Crosscurrents

Chief Economist Scott Brown discusses current economic conditions.

Minutes from the September 21-22 Federal Open Market Committee reinforced the view that the Fed’s reduction (“tapering”) of its monthly asset purchases will be announced in November. For the financial markets, that’s completely baked in at this point. The Fed has not been debating lift-off (when short-term interest rates will be increased), but the federal funds futures market has been pricing in a rate increase next year for a while now and economists have generally pulled forward their rate hike expectations. The market expectation of lift-off has continued to creep forward, with better-than-even odds of a hike by July. That may not be bad news for the stock market, as an earlier lift-off would mean a greater chance of containing inflation.

From the FOMC Minutes: “No decision to proceed with a moderation of asset purchases was made at the meeting, but participants generally assessed that, provided that the economic recovery remained broadly on track, a gradual tapering process that concluded around the middle of next year would likely be appropriate. Participants noted that if a decision to begin tapering purchases occurred at the next meeting, the process of tapering could commence with the monthly purchase calendars beginning in either mid-November or mid-December.”

There is a broad consensus outside the Fed that emergency support for the economy is no longer needed. The question is how to end asset purchases. For this meeting, Fed staff developed an “illustrative tapering path,” which would reduce the monthly pace of asset purchases (currently

$80 billion in Treasuries and $40 billion in Mortgage-Backed Securities) by $15 billion per month ($10 billion in Treasuries, $5 billion in MBS). Once started, asset purchases would be completed seven months later. Of course, the pace of tapering could be adjusted if economic developments differed significantly from expectations. “Several participants indicated that they preferred to proceed with a more rapid moderation of purchases than described in the illustrative examples.”

The minutes also showed increased anxiety about inflation.

Fun fact 1: In his September 22 press conference, Fed Chair Powell did not use the word “transitory.”

Fun fact 2: In an online chat with the Peterson Institute for International Economics, Raphael W. Bostic (President of the Federal Reserve Bank of Atlanta) had a swear jar with the work “transitory” on it. He put more than a few bills in.

“In their discussion of inflation, participants observed that the inflation rate was elevated, and they expected that it would likely remain so in coming months before moderating. Participants marked up their inflation projections, as they assessed that supply constraints in product and labor markets were larger and likely to be longer lasting than previously anticipated. Some participants expressed concerns that elevated rates of inflation could feed through into longer-term inflation expectations of households and businesses or saw recent inflation data as suggestive of broader inflation pressures. Several other participants pointed out that the largest contributors to the recent elevated measures of inflation were a handful of COVID- related, pandemic-sensitive categories in which specific, identifiable bottlenecks were at play. This observation suggested that the upward pressure on prices would abate as the COVID-related demand and supply imbalances subsided. These participants noted that prices in some of those categories showed signs of stabilizing or even turned down of late. Many participants pointed out that the owners’ equivalent rent component of price indexes should be monitored carefully, as rising home prices could lead to upward pressure on rents. A few participants noted that there was not yet evidence that robust wage growth was exerting upward pressure on prices to a significant degree, but also that the possibility merited close monitoring.”

One of the key concerns has been that if inflation remains elevated, inflation expectations will rise, reinforcing a higher inflation trend. Jeremy Rudd, a well-respected Fed economist, recently authored a working paper challenging this central tenant of monetary policy (which says a lot about the openness of the Fed to new ideas). Rudd argues that “a review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations, and a case is made that adhering to it uncritically could easily lead to serious policy errors.” Needless to say, not everyone is on board with this. While inflation expectations may not be a good predictor of actual inflation, constant headlines of higher inflation can change the public’s view.

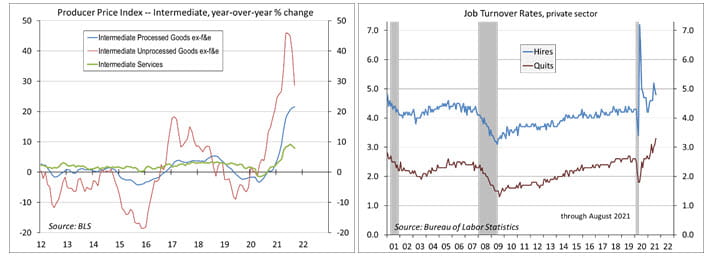

Whether higher inflation expectations will lift wages and whether higher wages will be passed through to higher prices is unclear, but the process bears watching closely. In August, 4.27 million people (2.9% of workers) quit their jobs, presumably to take better jobs elsewhere. The next several months are going to be interesting.

