Fixed income’s early Christmas… and it is still here

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Sometimes opportunities present themselves but it only matters if we act on them. Although many investors utilize fixed income primarily to protect principal and balance the growth assets in the portfolio, being able to capitalize on income generation and cash flow are welcome benefits. Those benefits are prevalent in our current economic environment. For how long? No one knows but we can view this additional income as an early portfolio Christmas present by taking advantage of what the market is giving right now.

At the beginning of this year, the Fed started a rate hike cycle and interest rates have soared all year. Past patterns by no means guarantee current or future outcomes but they can give a sense of direction and can help us make decisions based on our own assessment of historical occurrences.

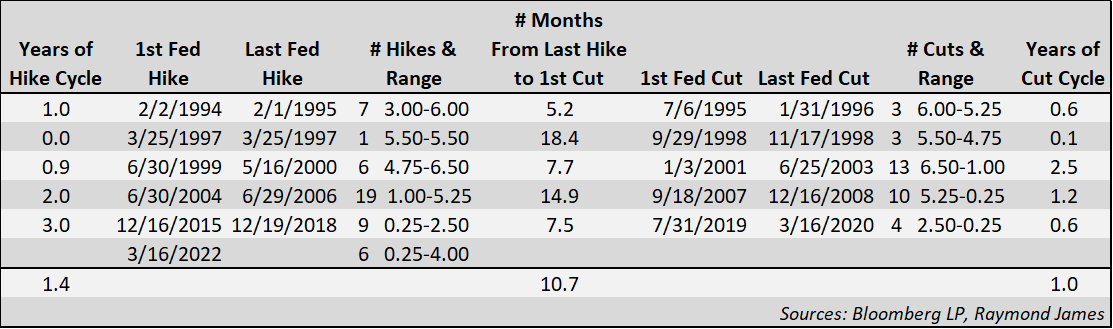

The average Fed hike cycle over the last 30 years has been 1.4 years. The current cycle is in its ninth month. The average time between the last Fed hike and when the Fed begins to cut interest rates is 10.7 months but has been as short as 5.2 months. This is important because the bond market is often forward looking. In other words, if the market “thinks” interest rates will come down, it begins to react before the Fed does, thus bringing interest rates down before the Fed starts cutting. The fact that the Treasury yield curve is inverted is also viewed as an indicator of future lower interest rates.

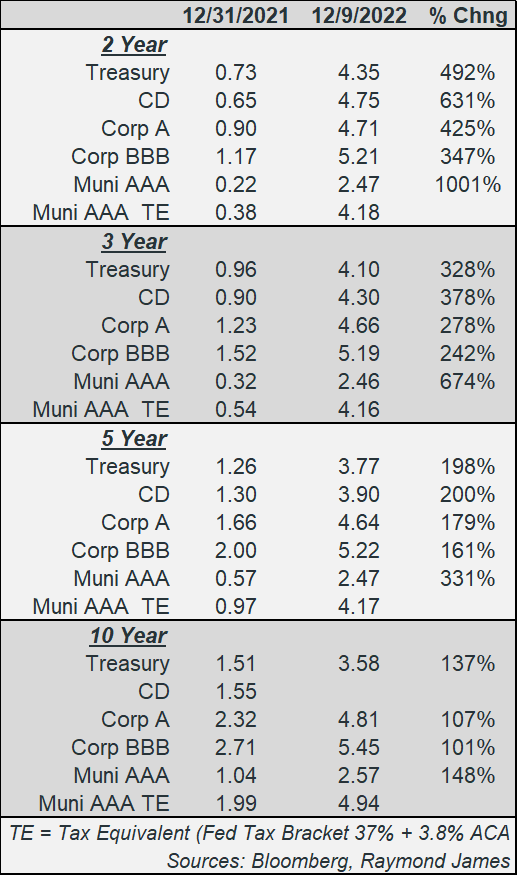

It is easy to get lost in all this data and it is fun to predict the future but in the fixed income world, we like to leave the risk and predictions to the growth allocation assets. Fixed income assets are within a window of opportunity where rates can be locked in at levels attractive in nearly any historic time range. See how far rates have climbed this year in the chart to the right. It is an obtainable goal to lock into +5.0% tax equivalent yields in an array of fixed income products.

It can also be noted that although income seeking investors are benefitting from this surge in yield, total return investors may also be able to benefit twofold if the market plays out as it has in the past. When interest rates begin to fall, recall that the inverse relationship between interest rates and prices will push the prices of bonds up. Total return investors will see rising returns on the price appreciation of their holdings, thus benefitting from the elevated income received during their holding period.

Fixed income has been experiencing an early Christmas for months. Take advantage of this while the window is still open!

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.