Monthly Recap

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Every second Thursday of the month, we have a strategy meeting providing key talking points on some of the most current topics. This morning’s objective is to recap these topics and provide some practical insight on how to apply fixed income strategy based on current economic events. For those interested in more detailed planning, contact your advisor to request a deeper dive into your specific situation.

Economic Forecasts: Forecasts by the Federal Reserve and a pool of economists suggest that economic releases will continue to show numbers of strength through 2021; however, the anticipation by both the Fed and economists is that key market drivers, GDP, employment and inflation data will likely gravitate in 2022, back toward less significant averages versus the extreme releases caused by the pandemic.

Fixed Income Demand: Both government sovereignties and the private sector have provided a strong demand for fixed income securities. I am often asked that when the Fed begins to taper (reduce the amount of open market purchases of Treasuries and mortgage-backs), will the reduced demand push interest rates higher? The liklihood is that this action will reduce the amount of new money the Fed puts into the economy.

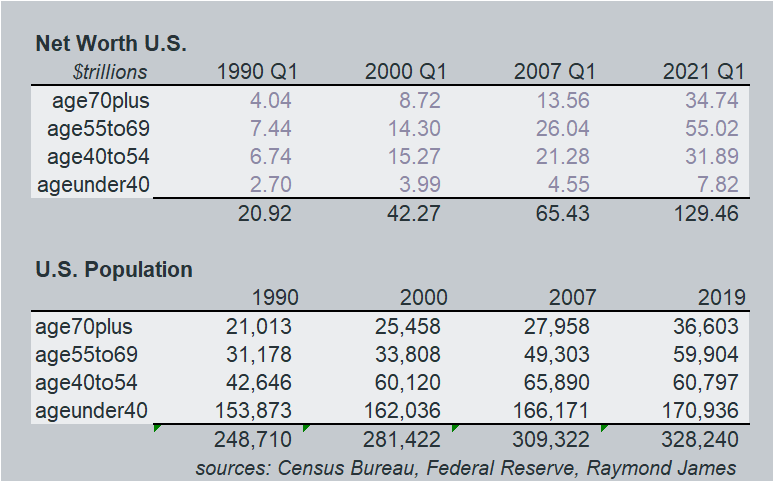

Although global central banks are still applying accommodative strategies, when they begin to pull back, it will reduce demand for the bonds they are currently buying; however, they are only part of the equation. Take for example, the private sector. In the U.S., the net worth of individuals between the ages of 40 and 54 has more than doubled from $15.3 trillion in 2000 to nearly $31.9 trillion this year. Every age category has seen tremendous growth in net worth which is why it is easy to support the idea that consumer spending can persist in supporting purchases of goods and services. This is a critical component in a consumer driven economy such as the U.S. where 70% of the GDP is derived from consumer purchases.

Of equal interest is that greater than 55 year old consumers have: 1) grown their net worth exponentially larger (290% increase from 2000 to 2021 vs. 106% increase for <55) and; 2) the greater than 55 age group population has grown 62% versus only 4% for under 55 year olds. The older age groups are holding 69% of the domestic net worth. Why is this significant? Think about the buying behaviors of someone over 55 years of age. Most of these consumers are done with paying tuitions, they own their homes, furniture and cars, and are concentrating more on saving and investing for their retirement years than on spending. This can translate to a heavy private sector appetite for various investment alternatives. The demand for investments can contribute to keeping rates down.

