Don’t Fight the Fed

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

As I have highlighted before in past commentaries, market forecasters seem to perpetually predict that rates are heading higher (with very limited success). This was again the case at the beginning of 2021 which has led to many investors being seemingly caught off guard by the steady move lower in yields since they peaked in March. While there are many seemingly legitimate arguments out there that support both higher and lower yields, today I focus on a major headwind to higher yields.

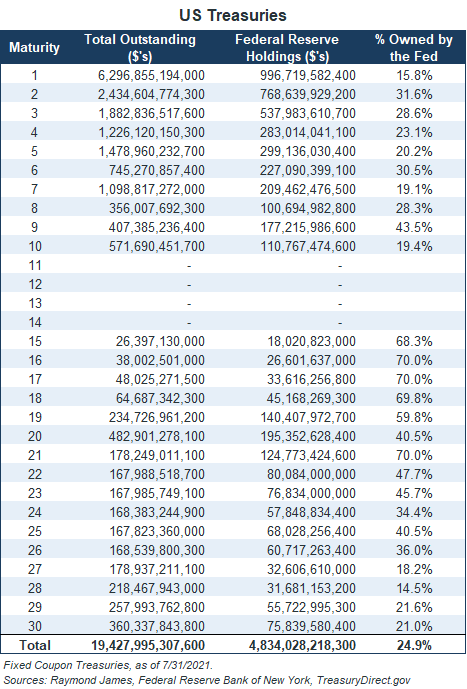

The massive number of bonds that the Federal Reserve owns and continues to purchase is intended to keep interest rates down. The purpose of the Quantitative Easing programs has been to lower borrowing costs (yields) in order to stimulate the economy. The more bonds the Fed purchases, the higher they can drive prices and the lower yields can potentially fall. The Fed currently owns over $8.2 trillion of mostly agency mortgage-backed securities and Treasuries. Simply put, the Fed is a huge force in the market. Just how big a force? The chart shines some light on how big of a demand side force the Fed has been, which shows total outstanding fixed-coupon Treasuries as well as the amount owned by the Federal Reserve, broken down by maturity year.

The percentages on the far-right column tell the story. The Fed owns ~25% of the overall market. In the 11 to 20 year maturity range, the Fed owns ~51% of the market. From 21 to 30 years, the Fed owns ~33% of outstanding Treasuries. Supply and demand basics tell us that the more demand in a market, the higher prices will go. The Fed has been an enormous source of demand in the Treasury market, driving prices higher and yields lower.

The current policy of the FOMC has them buying an additional $80 billion in Treasuries each month, so their holdings continue to grow. While there is talk of tapering these purchases, remember that tapering doesn’t necessarily mean that they are decreasing their holdings, it just means that they may be increasing them at a slightly slower rate over time. For those investors that are waiting for interest rates to move higher before committing money to fixed income, there is a chance you will be waiting quite a while. Stay invested and properly allocated to wealth preserving individual bonds throughout the course of Fed actions. As the saying goes: Don’t Fight the Fed.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.