Ill at Ease

Chief Economist Scott Brown discusses current economic conditions.

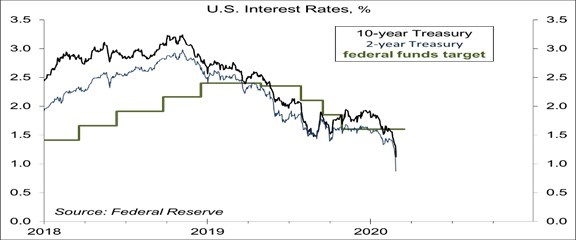

The coronavirus has spread to other countries and the CDC issued a stark warning about the possible consequences in the U.S. Stock market participants appear to have entered the panic phase. Bond yields have plummeted to record lows. On Friday, Fed Chair Powell issued a statement in an attempt to calm the markets. A week ago, the federal funds futures market had signaled less than a 50% chance of a rate cut by June. It has pulled forward expectations of a Fed rate cut and is now pricing in a strong likelihood of a 50-basis-point cut on March 18. The Fed’s decision will depend on whether the coronavirus spreads in the next couple of weeks, which it may. Consumers and businesses should hope for the best, but prepare for the worst.

Getting a precise estimate of the economic impact of COVID-19 is impossible. We simply don’t know. The worst-case scenario is dire, something akin to the Spanish influenza of 1918-20. However, we could see only a limited outbreak in the U.S. In the next couple of weeks, we ought to get a better handle on how the virus spreads and whether it is likely to become a broader epidemic in the U.S. The spread of the coronavirus beyond China makes it more difficult to isolate the risks to the U.S. Around 80% of those infected have only mild symptoms and the virus may be transmitted asymptomatically, meaning that it can be spread by someone infected but showing no symptoms.

Warmer weather could limit the spread of COVID-19, but that’s unclear, and even if that were true, we could see it return later this year. A vaccine is likely at least a year away. Health experts advise us to wash hands regularly and avoid touching your face. Firms should move to facilitate working from home, although that’s not an option for many.

The economic impact of avoidance (restricted travel, reduced attendance at restaurants, theatres, sporting events, and shopping centers) would be several times the direct effect (reduced labor input of sick employees).

The drop in the stock market will not prompt the Fed to lower short-term interest rates. However, the Fed would respond to growing downside risks to the growth outlook (which is driving the stock market down). Fed officials still view the economy as being in a good place. Consumer fundamentals remain sound. Business fixed investment appears to have been in the process of bottoming, with some improvement likely in the near term. Residential housing has strengthened. Given that the federal funds target rate is relatively low to begin with, the central bank should be more aggressive in cutting rates if it thinks it needs to. However, the fundamentals remain sound and policy is already accommodative, which argues for a more gradual approach. Nevertheless, anecdotal evidence of a quicker and sharper avoidance (such as travel and hotel cancellations, school closings, etc.) could prompt more aggressive action. (M20-2974411

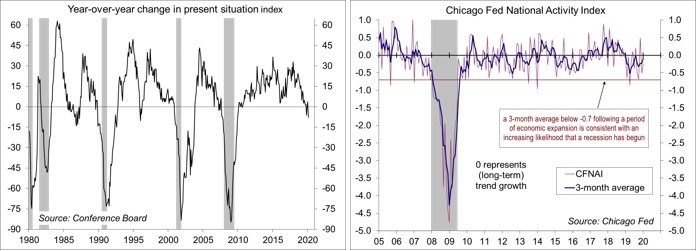

Data Recap – The spread of COVID-19 to other countries and a stark warning from the Centers for Disease Control sent share prices sharply lower. Bond yields plunged to record lows. The economic data reports painted a picture of moderate growth in early 2020, but that doesn’t matter much given coronavirus fears. The Chicago Business Barometer and the UM consumer sentiment reports indicated that COVID-19 is beginning to have an impact on the economy (disrupted supply chains, some impact on consumer attitudes).

Fed Chair Powell issued the following statement: “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.”

COVID-19 spread further outside of China, fanning fears of a more extensive outbreak within countries (what health experts call “community spread”). Nancy Messonnier, M.D., Director of the National Center for Immunization and Respiratory Diseases, said that “it’s not so much a question of if this will happen anymore but rather more a question of exactly when this will happen and how many people in this country will have severe illness.”

