Five potential market-moving events to be mindful of

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Powell’s Press Conference Next Week Will Be Key

- All Eyes On The Quarterly Refunding Announcement

- Will The Labor Market’s Resilience Continue?

Welcome to pro football’s draft—the most anticipated three-day event ahead of the upcoming season! This year’s draft for the 105th football season is buzzing with excitement as teams revealed their first-round draft picks last night. There will be no shortage of coverage on the remaining six rounds as experts analyze every move the 32 pro football teams make in the coming days. And just like the sports experts make predictions and try to handicap how this year’s draft will impact each team over the coming season, economists and financials markets will be evaluating several big events next week. In the spirit of the draft, here are our top five picks for events that have the potential to be market moving:

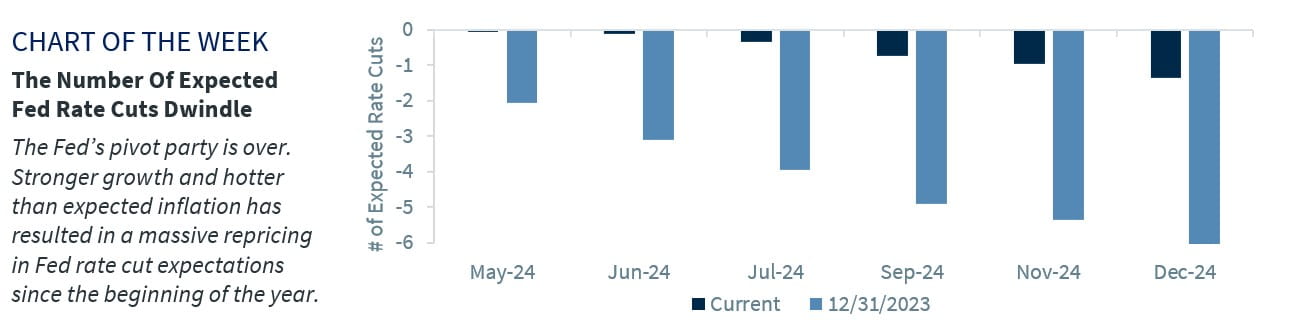

- Powell’s Press Conference Could Bring Fireworks | Ongoing economic strength and hotter than expected inflation caused the market to dial back expectations for near-term rate cuts, with the Fed’s first rate cut pushed back to November. Some market pundits are even speculating there may be no rate cuts this year. The Fed is widely expected to hold rates steady at its May 1 meeting; all eyes will be on Chair Powell at his 2:30 pm press conference. To be sure, the latest data did not instill confidence that inflation is moving sustainably toward the 2.0% target. Powell will likely stick to his ‘data dependence’ script, reiterating that rates are likely at their peak, but may need to remain restrictive for a little longer. However, Powell will need to navigate questions regarding this week’s slower growth/hotter inflation flagged in the GDP report and whether the three rate cuts penciled into the March dot plot are still relevant. We are also expecting more details on the Fed’s balance sheet reduction plans.

- All Eyes On The Quarterly Refunding Announcement | The Treasury Department will announce its borrowing requirements for the upcoming quarter on April 29 and detail the composition of issuance (i.e., the split between bills and coupons to be issued) on May 1 ahead of the Fed meeting. The sharp increase in debt issuance in recent years has captured the market’s attention as the swing buyer of Treasurys has shifted from the Fed to price-sensitive buyers (i.e., households and mutual funds). Tax receipts have rolled in ahead of last year’s pace, which has left the Treasury’s operating account flush with cash ($955B), which suggests less need for bill issuance in the coming quarter. Additionally, the Treasury Department noted in the last refunding that further increases in Treasury notes and bond auctions would likely not be needed. The good news: investor appetite for Treasurys has remained healthy. The bad news: net Treasury supply to fund the ongoing ~$2T deficits leaves plenty for the market to absorb.

- Will Earnings Growth Deliver To Keep The Rally Going? | With 49% of the S&P 500 market cap having reported thus far, the 1Q24 earnings season has been lackluster. S&P 500 earnings are on pace to rise ~1.6% YoY with earnings and sales beats in line with historical averages. Mega-cap tech remains a standout, with a composite of MAGMAN’s earnings expected to rise 44% YoY, while the rest of the Index is expected to decline 2.3%. Next week will mark the second busiest week of the 1Q24 earnings season, with 175 S&P 500 companies, representing 28% of market cap set to report. Importantly, two mega-cap tech names (Apple, Amazon) report on Thursday. As valuations are trading near the upper end of their 20-year range, earnings will need to be the catalyst to drive the market higher from current levels.

- Manufacturing And Service Activity Improving? | Last month, ISM Manufacturing rose into expansion territory (a level >50) for the first time since October 2022. The Index (released on Wed) is expected to moderate slightly but still show that manufacturing activity improved for the second consecutive month. This supports our view that manufacturing activity has bottomed, which favors the Industrials sector. ISM Services (released on Friday) is expected to rise for the first time in three months and remain in expansion territory for the 15th consecutive month. This is important, as the services sector makes up a larger portion of the economy relative to manufacturing. In all, these figures reflect an economy that is expanding, albeit at a more modest pace.

- Will The Labor Market’s Resilience Last? | The labor market, and therefore the consumer, has been the MVP of the economy up until this point. The US labor market has added 276k jobs on average over the last three months (the fastest pace since March 2023). If the unemployment rate remains below 4% for an additional month, it will tie the second longest consecutive streak below 4.0% (27 months) on record. Despite this, there are signs of a slowing labor market. The employment subsectors within ISM Manufacturing and Services readings are both in contraction territory and the number of job openings is near the lowest level since March 2021. The jobs report (released on Friday) will provide an update on the strength of the labor market. While job growth is expected to remain healthy at 175k jobs added, the pace of gains is expected to slow to a five-month low. Ultimately, the pace of job gains is likely to slow over the coming months.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.