Has the U.S. Economy Peaked?

Judging by incoming calls and emails, investors are becoming more concerned about the possibility of recession. The flatter yield curve may be partly to blame, but there are growing concerns about the impact of the president’s trade wars and Fed rate increases have created some anxieties. These queries seem odd right now. There are no signs of a recession on the immediate horizon. As judged by economic forecasters, the odds of a downturn beginning in 2019 or 2020 have risen somewhat, but a recession, while possible, is not the likely scenario. However, fading fiscal stimulus, a scarcity of labor, tighter monetary policy, and trade policy disruptions ought to lead to slower growth in the quarters ahead.

Following brief remarks to business leaders the day after the FOMC meeting, Fed Chairman Powell was asked about the likelihood of a recession. “There’s no reason to think that the probability of a recession in the next year or two is at all elevated,” he said.

What is a recession? It’s not two consecutive quarterly declines in Gross Domestic Product. Rather, the National Bureau of Economic Research’s Business Cycle Dating Committee, which determines the beginning and ending dates of a recession, define it as “a significant decline in economic activity spreads across the economy and can last from a few months to more than a year.” In making its decisions, the BCD focuses on nonfarm payrolls, industrial production, real business sales, and real personal income.

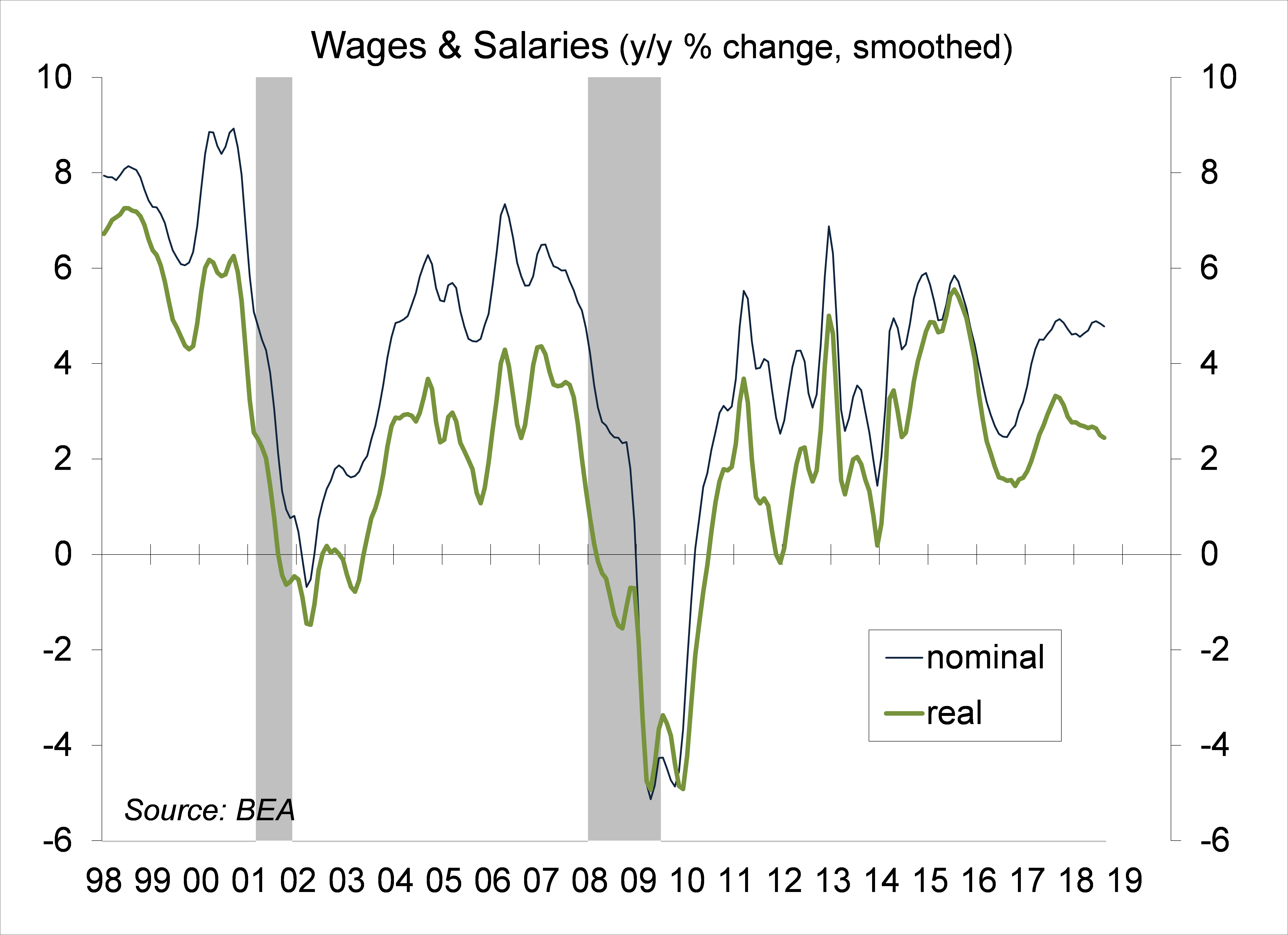

Nonfarm payrolls have continued to advance at a strong pace, well beyond what’s needed to absorb new entrants into the labor market. Job gains have driven growth in aggregate wage income, both on a nominal (current dollar) and real (constant dollar) basis. Average wages have been about flat adjusting for inflation. Industrial production continues to trend higher. Real business sales have continued to improve. These gauges suggest that we are nowhere near a recession.

