Employment, Wages, and the Fed

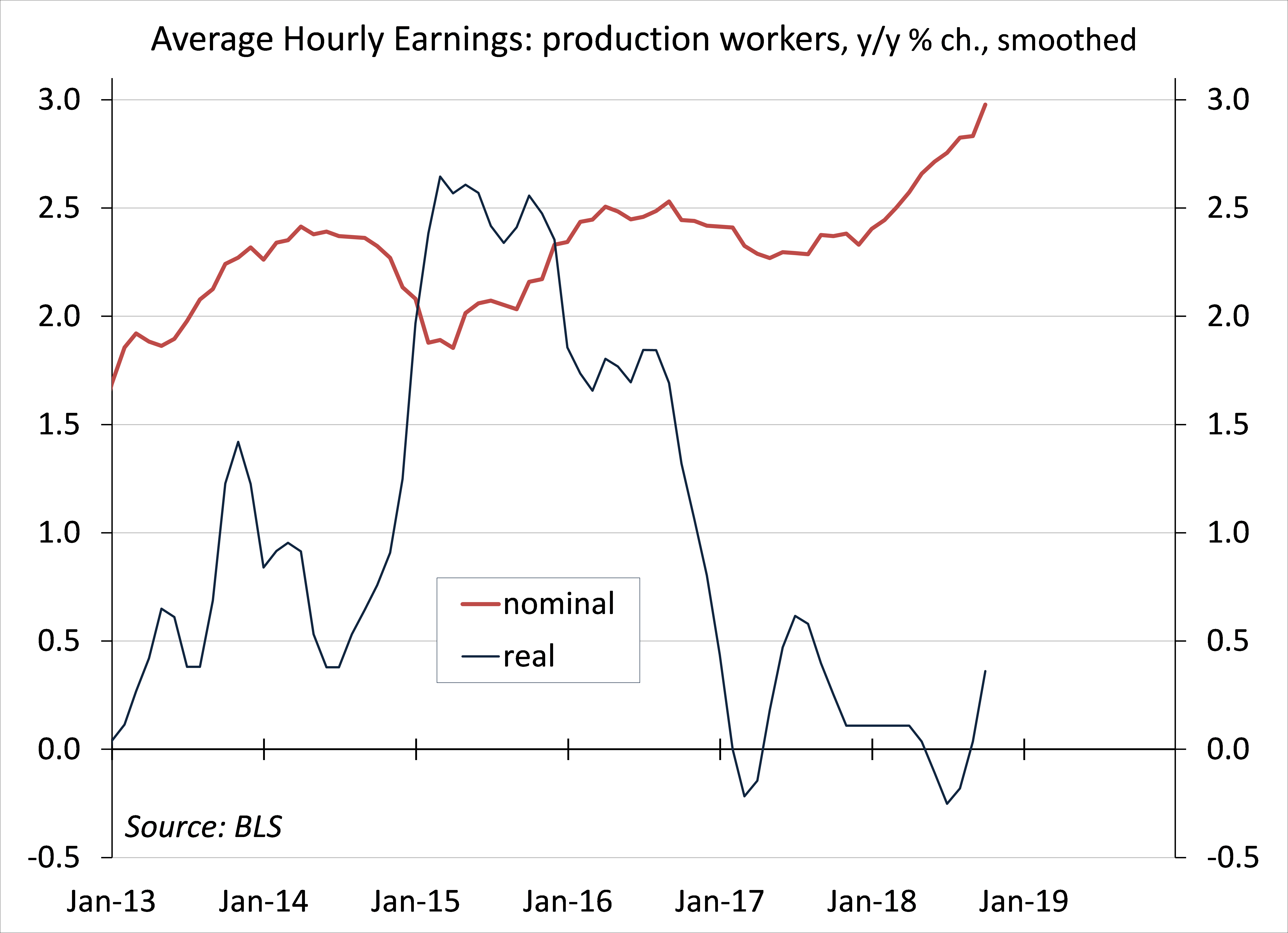

The year-over-year increase in average hourly earnings was a bit exaggerated in the October employment report, but the underlying trend is higher. Growth in nonfarm payrolls rebounded from the effects of Hurricane Florence, while Hurricane Michael “had no discernible effect,” according to the Bureau of Labor Statistics. Looking through the weather and the noise, job growth remains beyond a long-term sustainable pace and wage pressures are rising. Thus, the Federal Reserve can be expected to continue on its gradual path of increases in short-term interest rates.