Recent Economic Data

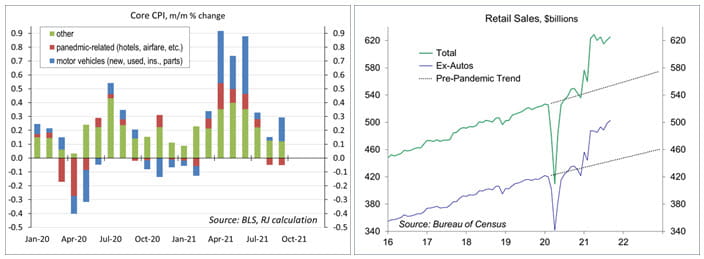

The Consumer Price Index rose 0.4% (+5.4% y/y) in September, up 0.2% (+4.0% y/y) excluding food and energy. Many of the prices that ran hot in the spring continued to moderate. New car prices advanced 1.3% (+8.7% y/y). Used vehicle prices fell 0.7% (+24.4% y/y).

Retail sales rose 0.7% in the advance estimate for September, about 13% above the pre-pandemic trend (although some of that is inflation). Figures for July and August were revised higher. Auto dealership sales rose 0.5%, a contrast to the 6.4% drop in unit sales reported by the various automakers.

Import Prices rose 0.4% (+9.2% y/y) in September, down 0.4% (+4.7% y/y) ex-food & fuels. Ex-fuels, prices of industrial supplies and materials fell 0.9% (the third consecutive decline, although +35.1% y/y). Inflation in imported capital goods, autos, and consumer goods remains moderate.

The Producer Price Index rose 0.5% (+8.6% y/y) in September. Up 0.1% (+5.9% y/y) excluding food, energy, and trade services. Ex-food & energy, pipeline pressures were mixed (intermediate unprocessed goods down 3.5%, intermediate processed goods up 1.1%).

Job openings fell to 10.4 million in August, following a record 11.1 million in July. The quit rate rose to another record high – 2.9% of workers (4.27 million people) quit their jobs in August.

In its World Economic Outlook, the IMF lowered its global growth outlook for this year to 5.9%, but noted that “the balance of risks for growth is tilted to the downside.”

Gauging the Recovery

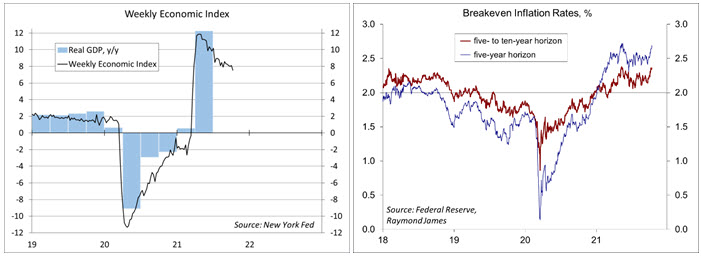

The New York Fed’s Weekly Economic Index fell to +7.54% for the week ending October 9, vs. +8.02% a week earlier (revised from +7.78%). The WEI is scaled to y/y GDP growth (- 2.9% y/y in 3Q20).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries) continue to suggest a moderately higher near-term inflation outlook. The 5- to 10-year outlook remains consistent with the Fed’s long-term goal of 2%, but the level is near the top of its recent range.

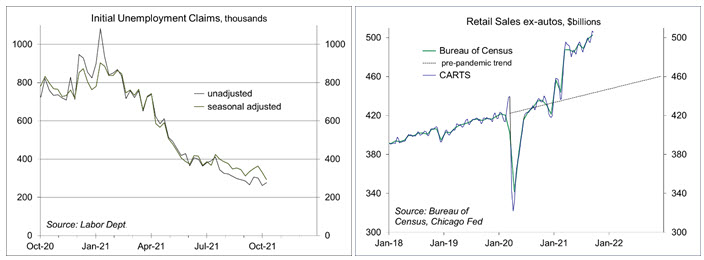

Jobless claims fell by 36,000, to 293,000 (a pandemic low) in the week ending October 9, but that largely reflect a shift in the season adjustment (which added 15,177, vs. +67,195 in the previous week).

Chicago Fed Advance Retail Trade Summary (CARTS): down 0.2% in the fourth week of September, following a 1.4% gain in the previous week. September retail sales (ex-autos) were projected to rise 0.9% from August (the government reported a 0.8% increase).

The University of Michigan’s Consumer Sentiment Index fell to 71.4 in the mid-month assessment for September (vs. 72.8 in August and 70.3 in July). The report noted declining confidence in economic policies (budget process, debt ceiling), with decline across income, age, and political affiliations.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.