Fixed Income Options That Aren’t the 10-year Treasury

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

The 10-year Treasury ended last week at a yield of 1.33%. Is that information important and relevant to the fixed income market? Yes. Does that mean that any investment in fixed income right now is only going to earn you 1.33%? No. Unfortunately, when many market commentators are talking about yields being offered by the fixed income market right now, they usually mention the yield of the 10-year Treasury and then draw their conclusions from there.

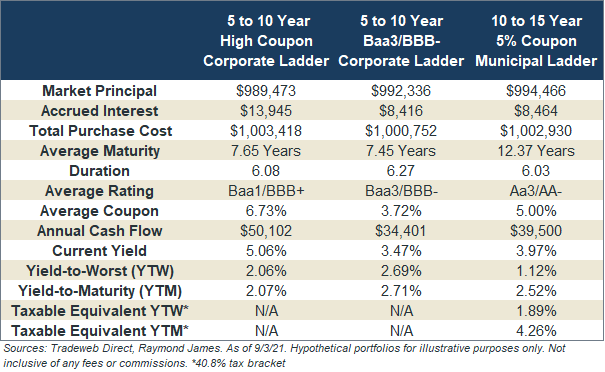

Fortunately, fixed income investors have a wide range of options to invest in that are not the 10-year Treasury. To highlight a few fixed income investment options as well as some of the benefits of building a custom portfolio of individual bonds, I put together three sample portfolios. Note that these portfolios are not a recommendation and might not be appropriate for every investor, but are simply intended to show the wide range of available options.

The first portfolio is a 5 to 10 year corporate bond ladder consisting of high coupon bonds. An investor in a lower tax bracket or someone investing in a qualified account might find value in a portfolio like this if they are seeking high levels of cash flow. It is a highly rated portfolio with a yield of just over 2%, and by utilizing high-coupon bonds (average coupon of 6.73%) the investor is able to achieve a current yield of over 5% which translates to $50,102 in annual cash flow for a ~$1,000,000 investment.

The second portfolio might be appropriate for a somewhat more aggressive investor. Although the entire portfolio is investment-grade, the portfolio is mostly rated at the bottom rung of the investment-grade universe. It is also 5 to 10 a year corporate ladder, but with an average rating of Baa3/BBB-. By purchasing a portfolio of slightly lower-rated bonds, the yield on this portfolio comes in at 2.69%.

The final portfolio is likely a good fit for a higher tax bracket investor who is looking for high levels of tax-free cash flow while keeping the duration of the portfolio in the intermediate range. This is a 10 to 15 year ladder, where all of the bonds are 5% coupons and callable in the 5 to 10 year range, thus maintaining a lower duration of 6.03, which is comparable to the 5 to 10 year corporate ladders. It is a very high credit quality portfolio, with average ratings in the ‘AA’ category. The yield-to-worst is 1.12%, which for a top tax-bracket investor is a taxable equivalent yield of 1.89%. Note that if by chance these bonds all go uncalled and remain outstanding until maturity, the taxable equivalent yield-to-maturity jumps up to 4.26%. While the yields are important, the primary reasons that many investors would purchase a portfolio like this are principal preservation (‘AA’ rated bonds) and tax-exempt cash flow, of which this portfolio would produce $39,500 per year on a ~$1,000,000 investment (a current yield of 3.97%).

Hopefully, this shines some light on a few of the opportunities that are available right now across the fixed income landscape. When you hear the yield of the 10-year Treasury quoted, know that that does not represent the full opportunity available in the fixed income markets. Reach out to your advisor to see how a custom built bond portfolio can help you achieve your goals.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.