Master Limited Partnerships

Readers of these missives know that we have been favorable on the midstream Master Limited Partnership (MLP) space for a number of months. The reasons for that strategy have often been mentioned in these letters. First, the midstream MLPs sold off when the upstream MLPs blew up with most of them going bankrupt. The midstreams were sold because of guilt by association. Quite frankly, the upstream MLPs had way too much sensitivity to the price of crude oil, but the midstreams do not. You can think of them as a transportation company without wheels since they own pipelines and storage facilities. Second, most of them have reduced their dividend distributions, not because they had to, but to get their “leverage ratios” down. Third, in March 2018, the Federal Energy Regulatory Committee (FERC) dropped a bombshell on the MLPs when it wrote, “The Commission today acted in response both to the court remand and comments filed in response to an inquiry issued after the court ruling. FERC will now revise its 2005 Policy Statement for Recovery of Income Tax Costs so that it no longer will allow MLPs to recover an income tax allowance in the cost of service.”

The resulting MLP sell off accelerated, and many of the hedge funds actually sold the MLPs short. Indeed, from its peak price in September 2014, the Alerian MLP Index (AMZ/$270.94) declined some 63% into it’s the February 2016 low and now resides about 50% below those September 2014 highs. Fourth, that sell off has left the MLP group in aggregate trading at some of the most inexpensive valuation metrics in a long time. According to one Wall Street MLP fundamental analyst, “The aggregate EBITDA for the MLP/midstream names we cover has grown by 70% while [the] aggregate industry leverage has declined from 6.2x in 2015 to our 2018E of 4.6x.”

Fifth, last week, FERC modified its March 2018 statement that removed several concerns and uncertainties for the MLP space. As our MLP analyst, Darren Horowitz, wrote on July 19, 2018:

Overnight, the Federal Energy Regulatory Commission posted a final rule on several components of the revised policy statement (RPS) and notice of proposed rulemaking from March 2018 – we commented in this report. MLPs with corporate parents are essentially excluded from the proposed changes, and accumulated deferred income tax (ADIT) reimbursement concerns have been eliminated for impacted MLPs.

Although FERC determined in the RPS that permitting MLP pipelines to include a tax allowance in their cost of service results in a double recovery of the MLP pipeline’s tax costs, FERC will not require MLP pipelines to eliminate their tax allowances in this rulemaking proceeding (i.e., no material change to ratemaking for MLPs with C-Corp. GPs).

MLPs are considered subject to the federal corporate income tax if all of their income or losses are consolidated on the federal income tax return of their corporate parent. This means that a pass-through entity is eligible for a tax allowance.

An MLP that will no longer recover an income tax allowance (ITA) may also eliminate its ADIT from cost of service rates, rather than flowing these back to ratepayers. This was a major question mark before this announcement as it was unclear if ADIT would be reimbursed, and over what time frame. As we stated when the news first broke in March 2018, these items are very difficult to quantify – we cannot quantify prior upside or newly perceived upside for all the stocks in our coverage. In the months between then and now, most midstream/MLP management teams had successfully explained the various mitigating factors that could be in play if the full FERC changes were introduced. Most of the stocks in our coverage universe have since recovered to reflect a much lower cash flow exposure than most investors initially feared

Obviously, some big clouds have been lifted from the MLP space, and that was reflected last week when many of the MLP stocks leaped on the FERC revised statement. Using our fundamental MLP analysts’ Strong Buy rated names, and screening them with our proprietary models, favors these names: Antero (AM/$31.64/Strong Buy) and Enterprise Products (EPD/$28.71/Strong Buy). For additional investment ideas, we suggest pursuing our energy analysts’ MLP research coverage list.

