Market impact of Mideast conflict likely to be contained

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Supply chains will not be impacted by Israeli-Hamas war

- Conflict unlikely to push oil prices significantly higher

- No changes to our economic or earnings forecasts

In light of the horrific attack on Israel last weekend, our weekly commentary on the markets takes on a more solemn tone. Our hearts go out to everyone impacted by the tragic events that are ongoing. As the death toll rises and a full-scale war breaks out between Israel and Hamas, geopolitical uncertainty has once again been thrust into the limelight. The surprise attack comes at a critical juncture for the global markets, a time when central banks are preparing to wind down their tightening cycles as the threat of inflation eases. And while unexpected Middle East tensions have the potential to drive oil prices higher, we are hopeful that the conflict will remain contained. In fact, the market’s initial reaction to the tragic events has been relatively muted. While the events are still unfolding, there are four key dynamics that we are watching to gauge the longer-term market impact:

- Middle East turmoil not likely to upend supply chains again | After three years of overlapping crises, it is natural to wonder whether the surprise attack on Israel and its subsequent declaration of war poses another threat to the global economy and supply chains around the world. While these concerns are valid, we do not think the tensions in the Middle East will lead to any major disruptions. Why? For starters, unlike Russia and Ukraine, Israel is not a huge oil or commodities supplier to the world. And because of this, it is unlikely that the Israeli-Hamas war will disrupt supply chains or drag down economic confidence in the same way the Russia-Ukraine war or the pandemic did over the last few years. A major impact on supply chains could occur if there was an escalation in the war throughout the region. Fortunately, our oil analyst does not view this as a likely outcome. If we’re right, this should be welcome news for the Fed as it is unlikely to place upward pressure on inflation or alter its projected rate path.

- Conflict is unlikely to push oil prices significantly higher | The surprise attack on Israel symbolically coincided with the 50th anniversary of the Yom Kippur war. While the timing is sure to spark memories of oil embargoes, supply shortages and massive disruptions in the energy markets, the likelihood of a repeat of 1973 appears limited. Yes, oil prices climbed ~5% after the war broke out last weekend, but that pales in comparison to the near tripling in oil prices during the Yom Kippur war. From our perspective, there are three major differences between today’s war and 1973. First, the war (as it stands today) remains contained between Hamas and Israel. Unlike 1973, other neighboring nations have not been drawn into the conflict. Second, there is no threat of supply shortages today. Yes, OPEC has been cutting production, but there is enough spare capacity to meet current oil demand. And finally, Israel and its immediate neighbors are not big oil producers—which limits the likelihood of any major disruptions. While we do believe that the uncertainty may hold oil prices near our $85-$90/barrel target, we are not expecting oil to spike sustainably higher.

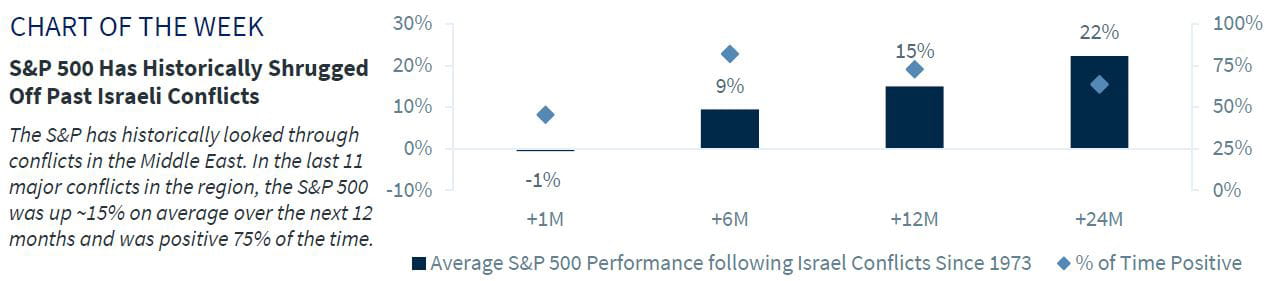

- No changes to our economic or earnings forecasts | Not to minimize the impact and devastation of the events that are taking place in the Israeli conflict, but we think it is important to assess whether the conflict alters our asset class views or outlook for the economy or earnings growth here in the U.S. In our view, it does not materially impact our outlook for a few reasons. First, from an economic perspective, Israel is a small country, with a GDP of $521 billion—making it the 29th largest country in the world, representing only 0.5% of world GDP. To put this into perspective, when measured by GDP, Israel would rank as the 13th largest state in the U.S. (roughly the size of Virginia) and when compared to companies in the S&P 500, Israel is roughly the same size as the 15th largest company (Eli Lilly). Additionally, Israel is not a significant trade partner of the U.S., making up only 0.7% of both U.S. imports and exports (the 25th and 29th largest trade partner respectively). And because of this, Israel is not big enough to derail the U.S. economy from its current path. From an earnings perspective, given that we do not expect a significant economic impact from the war, combined with the fact that the S&P 500 receives only 0.2% and 2.8% of revenues from Israel and the Middle East region respectively, we do not think that the conflict will have a meaningful impact on earnings. Finally, it is worth noting that previous events in the region have not had a significant market impact. In fact, in the previous 11 major conflicts, the S&P 500 was up ~15% on average in the 12 months following the onset of the conflict and was positive 75% of the time.

- Flight to quality in bond market may be a catalyst | After the brutal sell off in the bond market over the last few months, Treasury yields still demonstrated a traditional flight-to-quality response during geopolitical crises with the 10-year yield down ~18 bps to ~4.60% this week. Short covering (as we alluded to in our Quarterly Outlook) and some dovish remarks from Fed officials, who were unnerved by the rapid rise in bond yields since the last FOMC meeting, also added fuel to the rally. While yields have moved higher as the market has priced in a soft, non-recessionary landing, we think recession risks are higher than what is priced into the market. Hopefully, the flight-to-quality move this week is the catalyst to halt the relentless upward march in rates. And if we’re right and the economy does enter a recession in the first quarter of 2024, then there is plenty of room for yields to fall.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.