Exploring the financial markets’ evolution

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Non-synchronized nature of the business cycle

- A Fed pause bodes well for bond returns

- Historical trends suggest a stronger year for equities

What do the financial markets and sci-fi thriller Jurassic Park have in common? The theme of evolution. There are natural shifts in the investment landscape that present new situations to adapt to, but they also provide new opportunities to discover. With this in mind, we’ll be using prehistoric and archaeological concepts to present our Ten Themes for 2023 via a webinar this Monday, January 9 at 4 p.m. ET. Our Ten Themes presentation is a collection of what we deem to be the most critical economic and financial market insights for investors to consider in the upcoming year. As a sneak peak of what to expect, we’ll explain why a recession has felt a million years in the making, bonds are worth sinking your teeth into, corporate fundamentals won’t fossilize, and globalization won’t go the way of the dinosaurs.

- Consumer will keep a severe recession in the cage | Economists, consumers, CEOs, and the media have been predicting a recession for almost a year now. While it hasn’t happened yet, our base case is that the ‘official’ recession call will be made this year. Market pundits have been heavily debating growth forecasts, but in our eyes – whether GDP is slightly positive, slightly negative, or flat (our forecast) – the environment will be challenging. Sentiment has been depressed across the board for several months, and given the Federal Reserve’s (Fed) aggressive tightening cycle, many of the more interest rate sensitive areas of the economy (e.g., housing, transportation, some retail) are already contracting. The silver lining? Since many of the services industries (e.g., airlines, energy, health care) are still resilient, the non-synchronized nature of this business cycle should contain the depth of the decline. Also, still strong consumer fundamentals (e.g., excess savings, job openings) should provide a near-term buffer until weaker labor conditions eventually stall the momentum of the economy by midyear.

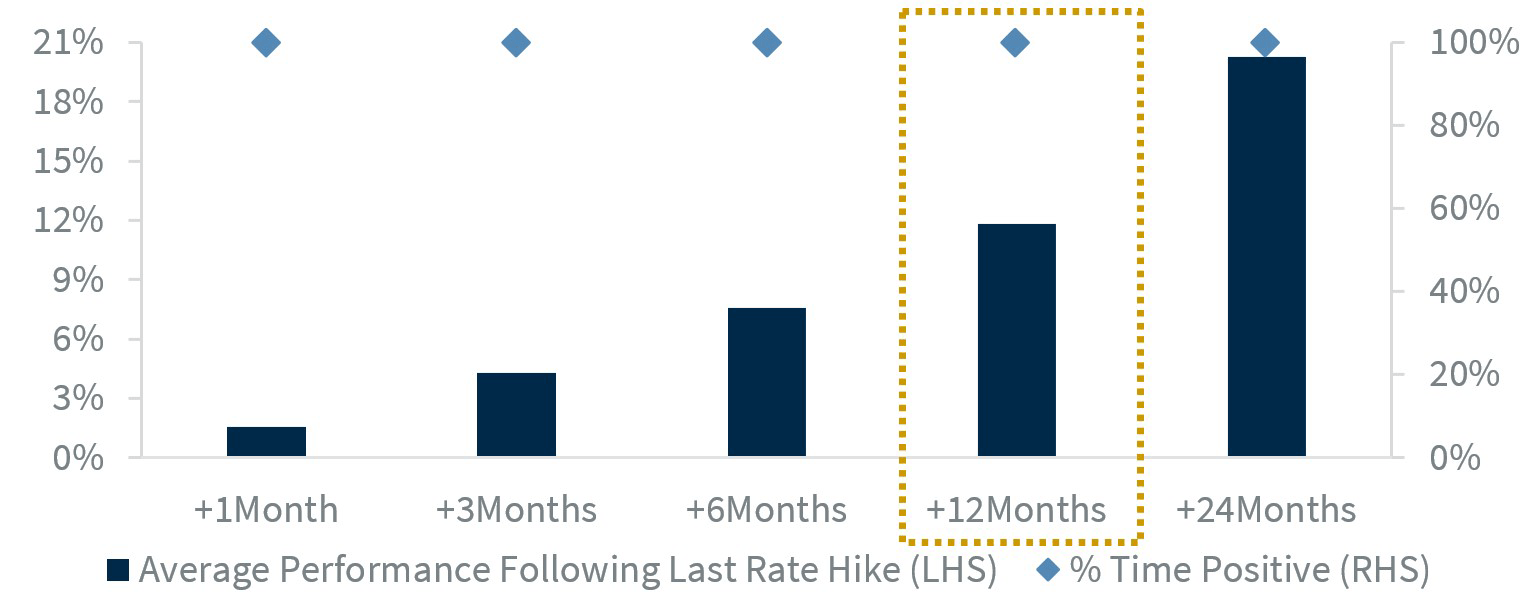

- Attractive yields back in the food chain | Needless to say, 2022 was a difficult year for fixed income investors. The Bloomberg U.S. Aggregate Bond Index posted its worst year since at least 1975, and investment grade bonds saw their largest drawdown on record. But now, with yields for nearly all subsectors near multi-year highs, there are opportunities to take advantage of—and with less risk involved! For example, an investor can capture the same amount of yield with a 3-month Treasury bill as he or she could’ve with a high yield bond at the start of 2022 – with ~90% less risk. Lower inflation and the end of the Fed’s tightening cycle should also bode well for bond returns. Looking back on the tightening cycles from 1989 to 2018, bond returns have been positive 100% of the time with an average return of 11.8% in the 12 months following a Fed pause. Add in the fact that yields now exceed the dividend yield of the S&P 500 by the largest differential since May 2008, and the environment is even more enticing.

- Positive returns for equities are not extinct | After the worst year for the S&P 500 since 2008, it is some comfort knowing that historical trends suggest that 2023 should be a better year. First, back-to-back negative years for the Index are unusual, only occurring in tandem with World War II, the 1970s oil embargo, and the tech bubble—quite extreme circumstances. Second, the S&P 500 has bottomed in the first quarter following the last four bear markets. Third, the third year of a presidential cycle is historically strong. And last but not least, the S&P 500 has not seen three consecutive years of PE contraction since 1994. But if precedents aren’t convincing, the fundamentals should be. If 2022 was the year of passing on pricing pressures, 2023 will be the year of cost cutting supporting margins, helping earnings hold in better than expected. The P/E multiple should also be supported by falling interest rates and the eventual easing of Fed policy. Add in above-average dividend growth and continued strength in buybacks, and there is substantial support for our S&P 500 year-end target of ~4,400.

- Not the end of the globalization era | The call that ‘globalization is dead’ is not some new phenomenon. In fact, we’ve been hearing this from market pundits for over two decades. While some specific industries, more specifically those related to national security, may be shifting back home, the long-term benefits of globalization remain intact. Whether it be cost efficiency, access to new markets, a larger, cheaper workforce, or mitigating risk, there are still reasons for companies to diversify their revenue streams and supply chains. Given that US brands are dominant in a multitude of categories (e.g., smartphone brands, fast-food chains, etc.) and that companies with a greater percentage of revenues generated overseas have historically seen higher margins and earnings growth, our bias for US multinational companies remains strong.

For a more in-depth discussion of all of our Ten Themes of 2023 and key insights from our quarterly Investment Strategy Survey, please register for Monday’s webinar using the link above or stay tuned to my Twitter and LinkedIn accounts for the replay.

While we would love for investors to receive all the gifts on our New Year holiday wish list, even a few could result in 2023 being a better, brighter year. But in addition to our hopes for the U.S. economy and financial markets, we want to send you and your family our best wishes for a new year of health, happiness and prosperity!

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.