Fed Policy Outlook: Certainly Uncertain

The minutes of the July 31-August 1 Fed policy meeting and Chairman Powell’s Jackson Hole speech reinforce the view that the central bank will raise short-term interest rates again on September 26. The pace of monetary tightening beyond that is unclear, reflecting a number of uncertainties. The impact of trade wars depends on how long they last and on their severity. However, even without trade disruptions, the Fed faces the same issues it always has when near full employment. There are risks of raising rates too fast, as well as too slow. Powell noted that in the last two recessions, “destabilizing excesses appeared mainly in financial markets, rather than in inflation” and, more recently, the Fed has “greatly expanded the scope of our surveillance for signs of labor market tightness and of destabilizing excesses more generally.”

The Fed’s dual mandate calls for maximum sustainable employment and stable prices. The Fed interprets “price stability” as a 2% inflation rate in the PCE Price Index (call this π*). The natural rate of unemployment (u*) is unclear, and can vary over time (in June, most senior Fed officials put u* at 4.3-4.6%). Under a simple monetary policy rule, such as the Taylor rule, the central bank adjusts policy based on deviations for its objectives (π*, u*). This is more complicated in practice. Powell spoke of the Great Inflation of the 1970s and the tech boom of the late 1990s as illustrating the need for judgement beyond the application of simple rules. In the current environment, there are two opposing Fed policy questions:

1) With the unemployment rate well below estimates of its longer-term normal level, why isn’t the Federal Open Market Committee (FOMC) tightening more sharply to head off overheating and inflation?

2) With no clear sign of an inflation problem, why is the FOMC tightening policy at all, at the risk of choking off job growth and continued expansion?

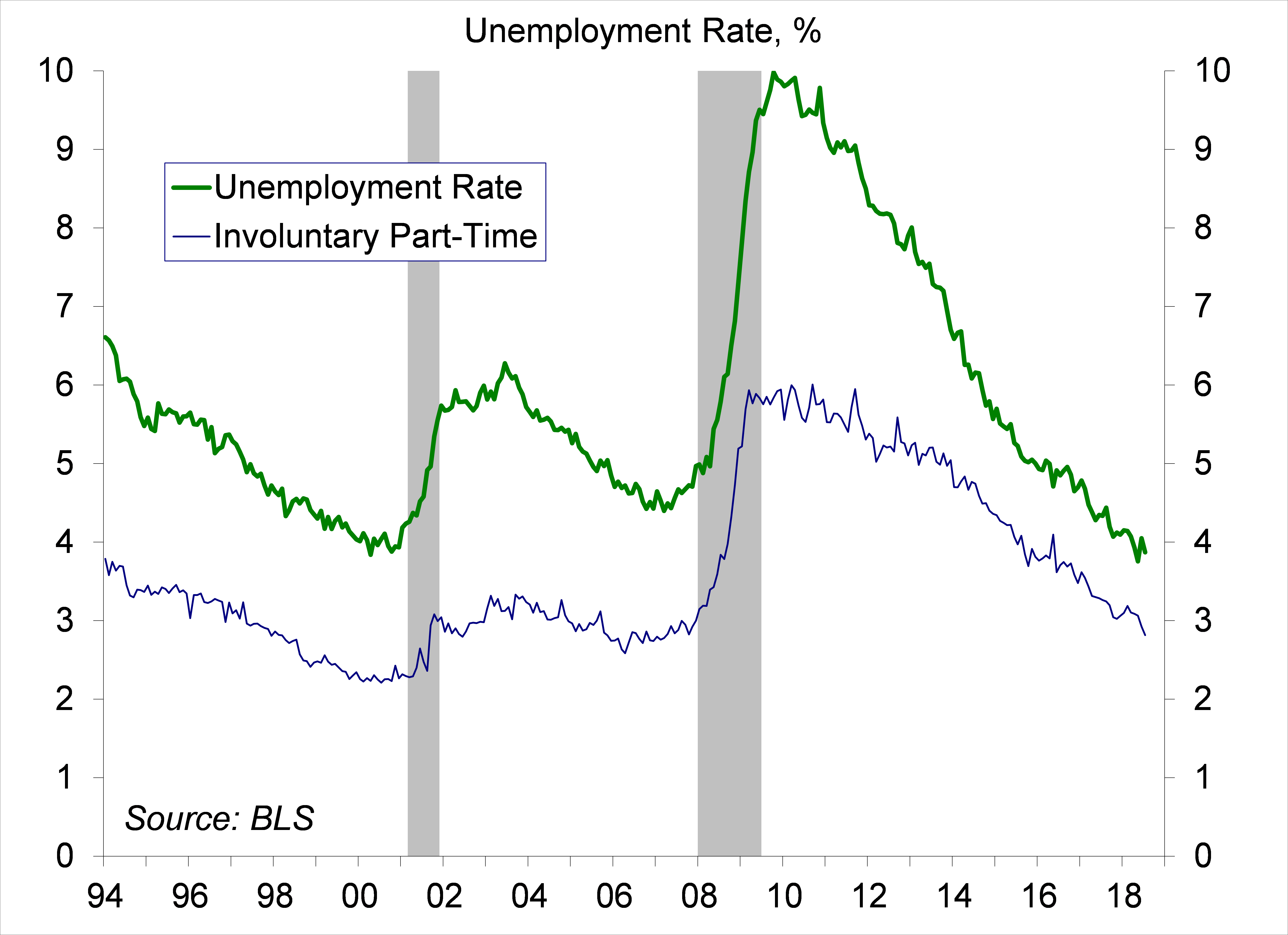

In regard to these two key questions, Powell noted a diversity of viewpoints on the FOMC, but described that as “one of the greatest virtues of our system.” Despite differing views of Fed officials, the tradition is to find common ground. Powell views the current path of gradual rate increases as taking both risks seriously. Estimates of the longer-term natural rate of unemployment (u*) are “quite uncertain,” according to Powell. In turn, the Fed relies on “many indicators when judging the degree of slack in the economy or the degree of accommodation in the current policy stance.” While inflation has moved near the Fed’s 2% goal, “we have seen no clear sign of an acceleration above 2%, and there does not appear to be an elevated risk of overheating.”

