Data Dump

Chief Economist Scott Brown discusses current economic conditions.

Fed Chair Powell covered no new ground in his monetary policy testimony to Congress. The Fed is a long way from raising short- term interest rates (federal funds target rate at 0-0.25%) and is in no hurry to begin tapering the monthly pace of asset purchases (currently $120 billion per month). The June report on consumer prices surprised to the upside (again), with another outsized gain in prices of used motor vehicles (which accounted for more than a third of the increase in June). Powell repeated that the recent increase in inflation is thought to be due to transitory factors. Meanwhile, retail sales ex-autos fell 1.0% in June before seasonal adjustment. Unadjusted sales typically fall more than that in June – hence, a 1.3% increase in adjusted sales.

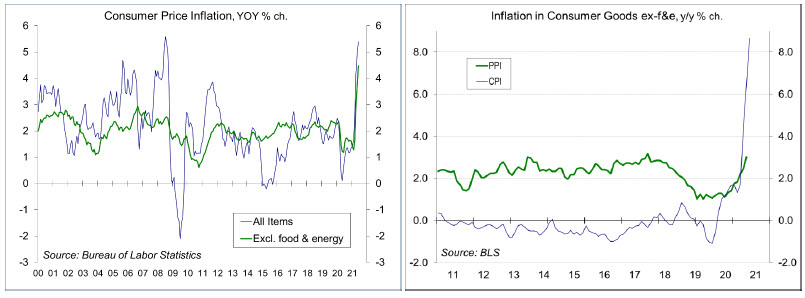

The June CPI story was essentially the same as in April and May. Inflation is up due to base effects (a rebound in prices that were held down a year ago), restart pressures (materials shortage and bottleneck pressures), and used cars. Prices of everything related to cars has risen sharply in the last three months. Some of that reflects low inflation readings last year (used car prices were down 2.8% y/y in June 2020), but the rise is mostly due to a mix of surging demand and supply constraints. Bottleneck pressures and supply constraints will take some time to clear. So far, these pressures have been a lot stronger and have lasted longer than the Fed (or just about everyone) predicted. The keys to the inflation outlook are inflation expectations and labor costs. Chair Powell noted that “measures of longer-term inflation expectations have moved up from their pandemic lows and are in a range that is broadly consistent with the FOMC’s longer-run inflation goals.” The Employment Cost Index, the preferred measure of labor cost pressures, will be released on July 30. Note that we may see some mild reverse base effects in the remainder of the year. That is, some prices may be overshooting to the upside and roll back a bit as supply chains open up.

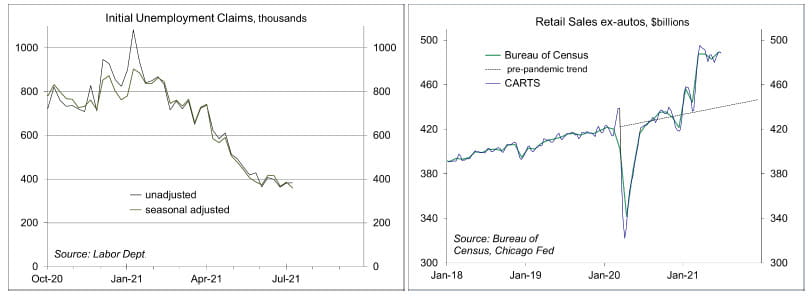

A key result of the pandemic has been a shift from consumer spending on services (constrained by social distancing) to spending on goods. It’s been widely expected that spending on goods would moderate as spending on services picks up. Last year, retail sales were back on the pre- pandemic trend relatively quickly following the lockdown plunge. This year, retail sales have vaulted to more than 10% above trend. That’s a huge increase. It may be partly fueled by government stimulus and some of it appears to reflect a rebound from pandemic-related weakness (apparel, for example), but we may be seeing more permanent changes in consumer behavior. Services are picking up, but we are far from a full recovery. Individuals may be reluctant to resume their pre-pandemic lifestyles. A surge in cases of the delta variant may weigh on decisions to move about.

