Market volatility is a normal feature of long-term investing

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Over optimism flagged near-term pullback

- Volatility is a normal feature of long-term investing

- Pockets of weakness are not overly concerning

Keep Calm and Carry On! The recent burst of volatility after a prolonged period of calm has captured the market’s attention and temporarily halted the S&P 500’s recent winning streak. While market gyrations can be concerning, remember not to panic – pullbacks and interim spikes in volatility are quite common. Below we put the recent market movements in perspective, which have been driven by time (it has been a while since we had a 5%+ pullback), overly optimistic, complacent market sentiment, and higher Treasury yields amid persistent inflationary pressures and signs of a more patient Fed. However, we reiterate our positive long-term view and suggest using periods of weakness opportunistically.

- A near-term pullback was expected | Our year-end target for the S&P 500 is 5,200. The problem: we exceeded that target in March – approximately nine months ahead of schedule. Why? Because equity market momentum and sentiment tend to cause the equity market to move to exaggerated values to both the upside and downside. It is not unusual and part of the fabric of the market. Let’s break our target down: first, it is based on 2024 S&P 500 earnings of $240, which we recently revised higher on the back of the resilient economy – a good thing. Second, we employ a P/E multiple of 21.5x our earnings forecast. That valuation is already expensive, representing a market priced in the top decile over the last twenty years, signifying the market is priced for perfection and susceptible to disappointments. Third, we base our numbers on fundamentals and strip out emotions/sentiment. However, the market had gotten uber optimistic from a positioning and sentiment perspective. For example, retail investors were the second most optimistic on the equity market over the last 30 years. Lofty levels of investor confidence have historically coincided with periods of more muted performance and increased volatility. What have been the catalysts to shake some of this confidence and initiate the recent pullback? Climbing interest rates (10-year Treasury yields are up ~75 bps YTD), troubling inflation, reduced expectations for Fed rate cuts (fewer than two cuts are now expected in 2024) and rising geopolitical tensions.

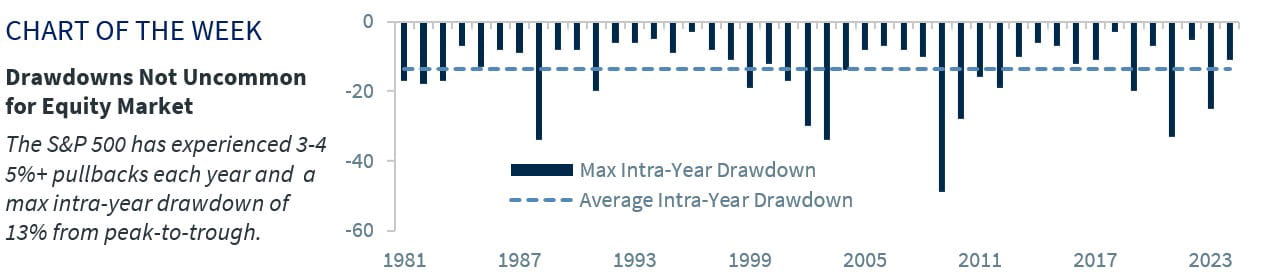

- Volatility is expected in the equity market | The S&P 500 had rallied more than 27% since October 27. This uninterrupted rally is uncommon as it is important to appreciate that the equity market does not go up in a straight line. Sure, bouts of market volatility can be unnerving, but they are a normal feature of long-term investing. In fact, pullbacks of the 5% variety occur multiple times a year. Dating back to 1980, the S&P 500 has experienced three to four 5%+ pullbacks on average each year. There have only been two years over that time span (44 years in total) during which the market bucked the trend and did not experience a 5% pullback during the year. Furthermore, the S&P 500 typically experiences a max drawdown (from peak to trough) during the year of ~13-14% on average each year. If the current 4.6% drawdown were to be the maximum drawdown this year, it would mark the third smallest annual drawdown over the last 44 years. The point is: this will likely not be the last or most significant pullback this year.

- Pockets of weakness are not overly concerning | Thus far, the pullback has been orderly and the spillover effects into other asset classes and the broader market have been limited. For example, we are not seeing a huge flight-to-safety into Treasurys, which typically occurs when the market is concerned about sharp shifts in risk appetite. Credit spreads have remained historically tight – not signaling any major concerns that something more ominous may be on the horizon. Within the stock market, the defensive sectors (i.e., Staples, Utilities, Health Care) are still underperforming the S&P 500 since its recent peak in late March. If the market was worried about a major risk-off event, these sectors would typically assume leadership, which they have not. However, areas of weakness have been justifiable: homebuilders and REITS have suffered due to their interest-rate sensitivity; semi-conductors have retreated after an incredible 55% rally over the last four months; and Consumer Discretionary stocks have struggled with the automotive industry (price pressures with EV vehicles) and specialty retailers (some signs of consumer fatigue).

Bottom line | The biggest question on investors’ minds is whether the current drawdown is normal or the start of something more severe (i.e., a bear market)? Our answer: given we have been calling for a pullback, this is likely a consolidation phase to digest the recent gains and not the end of this bull market. But how much further downside can be expected? Well, given the historical average drawdown has been ~14% a year, further downside cannot be ruled out. One area of support – although this is unlikely as uber optimism has already begun to wane – would be the 200-day moving average (~4,670), which reflects 10% downside from recent highs or an additional 5% from current levels. However, even if this were to occur, it would not change our long-term positive equity view as corporate fundamentals remain on solid footing and earnings are trending upwards. While interest rates have moved higher, it is for the right reason—stronger economic growth. Stronger economic growth leads to upside for corporate earnings—the indicator with the strongest predictive power for future equity returns. As a result, we reiterate our year-end S&P 500 target of 5,200 and would use periods of weakness to add to our favorite areas of the market—Info Tech, Industrials, Health Care, and Energy.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.