Weekly Investment Strategy

Read the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Earnings Season Is Off to a Strong Start But Has Miles to Go

- Financials & Health Care Surge to the Front of the Pack

- Info Tech Has & Will Continue to Set the Pace

The fall marathon season is underway, with runners having competed or planning to compete in one of the many marathons across the country, including Chicago, Baltimore, Detroit, Columbus and DC. One ‘run’ that has yet to be completed is the current equity bull marathon which is the second longest in our history (127 months), but the strongest from a total return perspective at this point of the cycle (+453% since its March 9, 2009 inception). Just as a marathon runner needs disciplined training and proper nutrition to be successful on race day, the equity market needs a positive economic outlook, attractive valuations, supportive corporate activity, and strong earnings growth to continue its run to new record highs. With 3Q earnings season set to ‘fuel’ the near-term headlines, we reflect on the results thus far and highlight some of our expectations moving forward.

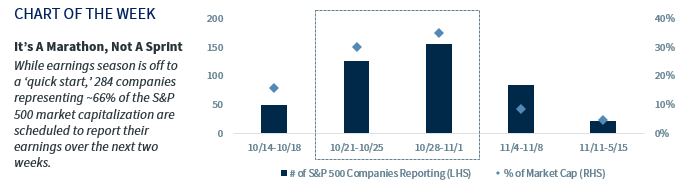

- It’s A Marathon, Not A Sprint | This week, 50 companies, representing ~15% of the S&P 500 market capitalization, reported earnings. The results are off to a quick start—77% of companies beat bottom line estimates (well above the previous 20Q average of 73%) and 59% of companies beat top line estimates (in line with the previous 20Q average of 60%). But as any seasoned runner knows, an aggressive pace out of the gate may be difficult to maintain. As we cautioned last week, headline earnings were expected to decline 4% year-over-year (YoY) in 3Q19, and although earnings typically beat estimates by ~4%, it is likely to ‘come down to the wire’ on whether or not we can skirt negative earnings growth. The next two weeks should provide additional insights, as 284 companies representing ~66% of the market capitalization of the S&P 500 are set to report. Although the results will weigh heavily on individual stock performance in the near term, building confidence in our expectation of 6-7% S&P 500 earnings growth in 2020 would be a tailwind for a market ‘thirsty’ for accelerating fundamentals.

- Financials Come From Behind | Most of the major financial services companies reported this week, and expectations were low given lower interest rates and the inverted yield curve likely ‘cramped’ net interest income. In fact, the 10-year/3-month subset of the yield curve was inverted for 84% of the quarter. While most companies beat their ‘low hurdle’ estimates, it is important to acknowledge earnings estimates for the sector were revised down 4.75% over the last three months. On a positive note, several financial institutions saw strength in their consumer-facing activities. With wage growth at 3.2% YoY and the unemployment rate at 50-year lows, several banks reported better than expected results for both home and auto loans. With our base case that the Federal Reserve will cut interest rates one additional time before year end and that the US consumer will remain strong, the Financial sector earnings should rebound.

- Health Care the Underdog | The Health Care sector is the second worst performing sector year-to-date (YTD), and currently lags the broader market by ~14%. The reason for the drastic underperformance is the potential negative earnings growth consequences as a result of ‘Medicare for All’ (MFA) and other regulatory propositions such as drug price disclosures in advertisements. Senator Elizabeth Warren, currently the Democratic front-runner, is one of the main advocates of MFA. However, in Tuesday’s debate, it was clear that MFA is not widely accepted amongst the Democratic candidates. Former Vice President Joe Biden balked at the program’s $30+ trillion cost, and Senator Amy Klobuchar referred to the system as a pipe dream. Due to the division, it is doubtful that MFA would be passed by Congress and the political risk associated with the Health Care sector is likely overblown. Health Care is one of only two sectors with earnings expectations revised higher over the last three months, and a few major sector constituents upped their forward guidance on their earnings calls this week. Attractive valuations, combined with solid earnings growth, support our current overweight to the sector.

- Info Tech Sets the Pace | The Technology sector is the top performing sector YTD, outperforming the S&P 500 by ~13%. Despite its outperformance, there are growing concerns that the slowdown in global economic momentum and the US-China trade war could start to impact the sector’s earnings. Earnings expectations were revised lower by 1.46% in the preceding three months, but that is substantially less than the 3.87% downward revision for the broader market. Over the last ten quarters, the Technology sector has seen the second largest earnings beats at 6.8% and we expect similar success this quarter. Headline risk (e.g., anti-trust debate) could present an opportunity to add exposure, and we maintain our positive outlook on the sector as it has historically been the top performer in an ‘insurance’ rate cut environment.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.