Emerging storylines from earnings season

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- MVP award goes to Mega-cap tech

- Consumer remains the ‘playcaller’ of the economy

- China a ‘turnover’ for company profits

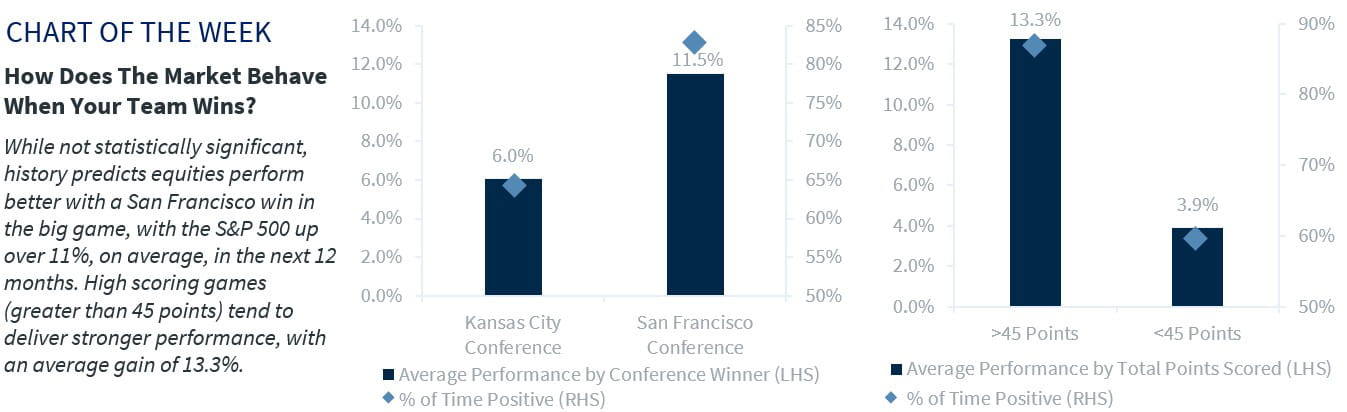

Ready for Game Day? This weekend over 200 million fans are expected to tune in to watch a rematch between the two best teams in football – Kansas City and San Francisco. With the excitement building, the National Retail Federation expects Americans to spend a record $17.3 billion on the big day – up from $16.5 billion in 2023! And that’s for good reason. This matchup has some great storylines to attract even the most casual observer – from a potential football dynasty in the making, to a possible Cinderella story for ‘Mr. Irrelevant,’ to the biggest celebrity couple right now. Speaking of storylines, there are plenty of great storylines that have emerged from the 4Q23 earnings season. With nearly 67% of S&P 500 companies having reported, here’s what we have learned thus far:

- ‘MVP award’ goes to tech | Mega-cap Tech names have been strong outperformers year-to-date. In fact, a composite of the biggest names, or MAGMAN (MSFT, APPL, GOOGL, META, AMZN, NVDA) is up 12%, while the rest of the S&P 500 is up just 2%. With MAGMAN’s outperformance backed by fundamentals, these names earn the MVP award for 4Q23 earnings season. While the S&P 500’s 4Q23 earnings enjoy their second consecutive quarter of bottom-line growth, up ~3% YoY, the strength of the mega-cap Tech names is masking significant weakness beneath the surface. For example, while MAGMAN’s earnings climbed 65% YoY, the S&P 500 ex MAGMAN (i.e., the other 494 companies) earnings declined6%! MAGMAN saw top-line sales growth rise 15% YoY (7x the rest of the Index), a stronger percentage of companies beating estimates (100% vs 73%), and net margins nearly 2x the rest of the Index (with an improvement on a YoY basis). Additionally, the cash on MAGMAN’s balance sheet climbed ~26% YoY, allowing these companies to potentially increase both dividends and buybacks! Company management teams have a positive outlook, as ongoing investments in AI and tech-related products should continue to drive earnings growth going forward.

- ‘Defense’ wins championships | In recent years, companies have been able to go on the offensive when it comes to pricing, as strong consumer demand allowed businesses to pass along higher input costs to consumers. In fact, margins in the post-COVID environment rose to the highest level since 2000. However, with consumers starting to push back on higher prices (McDonalds highlighting this dynamic this week), companies are finding it more challenging to pass along price increases. This dynamic has pushed margins down for the third consecutive quarter toward their ten-year average. As a result, businesses will now need to focus on mitigating costs (i.e., reducing labor expenses) to defend their margins. Some of the mega-cap Tech names focused on cost-cutting in 2022 and 2023 and have been rewarded for doing so. Going forward, we expect this trend to continue more broadly as there has been an uptick in the number of layoff announcements in recent weeks. For example, Challenger reported that job cuts increased ~130% MoM in January, with the primary reason for doing so noted as restructuring.

- The consumer remains the ‘playcaller’ of the economy | While consumers have faced significant headwinds (i.e., falling excess savings, reinstatement of student loans, etc.), businesses are reporting that consumers at both the high and low ends of the income spectrum are spending. Even more, they do not expect that trend to reverse. Bank CEOs also noted that consumer balance sheets remain healthy, deposit levels are only slightly down (albeit still well above pre-pandemic levels) and delinquency rates are running in line with seasonal trends. Consumer strength is reflected in some of the forecasted figures from the ‘Big Game’ in Las Vegas this weekend – with ticket prices selling at a record high, a record amount of money expected to be spent on food and beverages, and a record number of people and dollar amounts betting on the game. However, while consumer spending has avoided being ‘sacked’ thus far, mounting headwinds (e.g., layoffs) could pressure spending as the year rolls on.

- China a ‘turnover’ for company profits | In the broader global investment landscape, China has been the largest disappointment. Concerns surrounding slowing economic growth and the flailing property sector caused the MSCI China to fall ~11% since the start of the fourth quarter—by far the worst performing equity market over that time period. As a result, companies with the highest revenue exposure to China struggled in their 4Q23 earnings results. In fact, the top 50 S&P 500 companies ex-Tech with the largest revenue exposure to China are on pace to see their earnings decline ~25% in the 4Q, marking the sixth consecutive quarter that their earnings were weaker than the rest of the S&P 500. With a sustainable rebound in China unlikely in the near term, sluggish growth will likely continue to weigh on these companies moving forward.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.