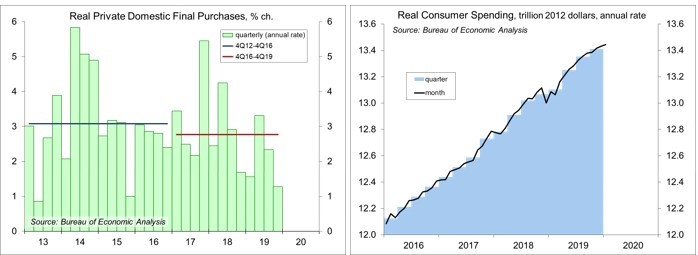

Real GDP rose at a 2.1% annual rate in the 2nd estimate for 4Q19, the same as in the advance estimate. Private Domestic Final Purchases rose at a 1.3% pace (vs. +1.4% in the advance estimate, +2.1% y/y). Consumer spending rose at a 1.7% annual rate (vs. 1.8%), while business fixed investment fell 2.3% (vs. -1.5%). Residential fixed investment rose 6.2% (vs. 5.8%). Inventory growth slowed a little less, subtracting a full percentage point from headline growth, while the trade deficit narrowed a little less, adding 1.5 percentage points.

Personal Income rose 0.6% in January (+4.0% y/y). Private-sector wages and salaries rose 0.5% (+3.7% y/y). Personal Spending rose 0.2% (+4.5% y/y), held down by a 1.7% decline in apparel sales and a 1.6% drop in gasoline sales. Adjusted for inflation, consumer spending edged up 0.1% (+2.7% y/y). The PCE Price Index rose 0.1% (+1.7% y/y), up 0.1% (+1.6% y/y) ex-food & energy (still trending well below the Fed’s 2% goal).

Durable Goods Orders slipped 0.2% in January, a smaller drop than anticipated. Orders for civilian aircraft surged 346.2%, reflecting a quirk in how the numbers are reported. Defense aircraft fell 19.4%. Ex-transportation, orders rose 0.9%, mixed but generally higher across industries. Orders for nondefense capital goods rose 1.1% (with shipments also up 1.1%), suggesting a possible bottoming in business fixed investment (however, all that goes out the window with COVID-19).

The report on Advanced Economic Indicators showed a narrower merchandise trade deficit in January. Wholesale inventories fell 0.2% and retail inventories little changed. It’s only one month, but the figures suggest mixed contributions to 1Q20 GDP growth (a narrower trade deficit adds to GDP growth, while slower inventory growth subtracts).

The Conference Board’s Consumer Confidence Index edged up to 130.7 in the advance figure for February, vs. 130.4 in January (revised from 131.6). Respondents were less enthusiastic (but still very optimistic) about current business conditions and job availability, but expectations for the next six months improved.

The Chicago Fed National Activity Index, a composite of 85 economic indicators, rose to -0.25 in January, vs. -0.51 in December. At -0.09, the three-month average was consistent with growth somewhat below trend in the near term.

The UM Consumer Sentiment Index rose to 101.0 in the full-month survey for February (vs. 100.9 at mid-month and 99.8 in January). COVID-19 was mentioned by just 8% of respondents, but 20% mentioned it in the final days of the survey (which came before the CDC warning and most of the stock market sell-off).

The Chicago Business Barometer rose to 49.0 in February (still in contraction), vs. 42.9 in January. Supplier Deliveries jumped 7.9 points to 61.3, “with anecdotal evidence that the coronavirus is already leading to supply chain disruptions.”

New Home Sales rose 7.9% (±17.8%), to a 764,000 seasonally adjusted annual rate (up 18.6% y/y, ±19.2%), aided somewhat by unseasonably mild weather (although consumer fundamentals remain strong and mortgage rates are low). Unadjusted sales for November-January were up 18.3% y/y (Northeast +33.3%, Midwest +30.8%, South +5.0%, West +40.6%).

The Pending Home Sales Index rose 5.2% in January (+5.7% y/y), following a 4.3% drop in December.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.