Chart 1

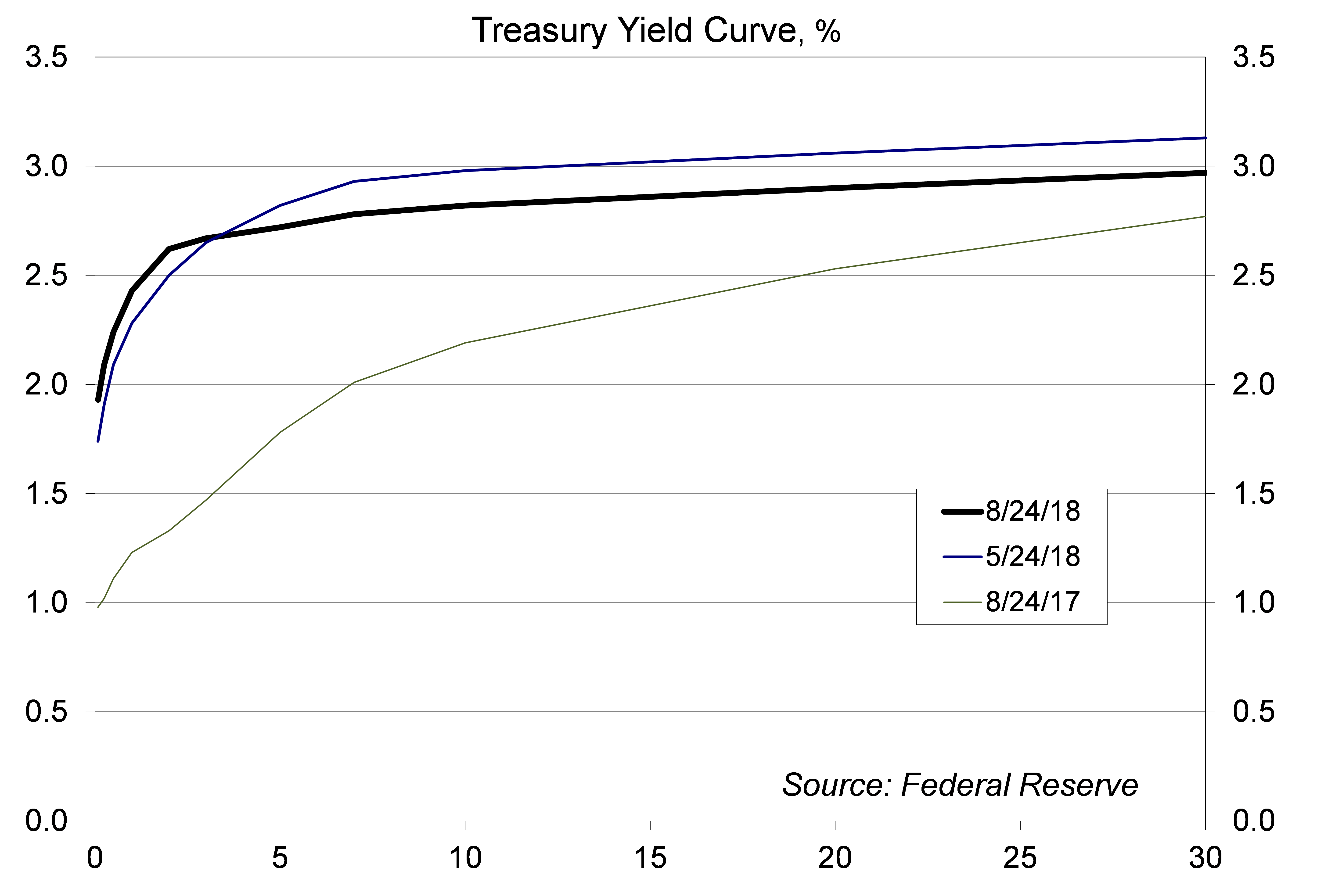

Chart 2

President Trump has now criticized Fed policy. That should have absolutely no impact on the FOMC’s deliberations. There is a long-standing belief among financial market participants that the Fed will avoid acting ahead of an election. However, in the detailed FOMC minutes, there is no evidence that the Fed has ever considered staying out of the way because of politics.

In the July 31-August 1 FOMC policy minutes, the Fed discussed the slope of the yield curve. The economic implication of a flatter yield curve depends on why it is flattening. If it is because investors are anticipating an economic slowdown, that expectation could be self-fulfilling. Strong economic growth, Fed rate increases, and the sharp rise in government borrowing all suggest that bond yields should be heading higher. However, long-term interest rates outside the U.S. remain very low, the inflation outlook is moderate, and trade policy uncertainty appears to have led to a flight to safety (into the dollar and long-term Treasuries). In other words, this time is different – a phrase commonly heard every other time the yield curve has inverted. Just saying.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.