Market optimism warranted as tightening cycle nears end

Review the latest Weekly Headings by CIO Larry Adam.

- Tighter lending standards still pose a risk

- The debt ceiling issue will get resolved

- The earnings outlook is improving

This past Thursday was National Twilight Zone Day. For those of you who are unfamiliar, The Twilight Zone was a sci-fi series created in the late 1950s. While the show only lasted five seasons, it was widely regarded as one of the greatest TV series of all time. Each episode was masterfully written and best known for the imaginative tales and ever-evolving narratives where ordinary people found themselves in extraordinary situations—“a place where anything could happen.” And given the rapidly changing twists and turns we’ve seen in the global economy and the financial markets over the last few years, it sometimes feels like we’ve crossed over into a modern-day version of the Twilight Zone. But, with the Fed’s fourteen month long tightening campaign near completion and the pandemic-related disruptions normalizing, we are optimistic that the financial markets’ recent strength can continue in the months ahead. Here’s why:

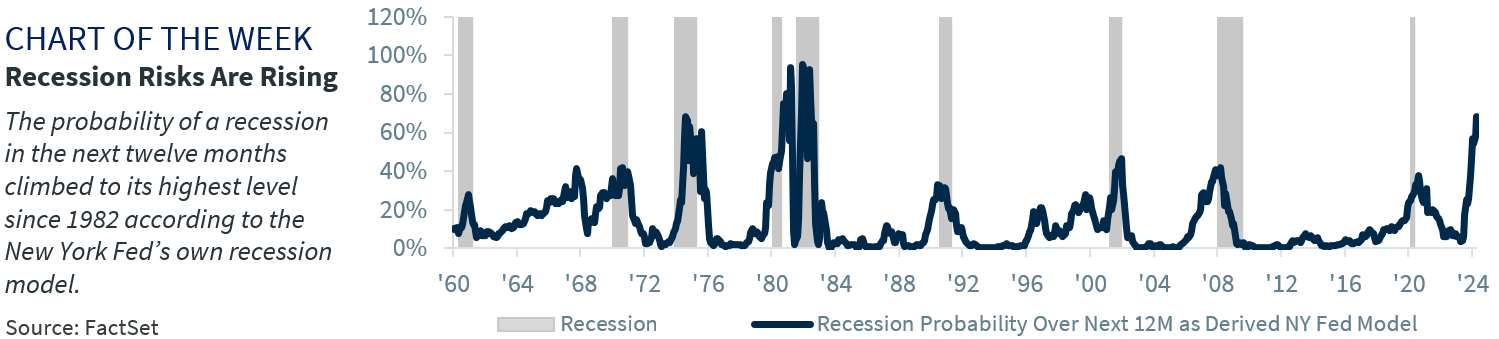

- ‘The Arrival’ Of The Fed’s Final Rate Hike | The Fed delivered what we believe to be its final rate hike in early May. Policymakers kept the door open for further rate hikes if inflation proves more stubborn than expected; however, Powell hinted at a pause as soon as next month’s meeting should downside economic risks start to pick up. This week’s inflation report showed core inflation pressures have flatlined at 5.5%; however, cracks in the labor market continue to mount. Soft JOLTS job openings, a steady decline in temporary-help services and ongoing layoff announcements suggest the labor market is cooling, despite the low 3.4% unemployment rate. With inflation moving in the right direction and the labor market becoming more balanced, policymakers can pause to assess how much impact the 500 bps of tightening is going to have on the economy. In fact, the NY Fed’s own recession model suggests there is a 68% probability of a recession over the next twelve months—its highest level in over 40 years—supporting our economist’s forecast of a mild recession in 2H23. While Powell gave no indication that the Fed will be cutting interest rates any time soon (consistent with our view), the market still expects rate cuts by year end.

- ‘The Fear’ Around Regional Banks Will Be Contained | Growing concerns about the health of the banking sector have dominated recent news headlines. Volatility, particularly among a few select names, continues to weigh on sentiment as market participants try to gauge what impact the recent bank failures will have on the broader economy. The Fed’s latest quarterly survey of bank lending conditions reported that banks, particularly smaller banks, tightened lending standards further, extending a trend that was well underway in the months preceding the recent turmoil. While the media negatively reacted to the news of weakening demand and tighter credit conditions, the survey responses were not as bad as feared. Only 3.2% of large banks reported considerably tighter lending standards and more than half of the respondents thought credit conditions were roughly the same—not substantially different than the results reported two quarters ago. And while smaller banks saw a gradual deterioration in lending conditions, those reporting substantially tighter conditions remain far below the levels reported during depths of the Great Financial Crisis, which reached into the mid-single digits. The point: we have yet to see any major spillover effects on the broader economy that would warrant any changes to our economic forecast and remain optimistic the risks are isolated, not systemic.

- Debt Ceiling Will Get Resolved In The ‘Nick Of Time’ | Looks like we’re headed for another collision course on the debt ceiling. Despite all the warnings, Congressional leaders have yet to resolve the ongoing impasse, so it appears we may test the boundaries of the ‘x’ date again. Treasury Secretary Yellen’s estimate that the ‘x’ date could come as early as June 1 has brought the deadline closer; however, the Bipartisan Policy Center has the window pegged between early June and early August—although the timing remains highly dependent on the May and June tax collections. President Biden’s bipartisan meeting this week did not produce any advances; however, we are encouraged that the negotiation process has begun. With both parties deeply divided about the path forward, the real work of getting to a compromise in the next few weeks will likely be full of drama and headline risks. We have already seen some dislocations in the Treasury bill curve and credit default swap spreads; however, this has not spilled over to the broader asset classes yet. Given the deep polarization in Congress, it just may take another market swoon to force the two sides to an acceptable compromise, but we believe a deal will ultimately get done as it has 78 times since 1960.

- Earnings No Longer In The ‘Valley Of The Shadow’ | Despite the ongoing banking concerns, S&P 500 earnings growth has gradually improved this quarter, with Q1 results down -2.0% on a year-over-year basis, up from over -6.0% YoY at the start of the quarter. Over 78% of S&P 500 companies reporting earnings have beaten their consensus estimates, which is above the five-year average, and companies are reporting earnings ~7% above estimates. Cost-cutting efforts have led to improved margins and comments from bank CEOs implied that the worst of the banking turmoil may already be behind us. This gives us confidence that our $215 earnings forecast, which has been more optimistic than some of our peers, remains achievable.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.