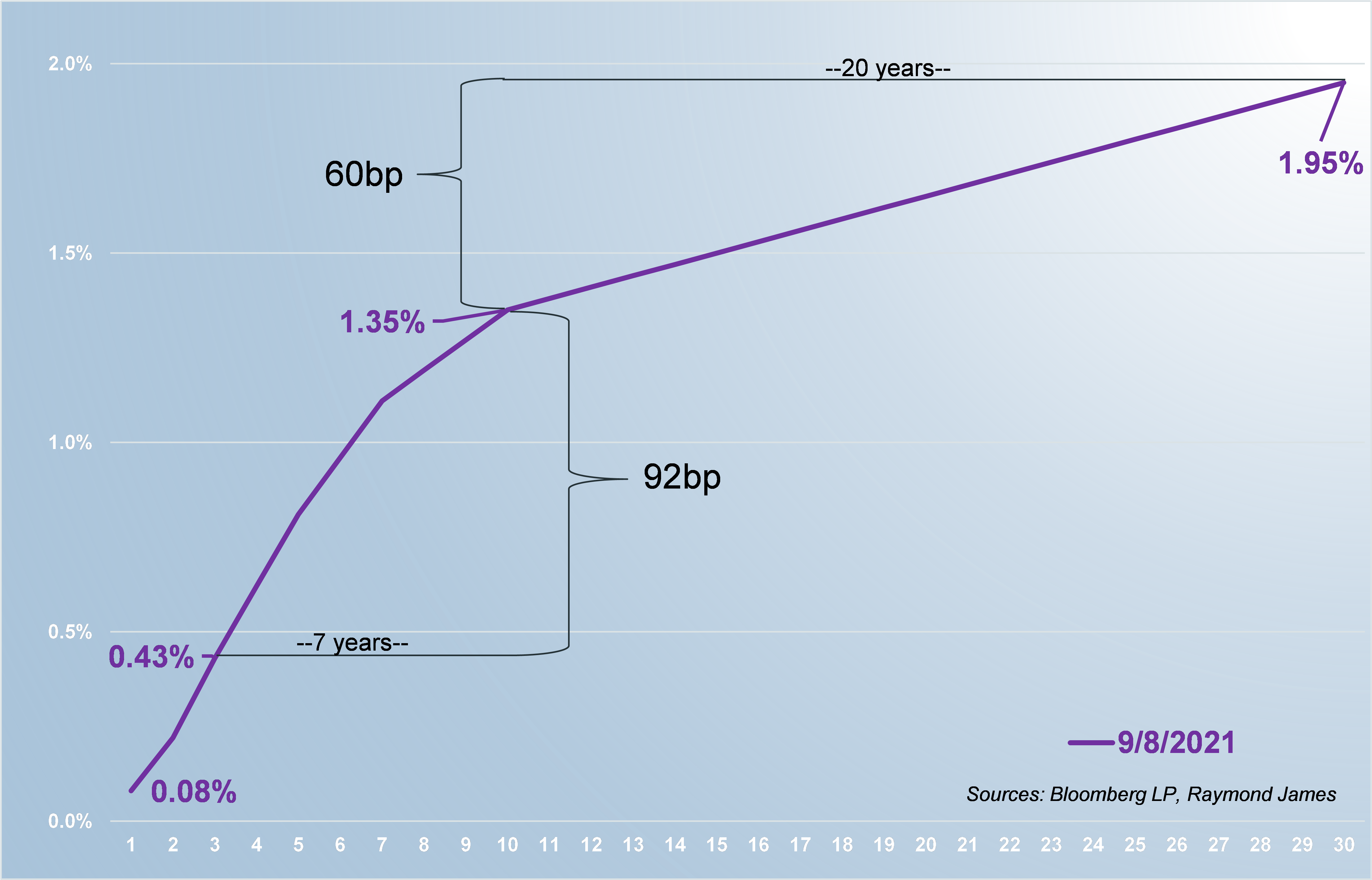

Yield Curve: The current yield curve dictates that fixed income purchases and rollovers dedicated to maintaining wealth (or as a ballast to portfolio’s growth asset allocation) should remain shorter in duration and in high quality choices. Simply put, you are not getting paid to take on credit risk or interest rate risk in this economic environment.

