Five key takeaways from Q2 earnings season

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Consumer remains healthy but spending is shifting

- Earnings recession has likely bottomed

- Margins are likely to remain resilient

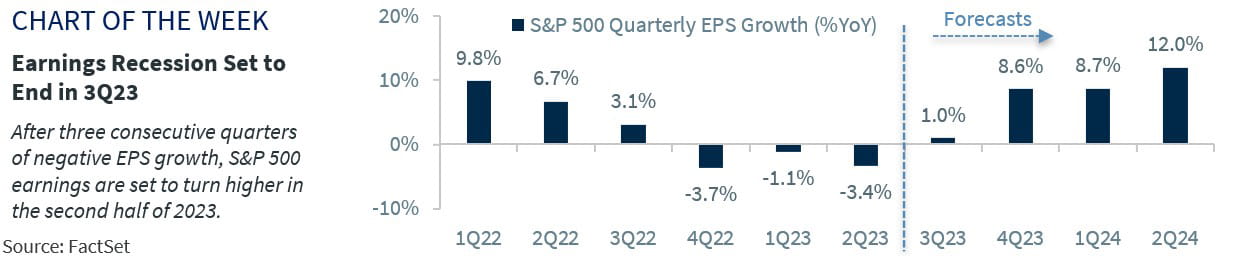

Summer is quickly coming to an end, and while the official end of the season doesn’t arrive until mid-September, many families have already transitioned back to school (if you live in the South) or are gearing up for their last few weeks of fun in the sun. And as many people prepare to turn the page on summer, it’s a great time to pause, reflect, and plan for the remainder of the year. Speaking of turning the page, with this week marking the unofficial end of earnings season, with over 90% of S&P 500 companies having reported 2Q23 results, it’s a great time to evaluate what we have learned over the last six weeks. Overall, the results were mixed – while earnings came in much better than feared, earnings growth remained negative (-3.4%) and revenue growth was relatively flat. The market’s reaction: Unenthused, as the S&P 500 has been negative (-3.1%) during earnings season for the first time in five quarters. Below are five key takeaways:

- The stock market is not the economy | While economic growth drives corporate earnings, remember that the S&P 500 is not a replica of the U.S. economy. In fact, as economic growth remains positive (and recession calls get pushed out), the S&P 500 remains marred in an earnings recession – posting its third consecutive quarter of declines. Similarly, while nominal GDP growth is growing at a ~6.3% Y/Y pace, revenue growth was up a paltry ~0.5% (the slowest pace since 3Q20). Why the disconnect? One reason is the Energy sector which has seen a decline in earnings of ~40%! Stripping out energy, the remainder of the S&P 500 earnings growth was up ~3% for the quarter and revenue growth was up ~4%. Then why has the Energy sector been rallying? Because since June 30, oil prices have rallied ~14% and the market is anticipating a rebound in energy earnings in 2H23. With the economy remaining resilient and energy earnings rebounding, earnings growth is expected to turn positive next quarter and continue into next year. As a result, there is upside risk building to our $215 and $225 earnings forecast for 2023 and 2024, respectively.

- Consumer dynamics shifting | Consumer resilience has been a key economic theme over the last 18 months. This trend continued in 2Q, with companies across a wide array of industries (e.g., financials, restaurants, retailers, payment processors) highlighting a healthy consumer across all income spectrums. Travel was a particular focus, with cruise lines and select airlines and hotels reporting record spring/summer demand. However, under the surface there are some shifts in spending dynamics beginning to form. First, consumers are becoming more discerning. Home Depot reported that consumers are focusing on smaller projects, while bigger ticket items remain under pressure. Kellogg’s mentioned that consumers are closely managing their household inventories, carefully guarding against waste. Second, Amazon, Unilever and McDonalds noted that consumers are looking for value and trading down. Lastly, some companies are concerned that student loan repayments could pressure already strained budgets. These trends bare watching and support our belief that consumer spending is set to slow and potentially lead to a mild recession late 2023/early 2024.

- Margins compress – will remain resilient | S&P 500 margin compression was minimal in 2Q23, falling slightly to 11.9% – down from a peak of 13.9% in 2Q21. While margins were modestly lower, there are reasons to believe that margins could stabilize or even move higher. First, inflationary pressures have largely abated, and commodity input prices continue to decline. Second, supply chains are normalizing, and transportation costs are sharply lower. Third, the inventory de-stocking process is near completion, eliminating the need to discount items (which should be a positive for ‘goods’ retailers). Lastly, margins are likely to remain resilient as companies focus on costs and efficiencies, while still maintaining some pricing power (albeit below peak levels). The key risk for margins is continued wage pressures, particularly given the historically tight labor market. But we expect the job market to soften.

- Financials still healthy | While concerns about the health of the banking sector reached a crescendo in early March, fears of contagion have largely subsided. Despite earlier trembles and ongoing commercial real estate concerns, Bank CEOs reported that the industry, overall, remains healthy versus historical standards. Credit quality and charge-offs remain much stronger vs pre-COVID levels but deteriorated slightly vs last quarter. Loan growth decelerated, but continues to outpace overall GDP growth. Deposit outflows continued in 2Q, but the pace of outflows moderated. Importantly, capital market activity appears to have bottomed as M&A and IPOs are picking back up. And with the biggest banks in good shape, passing the Federal Reserve’s rigorous stress tests, they’ve been able to boost dividends and increase share buybacks for shareholders.

- Tech improving | While Tech earnings growth was fairly muted (+1.2% YoY), the results were better than expected, with the sector posting its first quarter of positive EPS growth since 1Q22. In addition, Tech had the second strongest magnitude of beats of any sector and saw its 2023 earnings estimate revised 3% higher over the last three months (vs. flat for the S&P 500). Tech earnings were bolstered by strong business investment, as companies within all 11 sectors mentioned that they were looking to boost their tech capex. Importantly, companies are prioritizing AI investments while the pace of cloud spending growth is stabilizing. Strong tech capex is one reason why Tech EPS growth is expected to accelerate to 10% YoY by 4Q and why we continue to favor the sector.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.