How have markets and economy evolved since the last leap year?

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Stocks have continued to leap higher

- Bonds still have not recovered from their losses

- Economic growth has not skipped a beat

We’re having another leap year! This year, February will include another day – the ‘bonus’ day that we get about once every four years. While this practice may seem arbitrary, there is actually science behind it. Since the earth takes 365.25 days to rotate around the sun and our calendars round down to 365 days in a year, a fractional surplus of time remains unaccounted for each year. The ‘bonus’ day is needed to ensure that our seasons don’t fall out of alignment. The last leap year occurred in 2020, just around the time the global economy was beginning to be impacted by the COVID-19 pandemic. The world has changed, and the economy and the financial markets have experienced a rollercoaster the last four years, so we thought it would be instructive to take a look at how things have evolved over that time period:

-

- Stocks have leaped higher | Four years ago this week (2/19 to be exact) the S&P 500 climbed to an all-time high of 3,386 before plunging over -34% as the world economy shutdown due to the pandemic. Ironically, despite the pullback, with the S&P 500 today trading at 5,087, the four-year average annual return of the S&P 500 is 12.5%, once again suggesting that investors willing to endure volatility can be rewarded with long-term performance. Some of the performance statistics over that time period include:

- Since bottoming at 2,237 in March 2020, the S&P 500 has gone on to achieve 108 new all-time highs – with the bulk of the records occurring in 2021 as the economy and earnings recovered, powered by massive monetary and fiscal stimulus.

- Over the last four years, the S&P 500 sectors that have led the rally include the Technology and Energy sectors, which are cumulatively up 115.4% and 90.1% (or 21.1% and 17.4% annualized), respectively.

- However, the stock market’s recovery experienced its fair share of volatility along the way, with 14 5% pullbacks, 3 10% and a bear market (a decline of 20% or more) in 2022 along the way. Fortunately, the resilience of the U.S. economy, moderating inflation and the end of the Fed’s tightening cycle turned sentiment around, lifting the stock market back into bull territory.

- While our near-term market outlook is cautious given our expectations for slowing growth, relatively expensive valuations and bullish sentiment, we believe this bull market is still in its infancy. That’s because we are only 1.3 years into this bull market versus the average bull market lasting approximately 5.5 years.

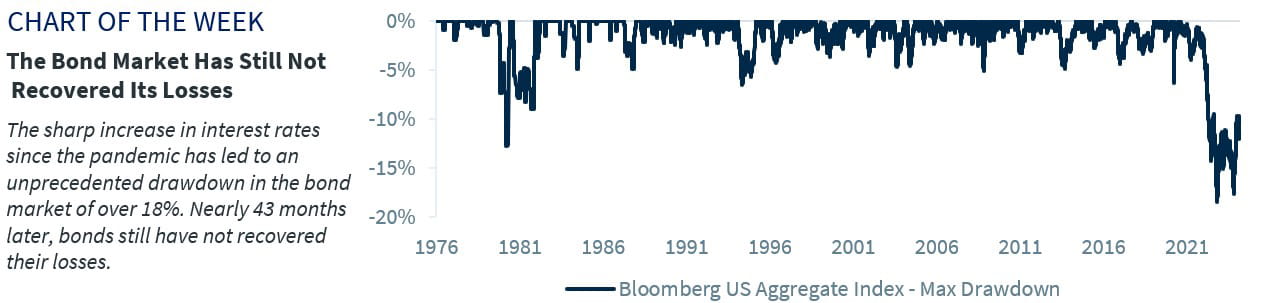

- Bonds have not yet recovered their losses | The grind higher in interest rates over the last four years has been painful for fixed income investors. Since the all-time low bond yields following the pandemic, the Bloomberg US Aggregate Bond Index suffered an unprecedented max drawdown of over 18%! That’s because the 10-year Treasury yield marched from a low of just 0.52% in August 2020 to near 5.0% last October.

- From an historical perspective, the length of the bear market in bonds is unprecedented – lasting 43 months. That’s nearly double the length of the previous longest bear market in bonds (October 1998 to March 2000).

- The bad news: if bond yields stabilized at current levels and remained steady for the foreseeable future, it would take another two years before the bond market was able to fully recoup the losses it sustained.

- The good news: the income generated from bonds (the highest in over 15 years) is starting to chip away at these losses. And, with the Fed’s tightening cycle now complete and an easing cycle on the horizon as growth and inflation ease from current levels, lower bond yields in the months ahead should bolster bond market performance and close the gap even faster.

- Economic growth has not skipped a beat | Despite criticism for letting the inflation genie out of the bottle, the Fed has done a very good job steering the economy through a once-in-a-generation pandemic, soaring inflation, supply chain disruptions and wars overseas. If the Fed is able to engineer a soft, non-recessionary landing, it would only supplement its already positive legacy in dealing with some of the most complex and extreme economic dynamics we have seen in decades. In fact, if you fast forward from the start of the pandemic to today, the economy has been resilient and is in the process of normalizing.

- Despite all the ups and downs, the U.S. economy has expanded by over $2 trillion or 9.7% (2.3% annualized) to record levels. Leading the way has been the consumer, with personal consumption expenditures driving the increase over that period, expanding by 12.3% (2.9% annualized) or $1.7 trillion.

- No doubt there was an inflation spike that sent the Fed’s preferred measure of inflation (PCE) up to 7.1% in June 2022. But that was short-lived. The disinflationary trend remains well established with the PCE decelerating to 2.6% on a year-over-year pace – and is likely to fall further after next week’s release.

- The unemployment rate has remained at 4.0% or below for 26 consecutive months—a record last seen in the late 1960s. In fact, it hasn’t changed much since February 2020 (3.5%), but average hourly earnings increased by 21% (or 4.9% annualized).

- Stocks have leaped higher | Four years ago this week (2/19 to be exact) the S&P 500 climbed to an all-time high of 3,386 before plunging over -34% as the world economy shutdown due to the pandemic. Ironically, despite the pullback, with the S&P 500 today trading at 5,087, the four-year average annual return of the S&P 500 is 12.5%, once again suggesting that investors willing to endure volatility can be rewarded with long-term performance. Some of the performance statistics over that time period include:

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.