Economics or Philosophy

“If it stinks, doesn’t work, is incomprehensible and doesn’t make sense – it’s either economics or philosophy.”

. . . Raymond DeVoe

Ray DeVoe was a friend I met when he was working at Legg Mason. He was one of the best writers on Wall Street , and to this day, I miss his wisdom and humor. When looking at last week’s economic reports, I was reminded of this quip from Ray:

“Because of an accident in college I took a year off and worked on the floor of the NYSE, initially as a page and subsequently as an apprentice specialist’s clerk. Returning to college I was offered the opportunity to become a dual major in Economics and Mathematics. I completed the requirements and graduated a year later – but those two disciplines have worked at cross purposes ever since. The precision of mathematics conflicts with the shifting vagaries of economics, and both are quite removed from the emotionally charged world of finance and trading, where money is won or lost in a true meritocracy. To reconcile these I have put together all sorts of “Laws” and “Theories”, including some that are unprovable, but highly probable, in my opinion. For the College Humor Magazine I submitted a collection of many “Laws” and other items, including my ‘College Course Descriptions:’

1) If it’s green, wiggles or slithers, it’s biology

2) If it stinks, it’s probably chemistry, although don’t rule out economics.

3) If it doesn’t work, it’s most likely physics – but keep the economics option open.

4) If it’s incomprehensible, it’s probably mathematics, but that’s part of economics also.

5) If it stinks, doesn’t work, is incomprehensible and doesn’t make sense – it’s either economics or philosophy.”

I recalled Ray’s “Laws” and “Theories” while dissecting last Friday’s employment report. The median estimate was for non-farm payrolls to increase by 180,000 jobs. One savvy pundit was even looking for an increase of 239,000 jobs. At 8:30 a.m. the number was reported at a shocking 20,000, and stocks sunk. As our economist, Scott Brown Ph.D., writes:

“Weather! Mild weather appears to have boosted the January payroll figure, while poor weather depressed the February figure. The household survey tracks weather effects (worst since the snowstorms of 2014). Although the household data are not directly comparable to the establishment survey data, weather likely had an impact on payrolls and hours (including manufacturing). So get a grip, people. The partial government shutdown boosted the unemployment rate in January, so the drop in February is a correction. Wage growth picked up – one shouldn’t worry about any particular month, but the trend is higher. A low unemployment rate and rising wage pressures ought to be a concern for the Fed, but the recent Beige Book noted that firms are seeing a mixed ability to pass higher costs along. There may be a knee-jerk reaction to the “disappointing” payroll figure, but this is a weather story, and the report doesn’t tell us much. Equity futures were lower ahead of this report, reflecting disappointing Chinese export data (due partly to the timing of the Chinese New Year) and reports (WSJ, FT) casting doubt on US/China trade negotiations.

Heads Up: Fed Chairman Jerome Powell speaks at the 2019 Stanford Institute for Economic Policy Research (SIEPR) Economic Summit, Stanford, California (Facebook link: http://facebook.com/SIEPR/). Powell will also sit down for a 60 Minutes interview on Sunday.”

As readers know, I have not paid much attention to the recent economic reports, due to the government shutdown, and do not think the economic reports will be a true reflection of the economy until either April or May. As a sidebar, I would note this number will probably be revised in the months ahead.

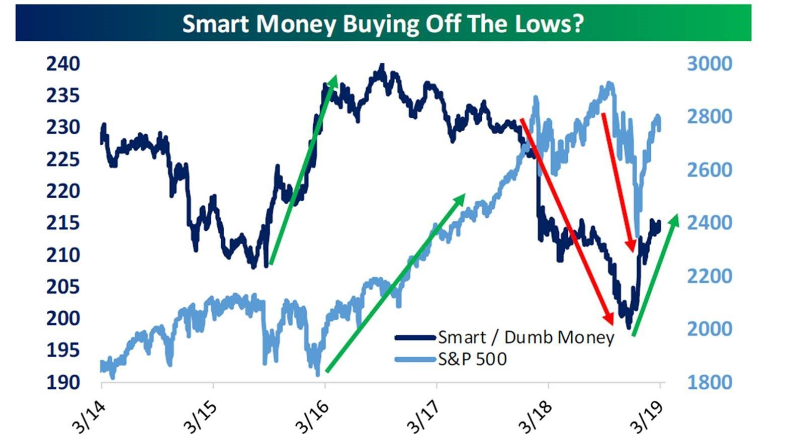

Clearly, the stock market was surprised by the employment numbers as the D-J Industrials (INDU/25450.24) fell over 200 points, but then a funny thing happened – stocks stabilized and began to lift. By the closing bell, the senior index was off by a mere 23 points. Maybe that is why my indicators have remained constructive despite some of the recent market gyrations. Indeed, despite last week’s swings, the Industrials remain above their 200-day moving average of 25127.99. For the week, the S&P 500 (SPX/2743.07) lost ~2.16% and remains below its 200-DMA (@2750.86), while the Russell 2000 (RUT/1521.88) decline by roughly 5.2% from intraday highs to intraday lows on the week and likewise is still below it 200-DMA of 1585.60. Of interest is the “smart money” versus “dumb money” indicator. Recall that “dumb money” tends to buy in the first half hour of trading, while “smart money” buys in the last half hour of trading. According to Bespoke:

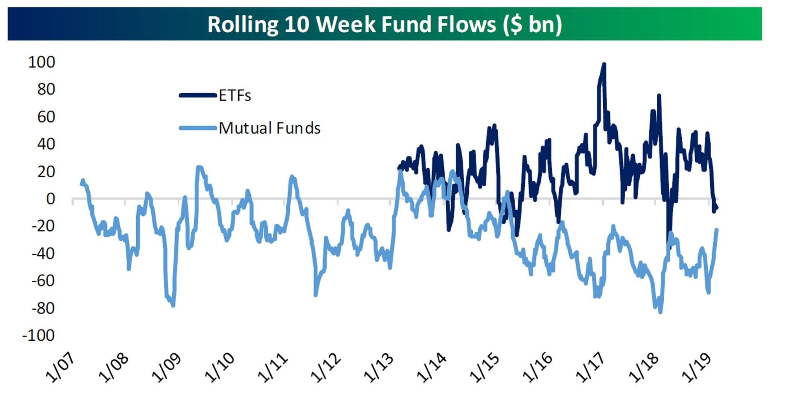

“In chart one [page 3] we show the performance of the last half hour intraday relative to the first half hour intraday in our Smart/Dumb Money index. As shown, that index started to rocket higher into the 2015/2016 bottoms and was a big tell in the peaking of equities during 2018. While not exactly ‘en fuego’, the outperformance of the ‘smart’ money trading at the end of the day versus the “dumb” money at the end of the day has been pretty strong since mid-December. That suggests the current downtick isn’t likely to extend significantly. [Also] on a combined basis, there’s no evidence that the current rally is seeing large inflows from non-institutional buyers, which is the same message (in a different form) as the “smart” money index, and gives more confidence that strong hands have been buying the market over the course of the recent rally (chart 2, page 3).”

Turning to earnings, last week was the end of the 4Q18 earnings season. By my pencil, earnings and revenues continue to come in pretty well, albeit at a slowing beat rate. As of last Friday, 63.2% of reporting companies have beaten earnings estimates, while 60.9% have bettered revenue estimates. Both of those numbers are above the five-year average. So much for the naysayers talking about an earnings collapse. Speaking of a collapse, I received a number of emails about the 5%+ decline in one of the vehicles that is a composite of big cap energy stocks, despite the fact that crude oil futures are trading around $56 per barrel. Well, the largest sovereign wealth fund in the world, at ~$1 trillion, announced last week that it would sell all of its holdings in the energy space. The fund owns 363 energy stocks and has extremely large positions in very recognizable names.

The call for this week: As I wrote on Friday, the weak economic outlook from the ECB, continuing reduced earnings estimates, worries about the Mueller Report, renewed Chinese trade war tensions, and the underperformance of the cyclical sectors bringing on cries of recession all proved too much for stocks after three attempts to break out above the overhead resistance zone between 2800 and 2830 basis the S&P 500 (SPX/2743.07).

And then there was this from Leon Tuey:

“Thanks, Jeffrey. I saw that yesterday. The Golden Cross or the Death Cross is as useful as buying after a company reports its earnings. Many reasons have been given for the correction, but as noted in my reports, in the week of February 25, all technical indicators, the various market indices, and the Advance-Decline Lines got grossly overbought, intermediate momentum peaked. Also short-term sentiment measures showed excessive optimism. Hence, the correction. Because investors are grossly under-invested in equities and sitting on a mountain as a result and most are still gripped by fear, however, I opined that the correction will be rotational/time rather than magnitude. It’s a normal reaction to an overbought condition and is healthy, but in no way alters the direction of this powerful bull market.”

After five consecutive daily declines for the S&P 500 Index, traders will play for a rally. The problem is that negative news has appeared over the weekend. The negative news from China and the UK are overriding the usual Sunday night bullishness. Futures opened lower last night. They rallied to a two handle gain during Powell’s interview on “60 Minutes” even though Powell said nothing new or salient. The highlight of the interview was Powell reiterating the Fed’s mantra: The Fed can be “patient with interest rate changes.” This morning, the preopening futures are relatively flat.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.