Powell at Fed Camp

The Kansas City Fed’s annual monetary policy symposium begins later this week in Jackson Hole, Wyoming. Around 120 people attend the conference, including central bankers from around the world. In the past, the Fed chair’s speech has often been a big deal for the financial markets. This will be Powell’s first speech as Fed chair and the title (“Monetary Policy in a Changing Economy”) suggests the possibility of a change in the Fed’s approach or some modification in its thinking. However, whether Powell provides any new clues is an open question. Of greater interest will be the debates and discussions (the impact of trade policy uncertainty, full employment) in the hallways and around the grounds. Powell may even address these issues.

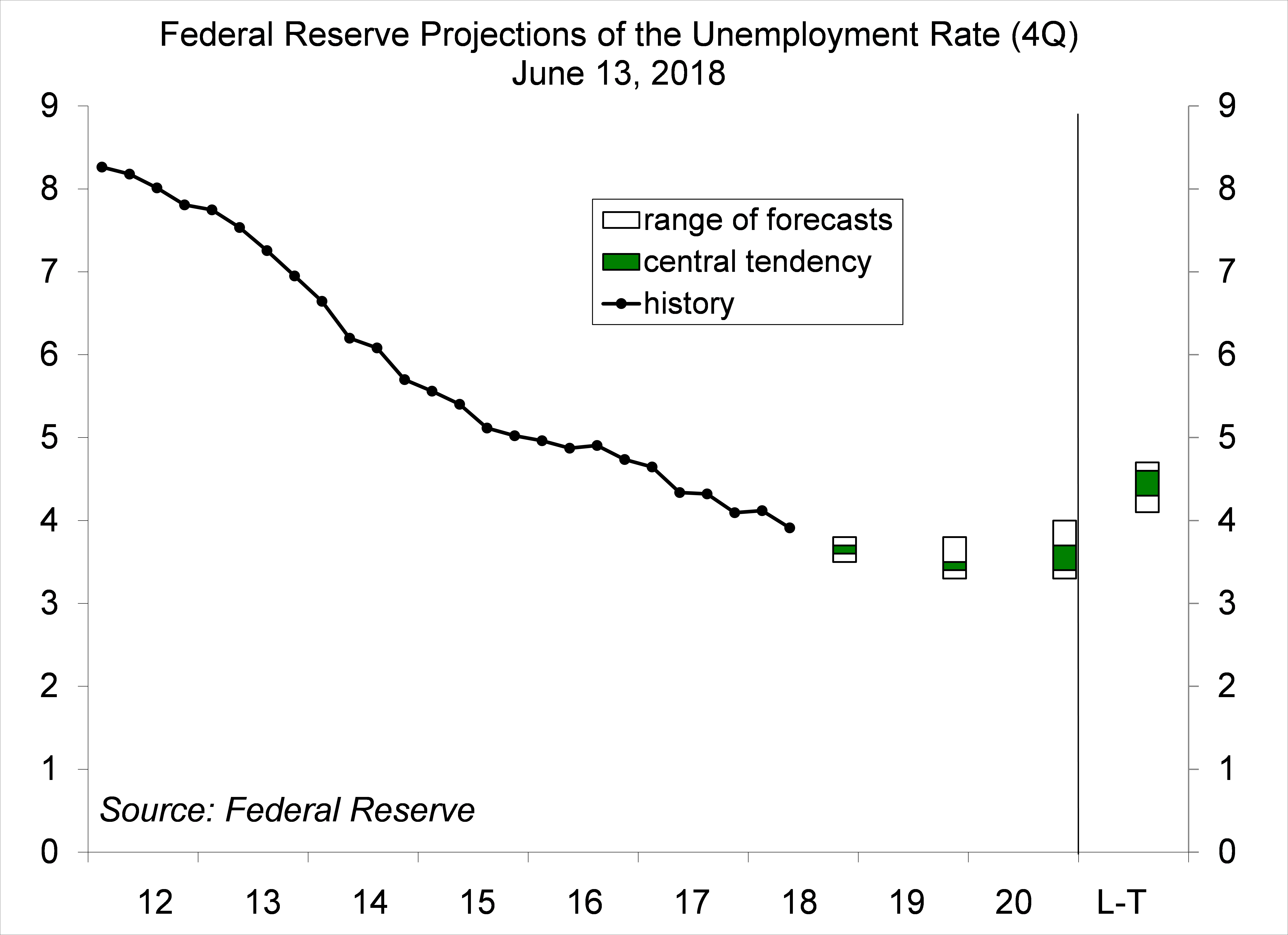

There were a few oddities in the June 13 Summary of Economic Projections (forecasts of senior Fed officials). The unemployment rate was expected to fall a bit further, averaging 3.6% in 4Q18 and 3.5% in both 4Q19 and 4Q20. However, the long-term average was seen as 4.3-4.6%, which implies that the economy would have to slow below its potential (the Fed sees the longer-term average of GDP growth at 1.8-2.0%). Job growth has remained relatively strong this year, well beyond a long-term sustainable pace (based on the demographics). At the same time, while wage growth has picked up, the pace is not especially strong (well below the kind of appreciation we’ve seen around low unemployment rates in the past). In hindsight, there was more slack in the job market than many had expected, but that slack is still declining. Labor costs are the widest channel for inflation pressure.

