Look to Steeper Corporate and Municipal Curves

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

It can be difficult for investors to differentiate between asset classes but knowing and understanding differences may help guide investment decisions. Stocks can move in one direction based not on current fundamental analysis but on anticipation of what will happen in the future. For example, price-to-earnings (P/E) ratios are well above five and ten year averages. Does this mean that stock prices will drop so that P/E ratios return to their averages?

Not necessarily. It can be argued that stock ratios are being driven by low interest rates and low inflation or economic factors. Higher earnings can shrink valuation ratios just the same as lower prices. The direction of stocks can be difficult to evaluate partly because interpreting the potential or future can be complicated.

Fixed income is very different in that on the day you purchase a bond, the future is fixed and the outcome is known. In other words, when holding a bond to maturity, the cash flow, income earned and point-in-time face value returned is fixed. In essence, the future does not play a role in determining the value to an investor. We know the value from the day of purchase. The only things that can change this are an outright default or an investor selling the bond prior to its redemption date.

This helps to explain why substituting asset classes can greatly influence an investor’s long term goals. Growth assets are essential as a means to potentially increase investor wealth. Fixed income assets can be crucial in protecting or locking in that amassed wealth.

Disciplined investing can be challenged when asset class allocation is abandoned to isolate on growth alone and thus elevated risk is instituted which in turn can swing wealth in one direction or another. The answer is not to abandon long term planning but to adjust long term planning by taking what the market is providing and listening to what the market is foretelling.

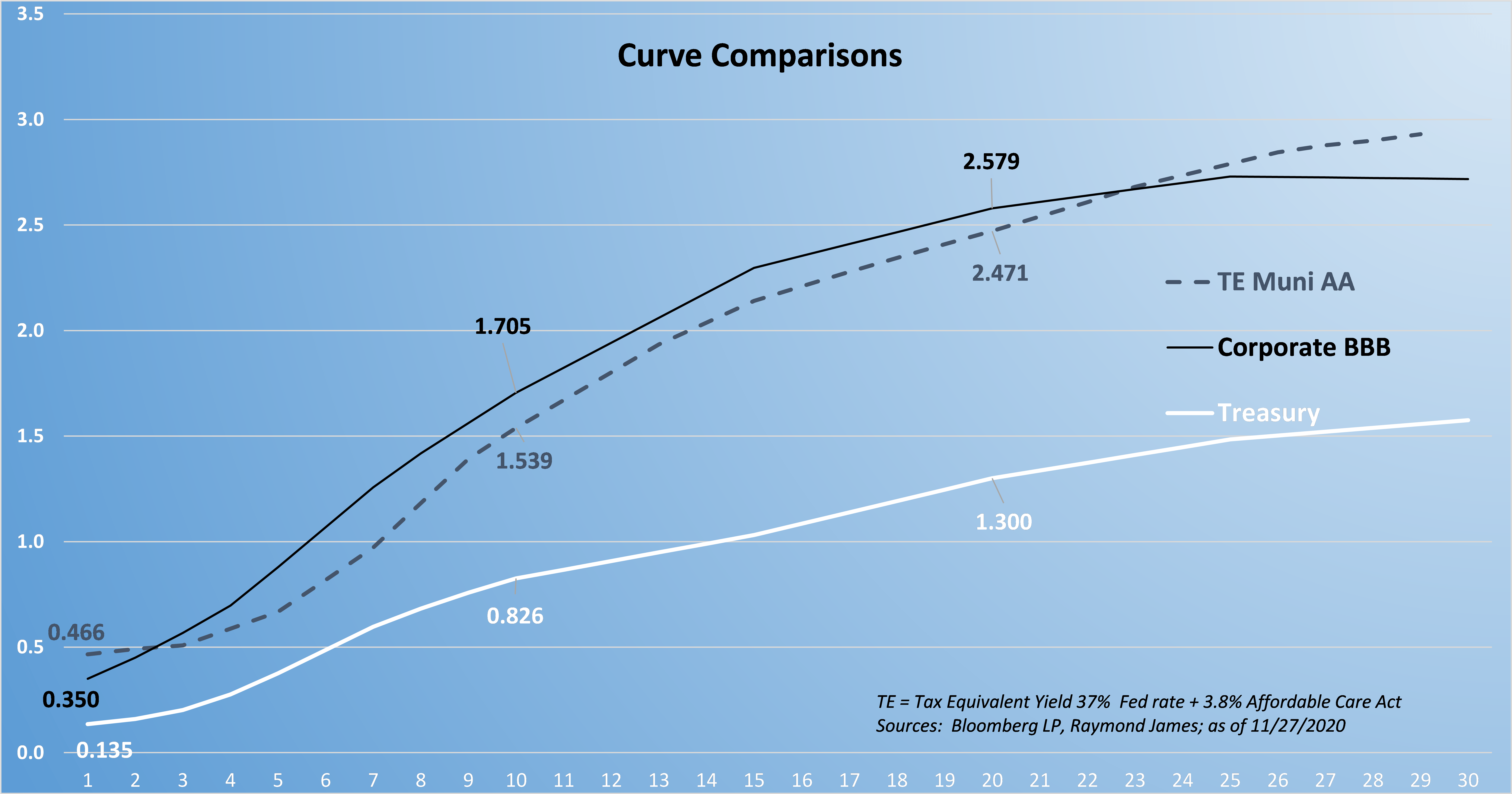

Continuing disciplined asset allocation in fixed income can include common-sense adjustments. When you hear “interest rates are low,” it is generally a reference to Treasury rates. A more suitable comparison should be to investment grade BBB corporates and/or AA rated municipal bonds, two asset classes utilized by many investors seeking to protect wealth.

Note that these asset classes reflect higher yields and steeper slopes versus the Treasury curve. Although increasing duration too high in a generally low interest rate environment is not desirable, staying in extremely low durations will not optimize results. The sweet spot of the corporate and municipal curve is with durations of 3-8. This can be accomplished with an array of various maturities. The important takeaway is to separate asset classes by purpose and utilize the steeper sloped fixed income curves while remaining disciplined with asset allocations.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.