Last week, roughly $15 billion in Child Tax Credit payments went out, 86% by direct deposit (the rest by check). Households received $300 per child under age 6 and $250 for each child aged 6 to 17. These monthly payments are automatic (based on tax returns processed by June 28 or through registrations for Economic Impact Payments) and last through the end of the year. The payments will help to support consumer spending growth, but will be especially beneficial to lower income households and are projected to cut childhood poverty in half. Democrats are hoping that they will prove to be popular and be extended.

I’ll be out of the office next week. No commentary for next Friday.

Recent Economic Data

Fed Chair Powell covered no new ground in his monetary policy testimony to Congress. Powell said that inflation is temporarily boosted by base effects and production bottlenecks. “Substantial further progress” towards the Fed’s goals, a trigger for tapering the monthly pace of asset purchases, “is still a ways off.”

Retail sales rose 0.6% in the initial estimate for June (+20.3% y/y), up 1.3% (+17.5% y/y) ex-autos. Excluding autos, building materials, and gasoline, sales rose 1.4% (+17.7% y/y and up 18.5% from two years ago). Figures for May were revised lower, but the level remains 10.6% above the pre-pandemic trend.

Industrial production rose 0.4% in June (+9.8% y/y), boosted by a 2.7% increase in the output of utilities (warm weather). Manufacturing output was flat, held back by a 6.6% decline in the output of motor vehicles. Ex- vehicles, factory output rose 0.4% (+9.9% y/y).

The Consumer Price Index rose 0.9% in June (+5.4% y/y, vs. +0.6% y/y in June 2020). Ex-food & energy, the CPI rose 0.9% (+4.5% y/y, vs. +1.2% y/y a year ago). Used motor vehicle prices (up 10.5%, a 30.4% increase in the last three months, and +45.2% y/y) accounted for more than a third of the June increase.

The Producer Price Index rose 1.0% in June (+7.3% y/y), boosted by an increase in trade services (higher margins in retail autos, in particular). Ex-food, energy, and trade services, the PPI rose 0.5% (+5.5% y/y).

Import prices rose 1.0% in June (+11.2% y/y), reflecting further pressure in industrial supplies and materials (+49.6% y/y). Inflation in imported finished goods remained low to moderate.

Gauging the Recovery

The New York Fed’s Weekly Economic Index edged down to +8.59% for the week ending June 26, vs. +10.30% a week earlier (revised from +9.73%), signifying strength relative to the depressed level of a year ago. The WEI is scaled to year-over-year GDP growth (GDP fell 9.0% y/y in 2Q20 and should be up about 12% y/y in 2Q21).

Breakeven inflation rates (the spread between inflation-adjusted and fixed-rate Treasuries, not quite the same as inflation expectations, but close enough) continue to suggest a moderately higher near-term inflation outlook. The 5- to 10-year outlook had crept above the Fed’s long-term goal of 2%, but has since moderated.

Jobless claims fell by 26,000, to 360,000 (a pandemic low) in the week ending July 10. Seasonal adjustment can be quirky in July, but the downtrend appears to have slowed in recent weeks.

In the fourth week of June, the Chicago Fed Advance Retail Trade Summary (CARTS) data (based on multiple sources) showed a 0.3% decrease in retail sales (ex-autos), following a 1.2% increase in the previous week. June sales were projected to have risen 0.8% from May (the Bureau of Census reported a 1.3% gain).

The University of Michigan’s Consumer Sentiment Index fell to 72.5 in the mid-month assessment for July (the survey covered June 23 to July 14), vs. 85.5 in June and 82.9 in May. The drop reflected concerns about higher inflation, which has put added pressure on the budgets of lower and middle income households and led to the postponement of large discretionary purchases, especially for upper income households.

The opinions offered by Dr. Brown are provided as of the date above and subject to change. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

This material is being provided for informational purposes only. Any information should not be deemed a recommendation to buy, hold or sell any security. Certain information has been obtained from third-party sources we consider reliable, but we do not guarantee that such information is accurate or complete. This report is not a complete description of the securities, markets, or developments referred to in this material and does not include all available data necessary for making an investment decision. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.