High Anxiety

The recent data releases continue to suggest moderately strong economic growth in the near term and little threat of higher inflation. However, investors remain anxious about a wide range of issues. In contrast, in his discussion last week, Fed Chairman Powell appeared confident that the economy is in good shape and can handle further rate increases.

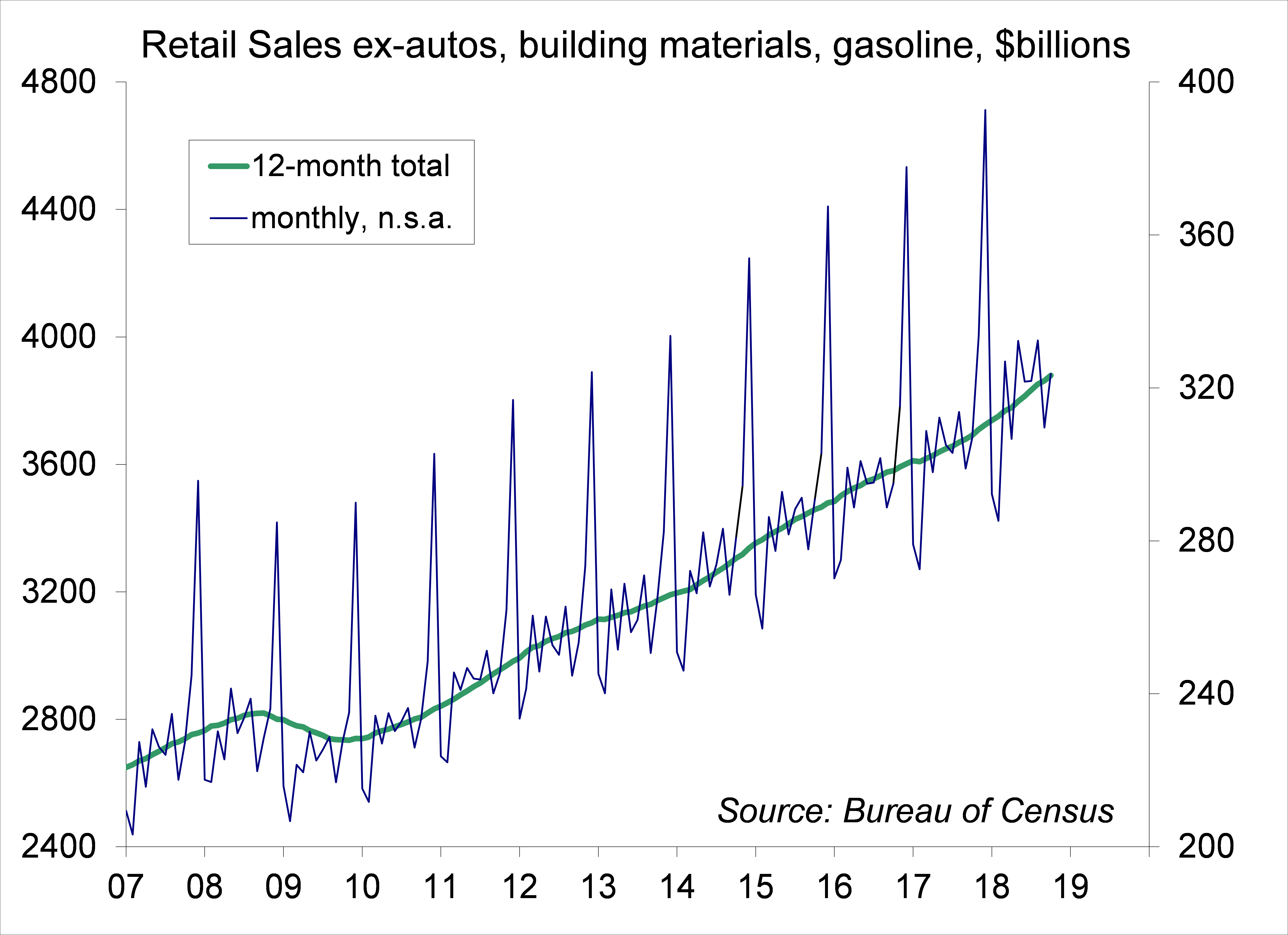

Retail sale rose more than expected in October, but that news was accompanied by downward revisions to the two previous months. Sales were unusually strong in the spring and early summer, leading a bit of a lull in August and September. The underlying trend appears moderate. Job gains and rising wages should provide support in the holiday shopping season. We should see a continuation of the trends of recent years. That is, consumers are generally conditioned to buy stuff on sale. We should also see a further shift toward online sales (amplified by the demise of Toys R Us), partly at the expense of traditional department stores.

Early 2019 may be a bigger challenge for the consumer spending outlook. Bear in mind that there is further fiscal stimulus in the pipeline. Expansionary economic policy is, well, expansionary – and the federal budget deficit is projected to widen significantly further next year (with most of the boost showing up in the first half of the year). On the other hand, trade tensions, which have had little impact on the aggregate economy so far, are set to ramp up. The 10% tariff on $200 billion in Chinese goods (industrial inputs, capital equipment, and some consumer goods) is set to rise to 25% in 2019 and President Trump has threatened to impose tariffs on an additional $267 billion in Chinese goods (mostly consumer goods). This could be avoided if we reach a trade agreement with China, but it’s unclear as to which of the opposing factions within the White House will prevail. January and February are not critical months for retailers, but a broadening of tariffs would boost consumer prices into the important spring selling season.

A tariff, we should note, is a tax, and taxes are not directly included on inflation measures. Of course, higher input costs may be passed along. Prices of raw materials generally picked up in the first half of the year, but have moderated in recent months. Still, excluding food and energy, goods account for a little less than 25% of the Consumer Price Index. Most of the CPI is services, which are driven more by labor costs. Growth in average hourly earnings has been trending higher (although offset largely by inflation over the last year) and we should see a further pickup in early 2019, reflecting annual cost of living increases and higher minimum wages at the state level. Firms will often try to raise prices at the start of the year, but they don’t always stick. Much of this is incorporated into the seasonal adjustment, but it’s likely that inflation will increase in the first half of 2019 and then moderate in the second half. Barring a substantial shock in oil prices, we aren’t going to see a return of the great inflation of the 1970s and early 1980s. Importantly, inflation expectations remain well anchored.

In his recent comments, Fed Chairman Powell seemed content with the economic outlook. He and other senior Fed officials aren’t worried much about the impact of trade policy or the recent stock market volatility. Powell noted a broad consensus among policymakers that further rate hikes will be appropriate. A December 19 rate hike is likely, but is not fully factored into the financial markets at this point. There will be a press conference after every Federal Open Market Committee beginning in January. That change will reinforce the idea that every policy meeting is a “live” meeting (where the Fed may raise rates). The Fed generally does not like to surprise the financial markets, so decisions should be well telegraphed ahead of each FOMC meeting. Officials are well aware of the lagged effect of previous interest rate increases and the risks of moving too rapidly.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.