Maturity Matters

March 8, 2021

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

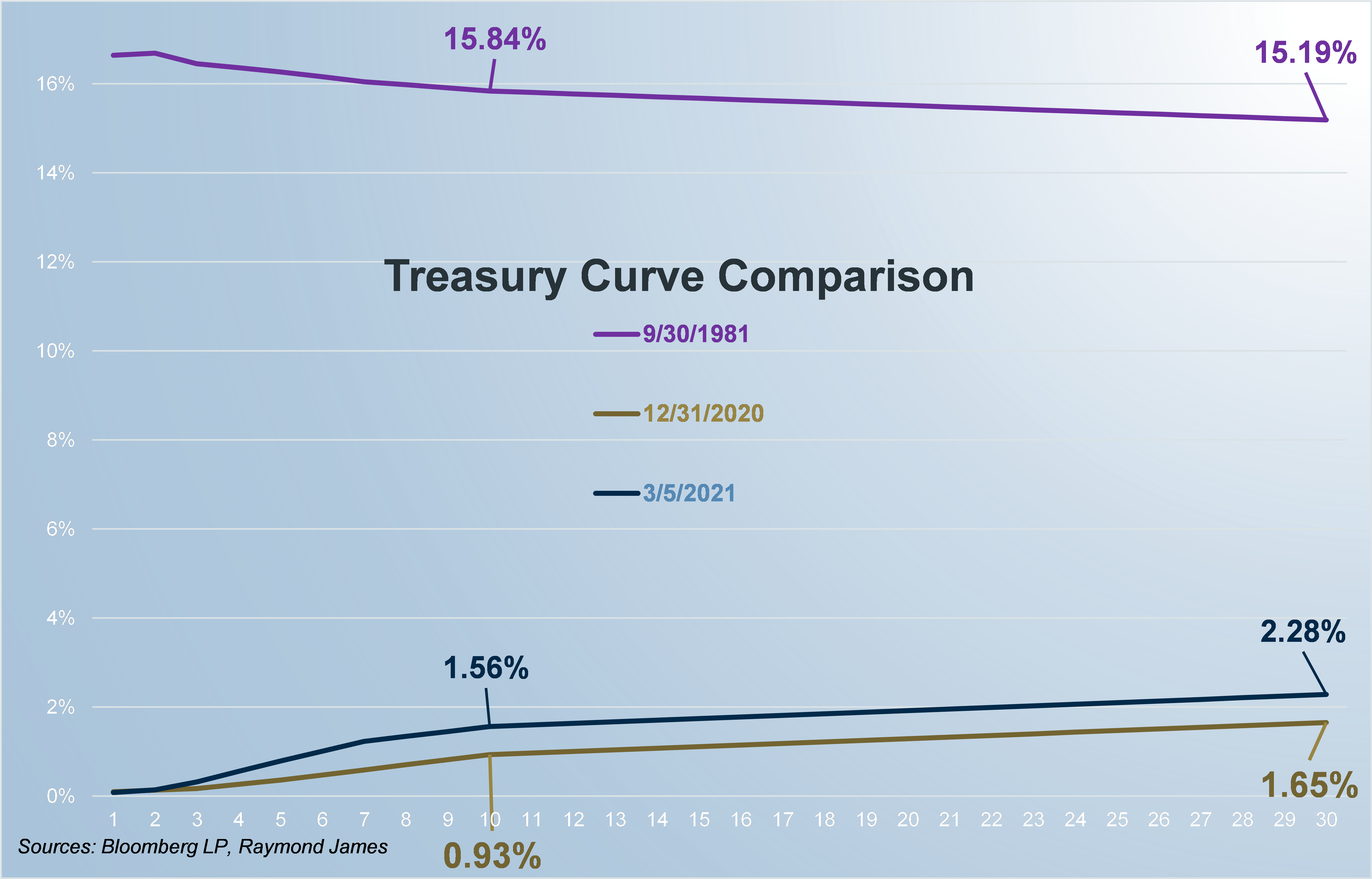

When 2021 started, the 2 year Treasury was 0.12% and the 10 year Treasury was 0.91%. Friday’s close reflected a 0.14% 2 year Treasury (+2bp) and a 1.57% 10 year Treasury (+66bp). As interest rates rise, prices fall, a basic fixed income fact that may need to be dusted off since, for nearly 39 ½ years, interest rates have been tumbling. Over that span, the 10 year Treasury has plunged from 15.84% to as low as 0.52% last year.

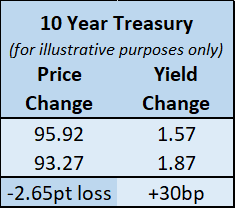

When interest rates are falling, the price appreciation on bonds creates a safety net for investors as bonds held amass a profit. When interest rates rise and individual bond prices begin to fall, it is a bond’s maturity that provides protection. Let’s look at an example and illustrate the math:

A mere 30bp rise in rates equates to 2.65 point loss or 2.8% price decline for a 10 year Treasury bond. The long-standing appreciation investors have benefitted from for nearly 4 decades will slide away if interest rates reverse course and begin to rise.

Many fixed income allocations are held in individual bonds with the intent to hold these bonds to maturity. That maturity date provides individual bonds a benefit not found in most alternative investments. Although market values may drop on individual bonds as interest rates rise, the market price amounts to nothing more than a paper statistic for individual bonds held to maturity.

A bond held to maturity, barring default, will continue to produce the same cash flow and income from its purchase date to its maturity, regardless of interest rate fluctuations over the holding period. Fixed income allocations are long term investments which provide principal protection and current market rates don’t negate their importance nor should they prevent purchases. Appropriate choices may entail credit quality and duration adjustments.

Investors of individual bonds have the option to hold their bond to its maturity. This benefit is afforded to them because individual bonds include a stated maturity feature. Especially when interest rates begin to rise, this maturity feature matters!

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.