Chart 1

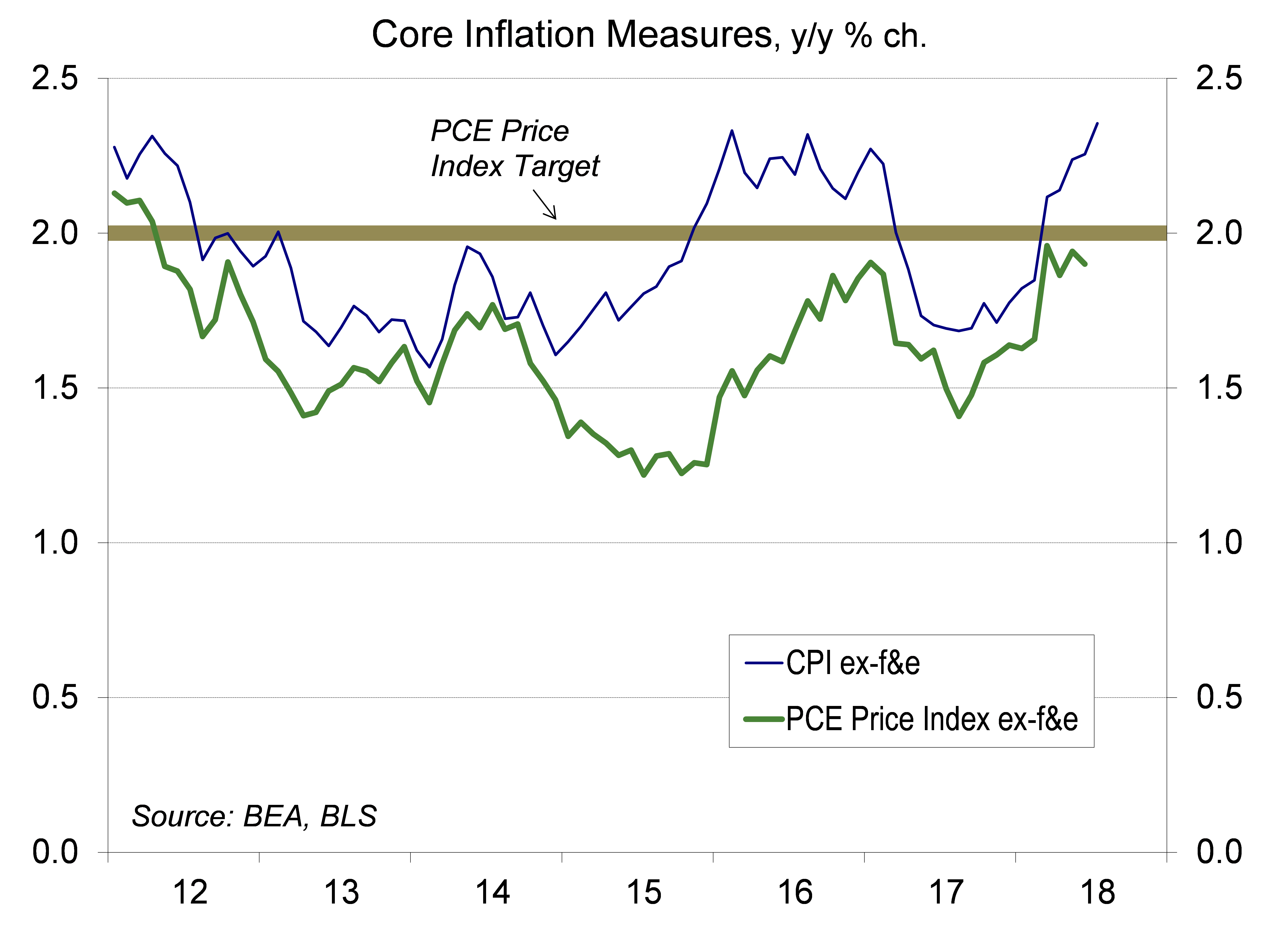

Chart 2

Inflation, as measured by the PCE Price Index excluding food and energy, is expected to match the Fed’s 2% goal for the 12 months ending in July (data due August 30). Fed officials have indicated a tolerance for having core inflation trend a bit above the 2% goal for a while. In this way, 2% becomes a target, rather than a ceiling (and in turn, inflation expectations should be anchored at 2%, rather than a bit below – that’s important for the Fed). With the exception of oil, commodity price pressures are not a major inflationary concern. It takes a gigantic increase in the prices of raw materials to have much of an impact at the consumer level. Increased tariffs have raised prices in some sectors (washing machines up 20%, lumber adding $9,000 to the average price of a new home), but have not been a significant factor in boosting overall inflation – at least, so far. However, the University of Michigan’s survey of consumer sentiment noted that recent data suggest that “consumers have become much more sensitive to even relatively low inflation rates than in past decades” and tariff concerns appear to have weakened buying perceptions for autos and new homes in early August (these are two of the most cyclically sensitive components of the economy).

The direct economic impact of increased tariffs may be limited, although that depends on how long the trade war lasts and how far it escalates. The indirect effects may be more troublesome and the long-term consequences can be severe. Trade policy uncertainty is a dampening factor for capital investment at home and abroad. Emerging market economies have improved with global trade. Pulling away from global trade leaves the U.S. at a disadvantage as these countries develop their own internal demand, including an appetite for U.S. exports (especially in services) – this has been really short-sighted.

Judging by the federal funds futures market, it’s still full steam ahead for a September 26 Fed rate hike. However, with monetary policy close to neutral, it’s likely that the Fed will consider a pause at some point. Markets believe that the Federal Open Market Committee will only act at meetings where there is a press conference. That’s not the true, but we won’t have to worry about that for much longer. There will be a press conference after every FOMC meeting beginning next year.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.