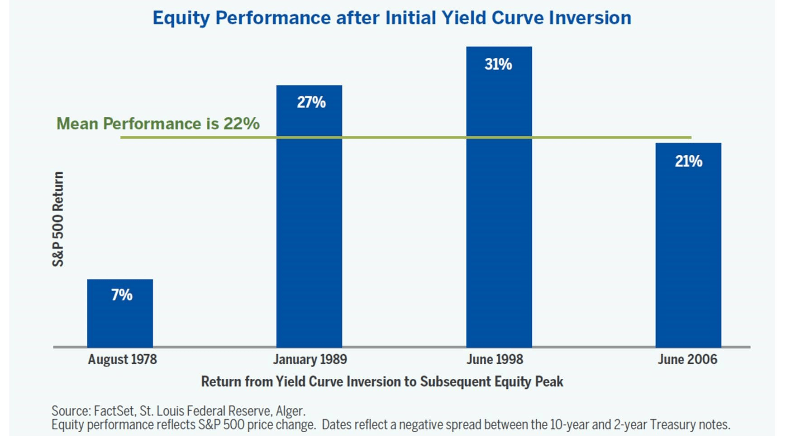

As the stock market fell into its worst weekly start of December since 2008, we spent the week in New York City seeing portfolio managers (PMs), doing media, and presenting at gigs for our financial advisors and their clients. We always like seeing PMs and exchanging investment ideas. Last week, we first met with Craig Drill, eponymous captain of Drill Capital and a brilliant investor. Over lunch, we chatted about various stocks and the overall stock market. Also at lunch was Dr. Albert Wojnilower, one half of the team of “Doctor doom and doctor gloom,” from an era gone by. Recall that Al was/is famous for his interest rate forecasts as well as his economic outlook. He told us the economy is strong, inflation is in check, and earnings are good; therefore, the stock market should be okay. The next day we saw our friend Rajiv Jain, GQG Partner’s CIO and portfolio manager of the Goldman Sachs GQG Partners International Opportunities Fund (GSIHX/$12.28). Rajiv is the PM that told us in the current investment environment he prefers “Certainty over Growth”, and that clearly makes sense to us. Subsequently, we met with our friend Amy Zhang, portfolio manager of the Alger Small Cap Focus Fund (AOFAX/$17.84) and one of the best small/SMID PMs we know. We discussed many stocks as well as macro themes. She tends to invest in companies that transform and disrupt. Of interest is that she told us that when the 2-to-10 year Treasury Note yield curve inverts, there tends to be a 22% subsequent return for the S&P 500 (Chart 1, page 2) and nearly a two year time lag before a recession begins. Of course, that foots with our comment that there is typically a 26-month time lag from when the Leading Economic Indicators (LEI) peak and a recession starts. She also noted that “the cloud” increases the addressable market. Amy espoused that healthcare has the largest dispersion between winners and losers and mentioned that her portfolio positions Healthequity (HQY/$68.38/Outperform) and CareDx (CDNA/$26.68/Strong Buy), both of which have positive ratings from our fundamental analysts, are dominate names in their respective “spaces.”

Next, we met with the best midstream Master Limited Partnership (MLP) portfolio manager we know, namely Eric Kaufman of VE Capital fame. Eric is the one that told us seven years ago we should not own “upstream” MLPs, because they have way too much sensitivity to the price of crude oil. Eric is one of the founding members of our group Friends of Fermentation (FOF), and the FOF Christmas party was held on Thursday at Eric and Victoria’s home across from the NYSE. In attendance were such notables as: Arthur Cashin, Amy Zhang, Dennis Gartman, Gerri Willis, Tom O’Halloran (PM for the Lord Abbett Growth Leaders Fund – LGLAX/$23.78), Bob Pisani, and a host of additional stars. Hereto, markets and stocks were discussed and will be featured in future missives.

The call for this week: I regret to inform you that our friend and colleague, Andrew Adams, has left the firm to pursue other opportunities. He has not, however, gone to another firm. As a result of his departure, there will no longer be the publications of Gleanings or Charts of the week. Moving on to the equity markets, except for the Utility averages, all of the other indices we monitor closed in the red last week. The reciprocal is that most of the commodities we monitor closed the week in the green. Of note is that the Advance – Decline Line remains near new highs (Chart 2, page 3) and that the real yield curve (3-month T’bills to the 30-year T’bond) is at levels that historically have been a “buy point” for stocks (Chart 3, page 3). The SPX has now had four tests of the October 29 low (Chart 4, page 4), which we deemed to be THE low, and our models continue to favor the upside. This morning, stock sell-off snowballs on world growth slowdown fears. How much will the French riots and Brexit/UK political turmoil impact markets today? If the S&P 500 low of 2621.53 from Thursday is breached, the index could tumble to 2600. The October low is 2603.54. The May low is 2594.62. The April low is 2553.80. The February low is 2532.69. More than one S&P 500 Index close below 2600 in a week would be extremely negative. The S&P 500 Index closed below 2600 for three times this year, but not twice within one week.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.