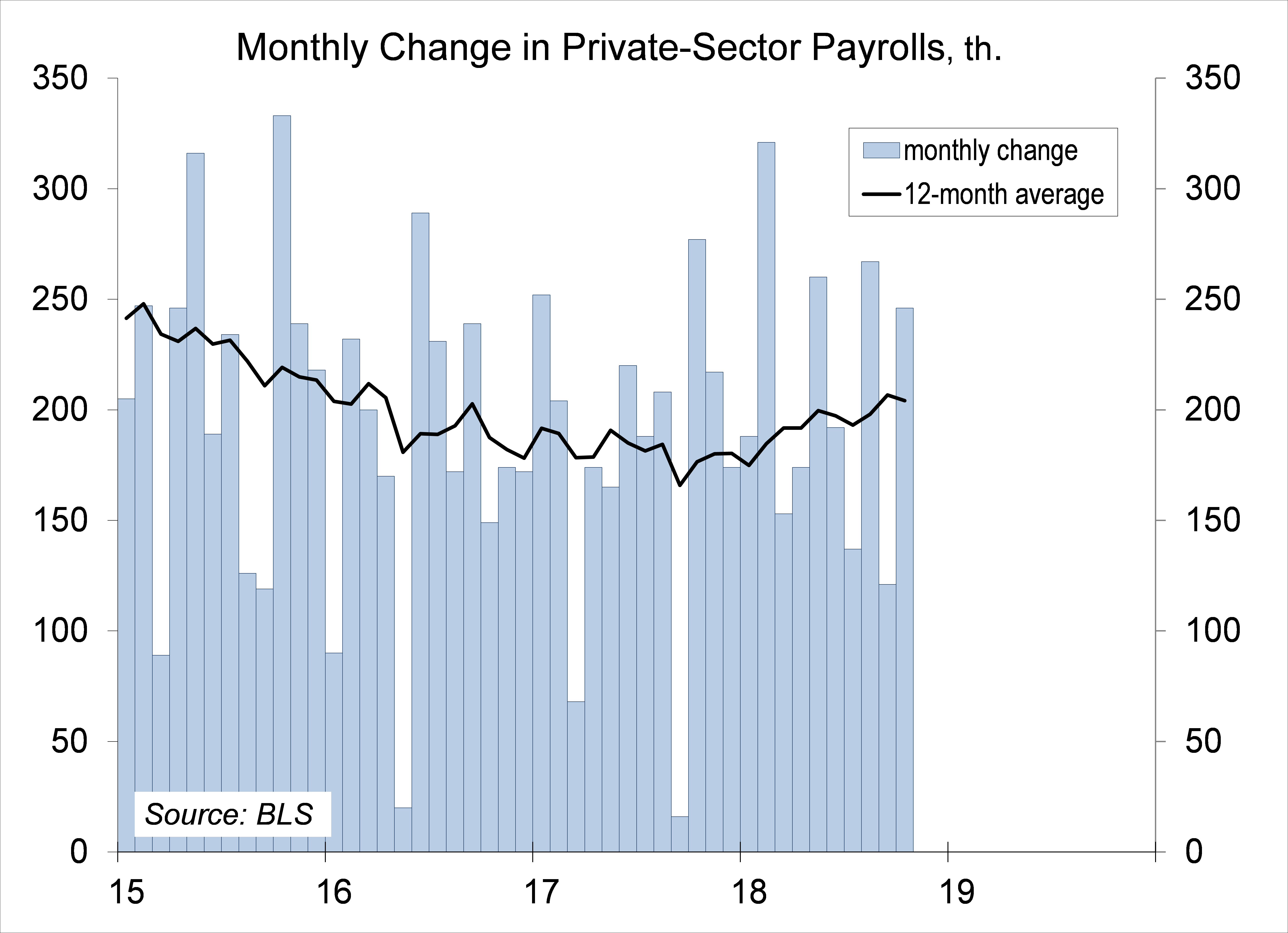

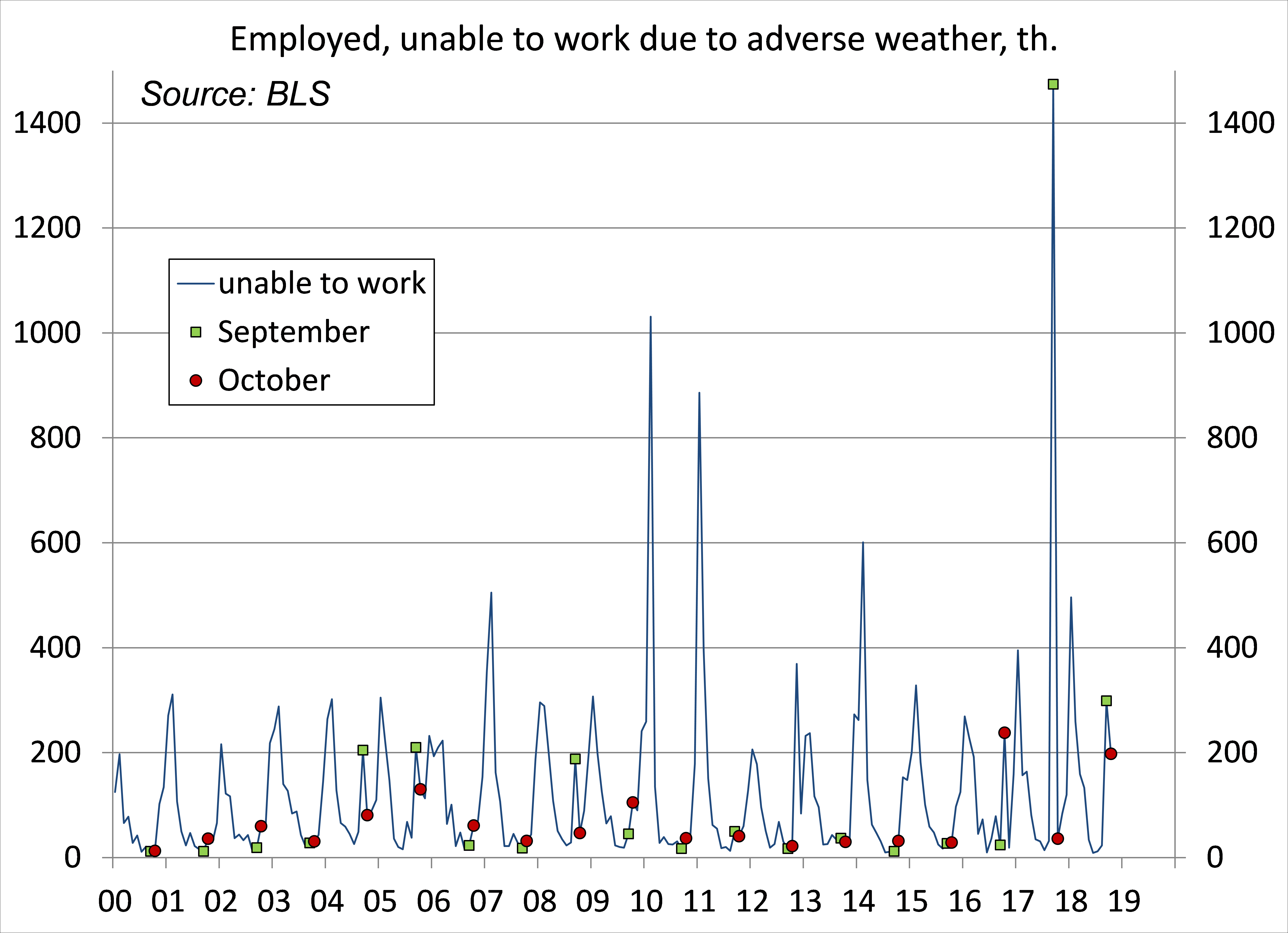

Nonfarm payrolls rose by 250,000 in the initial estimate for October, following a weather-restrained 121,000 gain in September. At 211,000, the three-month average gain in private-sector payrolls is more than double the pace needed to absorb new entrants into the workforce. The unemployment rate held steady at 3.7% last month, but the trend is lower. Some 200,000 individuals could not get to work due to adverse weather, according to the household survey, but the weather impact was larger in September (the household survey data are not directly comparable to the nonfarm payroll data) – and much worse September 2017.