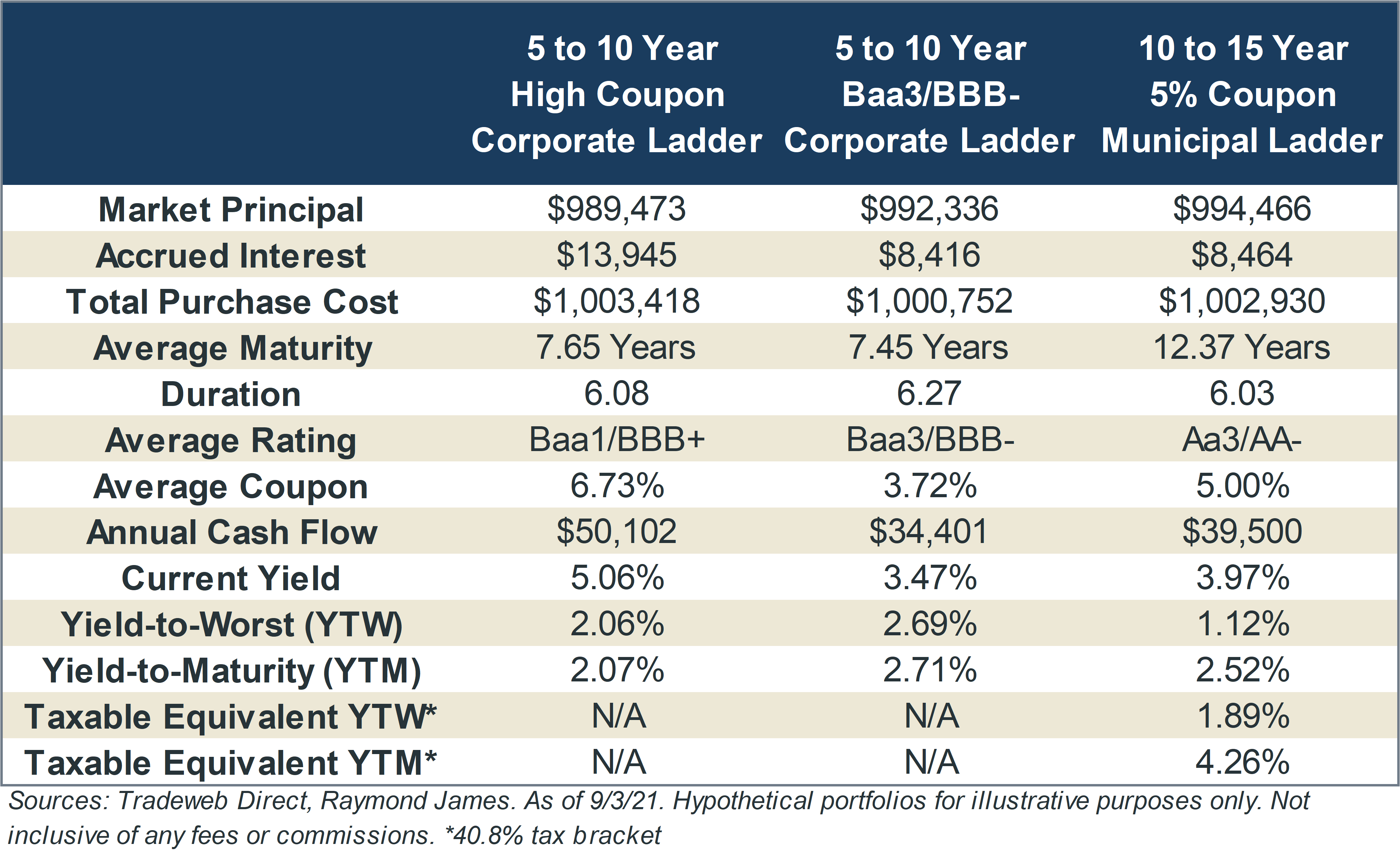

Spread Product Alternatives: Although Treasury bonds are the bellwether for fixed income, the spread alternative products can present thousands of tailored and higher yielding strategies to fit your client’s needs, balance growth assets and help preserve capital. Cash flow streams can be created to fit your needs or pure income strategies can be designed. The possibilities are limited only by market restrictions. Contact your advisor to request a tailor designed portfolio that best benefits your financial desires.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.