Jay Walking It Back

Fed Chairman Jerome “Jay” Powell will deliver his semiannual monetary policy testimony to Congress on Tuesday and Wednesday. In past decades, this testimony was a huge deal for the financial markets. These days, not so much. The Fed is a lot more forthcoming. Policy meeting minutes are released a lot sooner. Officials are more open in their public comments. The Fed now releases its monetary policy report on the Friday before the scheduled testimony. Still investors will want to pay attention. Meanwhile, delayed government data will arrive this week, providing a clearer picture of the past and, hopefully, pointing ahead.

In its Monetary Policy Report to Congress, the Fed noted that economic activity appeared to have increased at a “solid” pace in the second half of 2018 and “the FOMC judged that, on balance, current and prospective economic conditions called for a further gradual removal of policy accommodation.” However, “in light of softer global economic and financial conditions late in the year and muted inflation pressures, the FOMC indicated at its January meeting that it will be patient as it determines what future adjustments to the federal funds rate may be appropriate to support the Committee’s congressionally mandated objectives of maximum employment and price stability.” The financial press described this a flip-flop, a major U-turn. Bloomberg News said it was “the biggest policy about-face in years.” As if. The Fed went from a mild tightening bias to a seemingly neutral stance (though most officials still anticipate that higher rates may be needed). In his January 30 press conference, Chairman Powell said that “common sense risk management suggests patiently awaiting greater clarity – an approach that has served policymakers well in the past.” The Fed merely responded to increased downside risks – risks that had intensified in late December and early January.

The minutes of the January 29-30 FOMC meeting showed that “several meeting participants argued that rate increases might prove necessary only if inflation outcomes were higher than in their baseline outlook.” However, “several other participants indicated that, if the economy evolved as they expected, they would view it as appropriate to raise the target range for the federal funds rate later this year.” So, if we get a reduction in the near-term risks, then we may see the Fed edge short-term interest rates higher. The partial government shutdown is behind us and we may reach a trade agreement with China. However, uncertainty about Brexit remains.

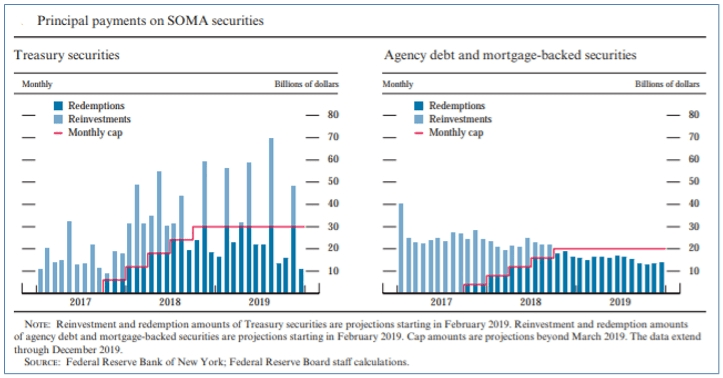

No surprise, the balance sheet was a key item for discussion in January. While many financial market participants felt that the unwinding of the balance sheet was a key factor in the stock market’s decline (from October), the Fed begs to differ. Officials thought that the unwinding “would put some modest upward pressure on Treasury yields and agency mortgage-backed securities (MBS) yields over time,” but “they generally placed little weight on balance sheet reduction as a prime factor spurring the deterioration in risk sentiment.” Still, “some other investors reportedly held firmly to the belief that the runoff of the Federal Reserve’s securities holdings was a factor putting significant downward pressure on risky asset prices, and the investment decisions of these investors, particularly in thin market conditions around the year-end, might have had an outsized effect on market prices for a time.” Policymakers hypothesized that investors may have misread the Fed’s intentions, that it would be inflexible (on rates and the balance sheet) to changing economic conditions. In early January, officials began to emphasize that the Fed would be “patient” in considering adjustments to short-term interest rates and “flexible” in managing reductions to its balance sheet. That seemed to do the trick – “on balance, stock prices finished the period up almost 5 percent while corporate risk spreads narrowed, reversing a portion of the changes in these variables since the September FOMC meeting.”

Last summer, Fed Vice Chair for Supervision Randall Quarles said that the unwinding of the balance sheet should be “as boring as watching paint dry.” Well, “times have changed,” noted Quarles recently.

“In January, after much discussion, including in previous meetings, the FOMC announced its intent to continue operating in a framework of ample reserves. In this regime, active management of the reserve supply is not needed. The Federal Reserve controls the level of the federal funds rate and other short-term interest rates primarily through the use of administered rates, including the rate paid on reserve balances and the offered rate on overnight reverse repurchase agreements. This regime is sometimes referred to as a floor system, because the administered rates place a floor under the rate at which banks and others will lend in the federal funds market. In adopting this framework, the Committee stated its intention to continue operating as it has for the past decade.”

With a decision made on the operating framework, “a natural next step is to contemplate the appropriate size of the Fed’s balance sheet and reserves and the process for getting there.” Quarles, said that “ultimately, the size of the balance sheet will be determined by a number of factors, including demand for non-reserve liabilities, such as currency (which has been rising), and, importantly, the quantity of reserves necessary to remain reliably on the flat portion of the reserve demand curve.” The level of reserve demand remains “quite uncertain.” When the balance sheet unwinding ends and at what level are uncertain, but most Fed officials expect an end later this year. We should hear some details over the next few FOMC minutes.

At this point, the composition of the balance sheet is expected to change. The Fed should allow its holdings of mortgage-backed securities to run to zero, returning to a balance sheet of all Treasury securities. The Fed does not plan to sell MBS initially, but may at a later date (the reduction will be accomplished through mortgage prepayments and maturation). The Fed may also shorten the duration of its portfolio. Such details are subject to change in this year’s debate, but should be settled over time.