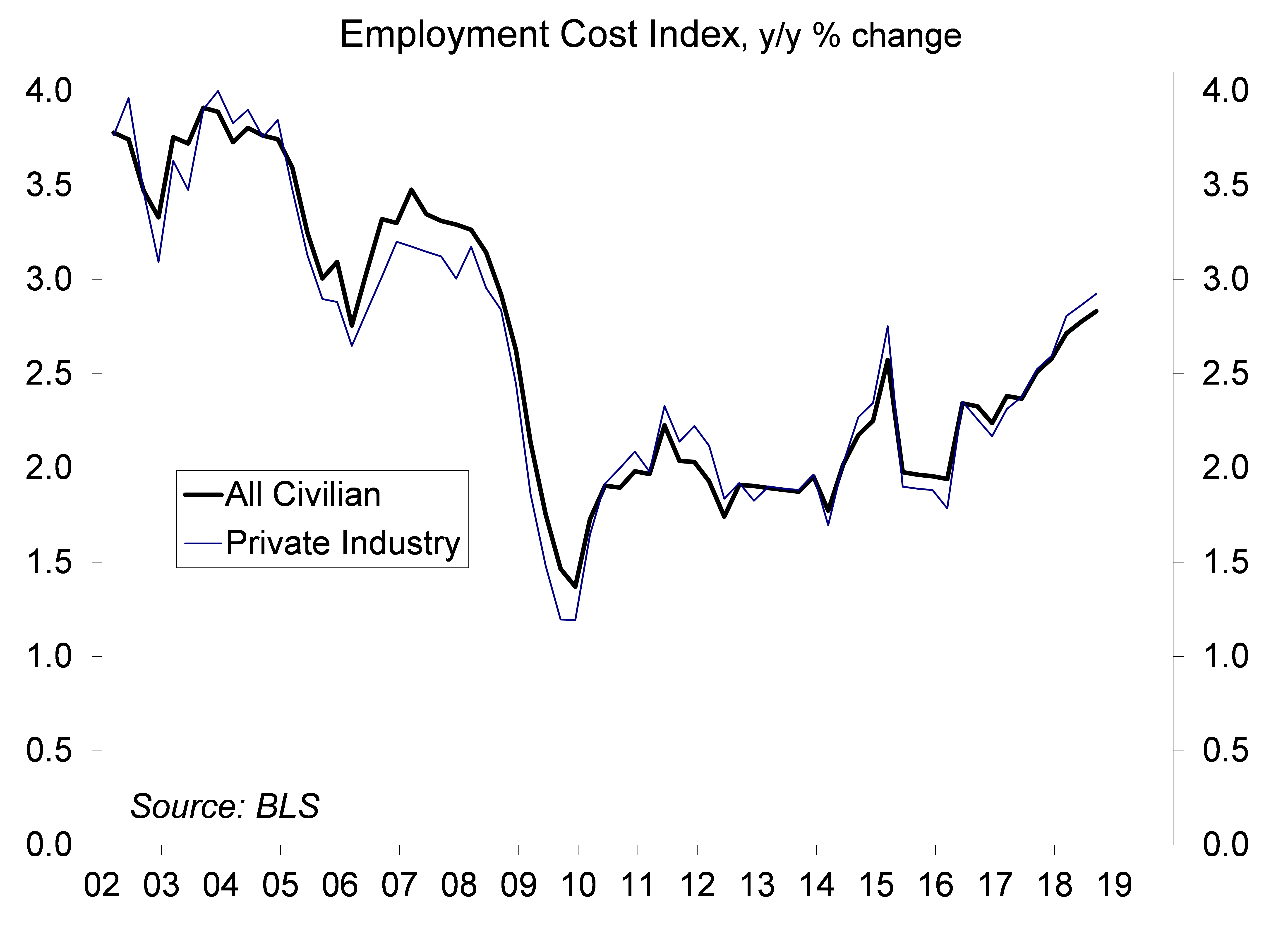

Average hourly earnings rose 3.1% y/y. That figure was inflated a bit, a weather-related quirk rolled off the 12-month calculation, but the underlying trend was higher. The Employment Cost Index, the preferred measure of labor costs, rose more than anticipated in the three months ending in September, lifting the y/y increase to 2.9% (private sector).

The Federal Open Market Committee’s decisions are data-dependent, and the labor market figures play a central role. However, policy decisions are based not on the data per se, but rather on what the figures mean to the economic outlook. The broad range of labor market indicators suggest an economy that is progressing beyond a long-term sustainable pace (we know that because the unemployment rate is trending lower and the trade deficit is increasing). This week, the FOMC is expected to repeat that the risks to growth and inflation are balanced, but the view is likely to shift a little more to the downside into early 2019.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.