Moving on to the stock market, after breaking above its 2792-2795 resistance level, and then doing the same at the 2800-2805 level, the S&P 500 (SPX2801.83) limped into last Friday’s closing bell. This is not all that unusual in that it is normal for an index to loiter around a previous peak, and retest the point of breakout, which in this case is the 2800-2805 zone. We also noted in last Friday’s report, “Yesterday we stated that the stock market’s ‘internal energy’ was pretty much used up on a short-term basis, although we thought the market’s forereach would carry prices higher into next week. Obviously that was wrong on a trading basis.” No sooner had we made that statement early last Friday when the D-J Industrials promptly fell almost 100 points. But, a funny thing happened. The decline was arrested and the senior index clawed its way back to the flat line. For the week, stocks were little changed as presidential tweets and comments took center stage. Our president’s comments about not being happy with the Fed’s raising interest rates had the media in a rant. However, while such comments have not been present in recent history, in an era gone by, those kind of comments were used by a number of presidents. Also worth mention is that there have been three politically novice presidents in the last 90 years. They were Herbert Hoover, Dwight Eisenhower, and now Donald Trump. Novices tend to make mistakes, but as Tom Lee points out, “The market can overreact, treating missteps as serious policy errors. Hence we are buying the negative headlines.” And that has been Andrew’s and my strategy ever since identifying THE low that occurred on February 9, 2018. So far that strategy has been working, as earnings and the economy have trumped the Trump tweets and missteps.

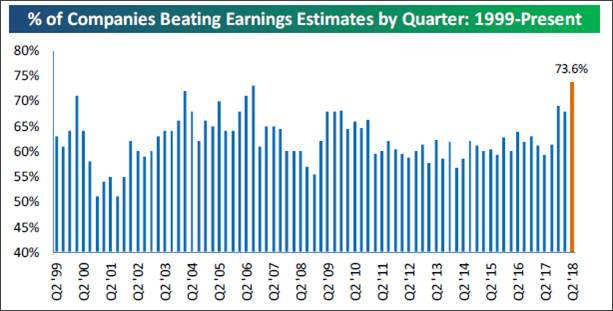

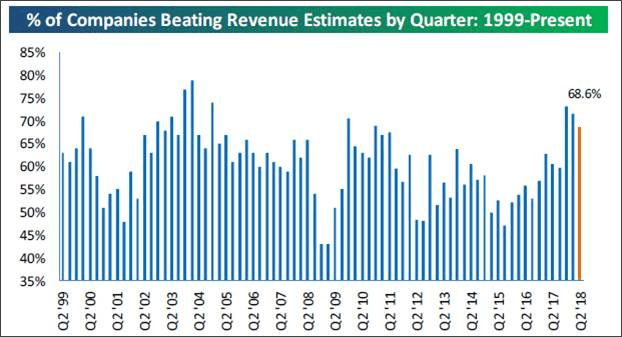

Speaking to earnings, of the companies that have reported 2Q earnings, 73.6% of them have beaten the consensus estimates (chart 1 below), while 68.6% have beaten revenue estimates (chart 2 on page 3). Using the smaller sampling of the S&P 500 shows that, of the 87 companies that have reported, 83.9% beat earnings estimates and 73.6% bettered revenue expectations. This week earnings season is in full swing with 175 of the S&P 500 companies slated to report. Looking at the estimates for the next four quarters leaves the S&P 500’s price earnings ratio at 16.7x.

The call for this week: So we recommended raising some cash in January and then put most of that back to work in February. Ever since then, we have been adamant the equity markets were going to trade to new all-time highs. Many of the indices have done just that, yet the S&P 500 and the D-J Industrials have not. However, we continue to think those two indexes will do the same as the Advance-Decline lines continue to point the way higher. As Sam Stovall (CFRA), son of legendary strategist Bob Stovall who was the keeper of the GM indicator, wrote last week, “History, encouragingly says, but doesn’t guarantee, that the S&P 500 could advance more than 10% beyond the prior high before slipping into another decline of 5% or more.”

Expiration stocks have a tendency to rally during the first hour of trading on position squaring. Friday was an Inside Day in the charts for the S&P 500 Index. Traders will be sensitive to Friday’s S&P 500 Index high (2809.70) and its low (2800.01). Plainly, 2800-2805 is a very important support level. This morning, the preopening S&P 500 futures are flat as we write at 5:07.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.