This year, Fed Vice Chair Richard Clarida is leading a review of the central bank’s monetary policy framework, its tools, strategies, and communications practices. The first question, according to Clarida, is “Can the Federal Reserve best meet its statutory objectives with its existing monetary policy strategy, or should it consider strategies that aim to reverse past misses of the inflation objective?” The Fed has consistently undershot its inflation goal in recent years. The Fed may consider a “makeup” strategy, allowing inflation to rise above the 2% target for a period (to reach the 2% goal “on average”). Another question: “Are the existing monetary policy tools adequate to achieve and maintain maximum employment and price stability, or should the toolkit be expanded? And, if so, how?” After hitting the zero lower bound on interest rates during the financial crisis, the Fed employed “forward guidance” (a conditional promise to keep short-term rates low for an extended period) and large-scale asset purchases (QE). Officials are reviewing alternative measures to be employed in the next recession. The third question is “How can the FOMC’s communication of its policy framework and implementation be improved?” The Fed will conduct town hall events and policy symposiums this year as it considers these issues.

The Bureau of Economic Analysis will release an “initial” estimate of 4Q18 GDP growth on Thursday (February 28). In terms of the available information, this falls somewhere between the “advance” estimate and the “2nd” estimate. We’ll also get some delayed pieces of the puzzle in the days leading up to that (December residential construction, factory shipments, and advance figures on foreign trade and inventories). Estimates of fourth quarter GDP growth have been coming down recently, mostly reflecting the disappointing retail sales report for December (released February 14). Shipments of capital equipment slowed. Inventories likely slowed sharply (a faster pace of inventory accumulation had added 2.3 percentage points to GDP growth in 3Q18, a slower pace will subtract from 4Q18 GDP growth). Through the November data, it looks as if net exports may make a positive contributions (net exports subtracted 2.0 percentage points from 3Q18 GDP growth).

Data Recap – There were no major surprises in the FOMC minutes, although the officials did not discuss lowering rates (as some market participants had anticipated). The economic data were generally on the weak side of expectations.

The FOMC Minutes from the January 29-30 policy meeting showed that officials “pointed to a variety of considerations that supported a patient approach to monetary policy at this juncture as an appropriate step in managing various risks and uncertainties in the outlook,” while they waited on more information. Policymakers also thought that the markets had over-reacted to balance sheet reduction, with stock market weakness made worse by “thin market conditions around the year-end.” Several officials felt that it would be appropriate to raise short-term interest rates if inflation rose above what was expected or if the economy evolved as anticipated.

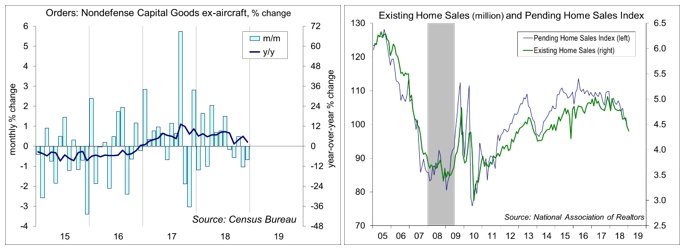

Durable Goods Orders rose 1.2% in December (the report was delayed due to the partial government shutdown), reflecting a further rebound in civilian aircraft orders (+28.4%). Ex-transportation, orders edged up 0.1%, mixed across sectors (primary metals -0.9%, fabricated metals +0.3%, machinery -0.4%, computers and electronics +0.0%, electrical equipment and appliances -0.1%). Orders for nondefense capital goods ex-aircraft fell 0.7%, following a 1.0% decline in November (revised from -0.6%), a -3.4% annual rate in 4Q18 (vs. +8.0% in 3Q18 and +11.0% in 2Q18). Shipments for this category rose 0.5%, a 2.3% annual rate in 4Q18 (vs. +6.9% in 3Q18 and +4.3% in 2Q18).

Existing Home Sales fell 1.2% in January, to a 4.94 million seasonally adjusted annual rate (-8.5% y/y). The National Association of Realtors’ figures represent closings and tend to lag. The NAR expects strengthening household income and a moderation in home prices to improve affordability. Thirty-year mortgage rates are nearly 60 basis point below where they were in the first half of November.

Initial Jobless Claims fell by 23,000 in the week ending February 16, to 216,000. Figures are often during this time of year. At 235,750, the four-week average was the highest in 13 months, but still very low by historical standards.

The Index of Leading Economic Indicators fell 0.1% in January, “essentially flat” in recent months, according to the Conference Board. Components were mixed. Positive contributions were led by stock prices, the credit index, and ISM new orders. Jobless claims, the factory workweek, and consumer expectations made negative contributions. The Index of Coincident Economic Indicators rose modestly (note that two of the four components are estimated). This report included annual benchmark revisions.

Homebuilder Sentiment rose to 62 in February, vs. 58 in January and 56 in December, reflecting lower mortgage rates.

The Philadelphia Fed Manufacturing Index fell to -4.1 in February, vs. 17.0 in January, reflecting decline in new orders and shipments. However, expectations for the next six months held up well. The report has been erratic and unreliable in recent years and one month does not make a trend.

This Week – The focus is likely to be on Fed Chairman Powell’s monetary policy testimony, but we’ll also get some delayed economic data. Wednesday’s data will help refine estimates of 4Q18 GDP growth, which is expected to be restrained by slower inventory growth. December personal income and spending figures will help to gauge the momentum heading into early 1Q19.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.