While we are clearly not in a recession, investors want to know whether we are headed toward one. The Conference Board’s Index of Leading Economic Indicators, up 0.4% in August, suggests not. Of the ten components of the LEI, the slope of the yield curve (the difference between the 10-year Treasury note yield and the federal funds rate) is the best single recession predictor. While the yield curve is flatter, it isn’t inverted (and when it does invert, it may take some time before we enter a recession).

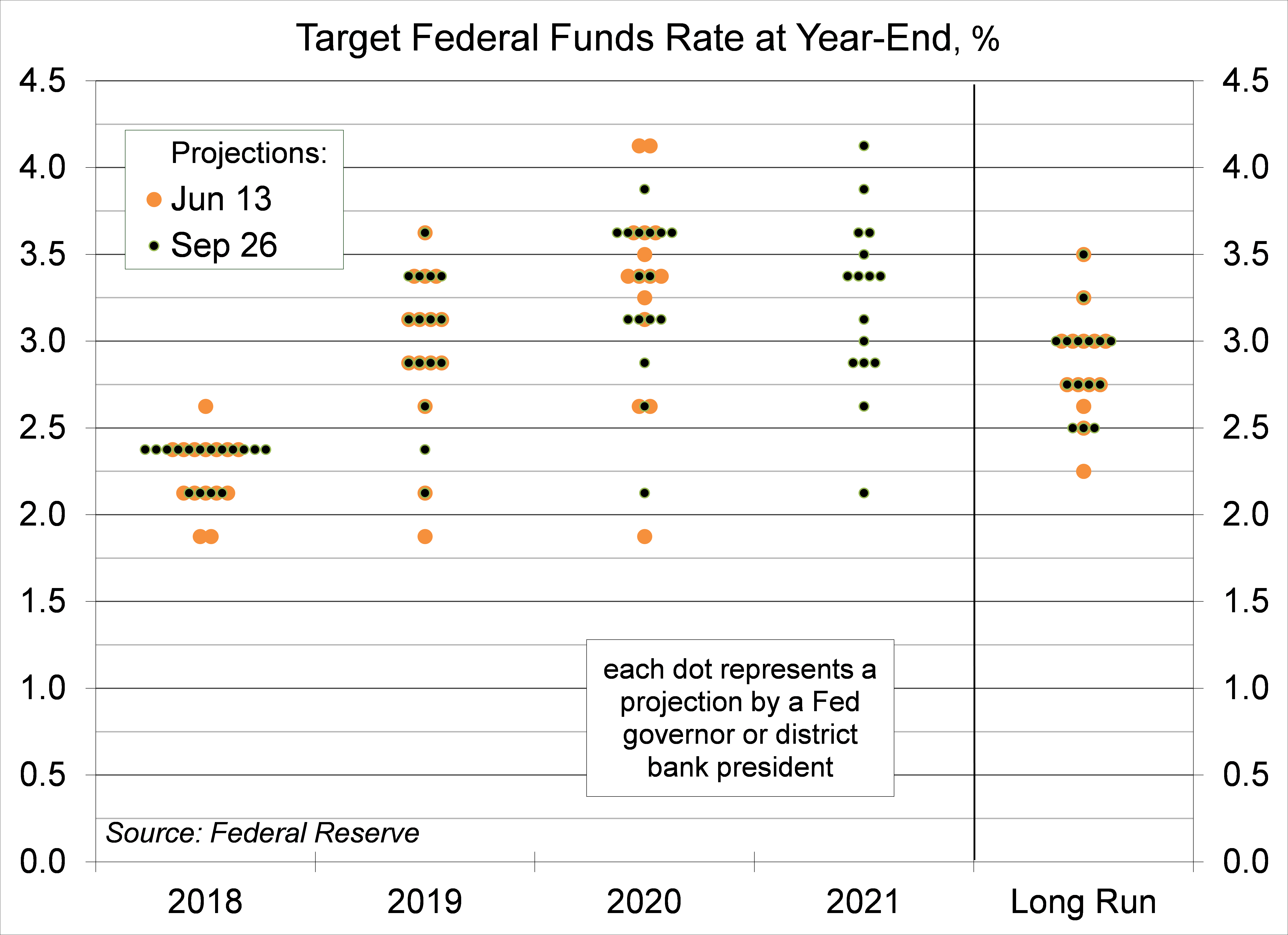

The Federal Reserve controls the short end of the yield curve. The revised dot plot shows that most Fed senior officials (12 out of 16) expect to raise short-term interest rates again on December 19 (that would bring the federal funds rate to 2.25-2.50%). Officials generally expect to raise rates further in 2019 and 2020, although there is no clear consensus on the pace. Still, most expect that the federal funds rate will be lifted above a neutral rate – making monetary policy restrictive – over the next few years. The Fed sees the current pace of growth as unsustainable over the long term. We know that because the unemployment rate is trending lower, and, while there may still be some slack in the job market, the unemployment rate can’t fall forever.

While the economy isn’t necessarily heading toward recession, the pace of growth is expected to slow. Job market constraint will become more binding. Fiscal stimulus has supported growth, but the impact should fade in the second half of 2019. Tariffs and foreign retaliation have not had a big impact on overall economic growth, but recent tariffs on $200 billion of Chinese goods will rise in January (from 10% to 25%) and President Trump has threatened to broaden that to cover all imports from China. That would likely be a drag on consumer spending growth. Growth outside the U.S. is expected to slow.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.