Nothing Recedes Like Recession

Financial market volatility remained elevated in the first few days of 2019, but it’s much more palatable when it is to the upside. Market participants remained concerned about a number of issues (global growth, trade policy, dysfunction in Washington), and fear remains a key factor in the outlook. Whether that fear abates or intensifies will tell the tale.

The employment report is composed of two separate surveys. The establishment survey (which covers 149,000 businesses and about 651,000 individual worksites) generates estimates of payrolls, wages, and hours. The household survey (of some 60,000 eligible households) yields reasonable estimates of the unemployment rate and labor force participation but terrible estimates of the monthly level of employment. The establishment survey covers the pay period that includes the 12th of the month (which can vary from firm to firm). The household survey is taken during the week of the 12th. The December Employment Report included annual benchmark revisions to the household survey data, but this was a very mild revision. The annual benchmark revisions to the establishment survey data (which ties the payroll estimate to actual payroll tax receipts) will be released next month, but early indications from the Bureau of Labor Statistics suggest that this will be a relatively modest revision.

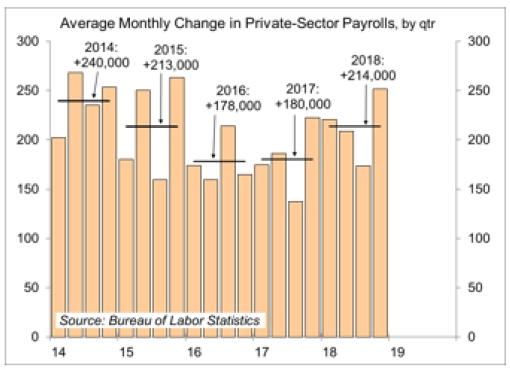

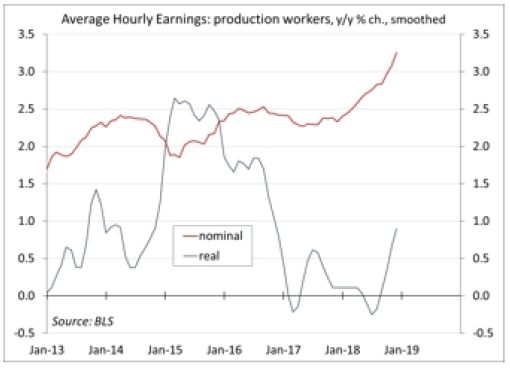

The U.S. economy shed 54,000 jobs in December – before seasonal adjustment, that is. Adjusted, payrolls rose by 312,000 in the initial estimate for December, well above the median forecast of +175,000. The two previous months were revised higher. Job growth in the last three months rebounded from the third quarter’s slower pace. Wage growth picked up more than expected (+0.4% m/m), pushing the year-over-year increase in average hourly earnings to 3.2% (3.3% for production workers). Adjusted for inflation, workers are finally seeing some gains from a tight job market.

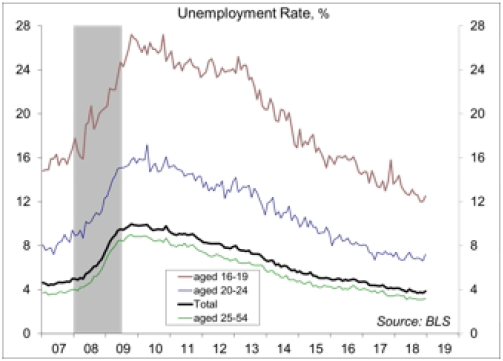

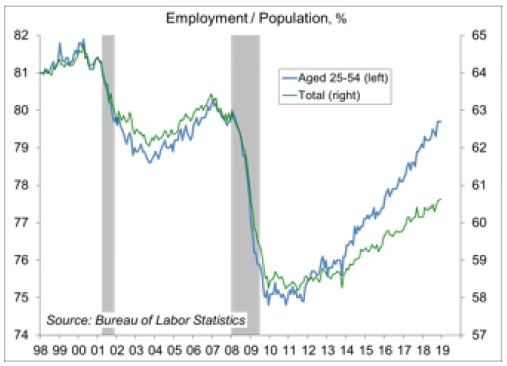

The unemployment rate rose to 3.9% in December, reflecting an increase in labor force participation. Much of that was concentrated among teenagers and young adults, which suggests a possible quirk in the seasonal adjustment. Still, the unemployment rate for the key age cohort (those aged 25-54) edged up to 3.2% (from 3.1%). The employment/population ratio held steady at 60.6, up from 60.2 a year ago. For the 25-54 cohort, this ratio rose to 79.7, vs. 79.0 a year ago and about where it was at the start of the Great Recession.

One of the most difficult parts of economic forecasting is getting the psychology right. Fear can be self-fulfilling. If consumers are worried about losing their jobs, they are less likely to purchase big-ticket items, like a new car. Consumer confidence declined in December. While it remains strong by historical standards (the Conference Board’s measure hit an 18-year high in October), most of the decline was in expectations. However, there are some positive factors for the consumer in the near term, including a rise in real wages. Tax returns are expected to be generally higher this year.

Expectations play a larger role in business decisions. If firms expect the economy to weaken, they would be less likely to invest in new plant and equipment and less likely to hire and train new workers. Trade policy uncertainty is not helping. The ISM Manufacturing Index fell in December. The details remained consistent with a further expansion but at a much slower pace. Supply managers noted increased concerns about tariffs.

The slope of the yield curve (the difference between long-term and short-term interest rates) is widely considered to be the best predictor of recession. While there is some debate about which rates to use (10-year Treasury vs. 2-year, 5-year vs. 3-month bill), the point is that curve inversion reflects an expectation that short-term interest rates will decrease in the future in response to weaker growth. In other words, the curve inverts because people generally expect a recession.

In mid-December, Fed officials were divided on the likely course for monetary policy in 2019 (two expected no rate increases this year, four expected one, five expected two, and six expected three). The median was for two rate increases, but that doesn’t mean that the Fed will raise rates twice. In the first few days of 2019, the federal funds future market began to price in an increased likelihood, up to 46%, that the Fed will cut rates in 2019 rather than increase them. The December employment report reduced the odds to about 33%, reinforced by Fed Chairman Powell’s comment that the Fed policy will be flexible.

Powell’s comments seemed rather obvious. Of course, the Fed will adjust policy if needed. Powell noted the discrepancy between current economic data, which suggest that the economy is in good shape but growth is likely to slow, and fears of a recession. Market expectations can just as quickly adjust in the other direction, and fears of recession ought to recede. That would especially be true if we get resolutions on trade policy and the federal budget.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.