“Now” looks pretty good

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Investors often rationalize procrastinating investment decisions. The Fed is meeting later this week. GDP data reports are coming. Corporate earning releases are approaching. Future Fed hikes will raise rates. These are all upcoming realities with unknown and numerous potential outcomes. I certainly recommend processing and analyzing information when developing long term strategic plans but doing so while tempering judgments which prevent missing opportunities that are front and center.

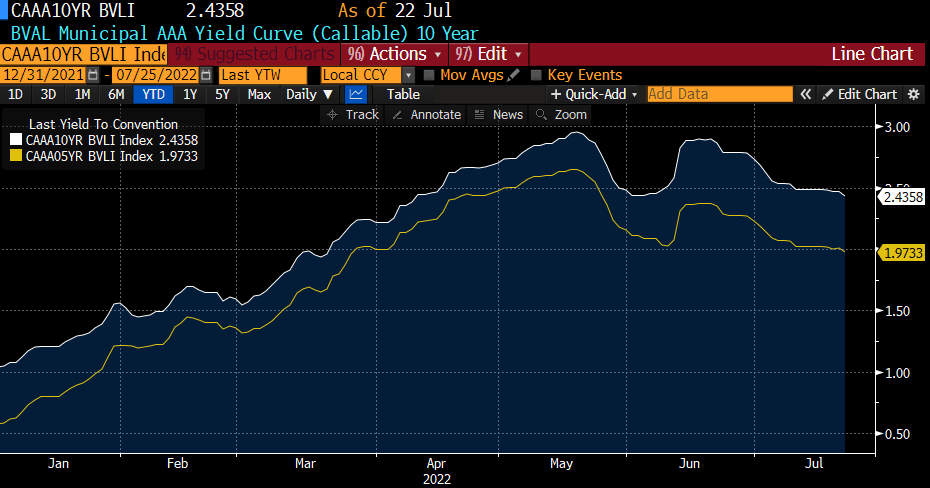

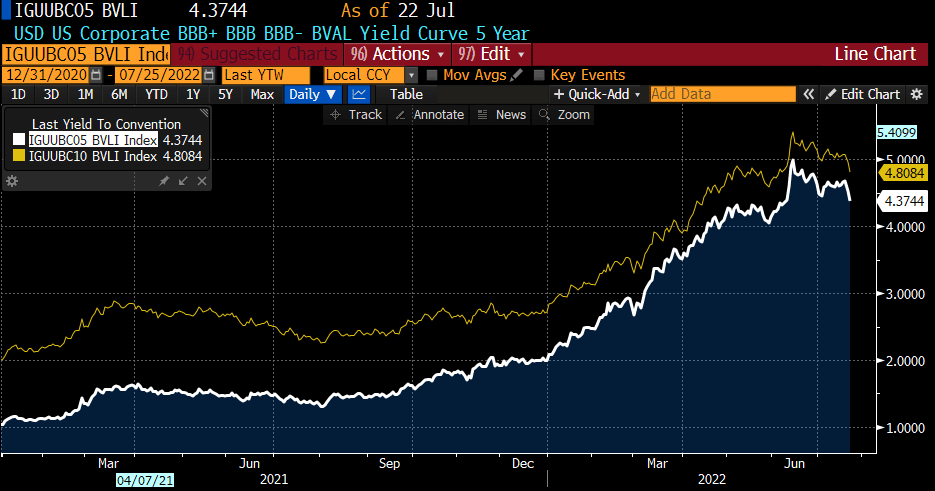

It is easy to be consumed in conversations and debates on whether the Fed is conducting affairs by means you approve of. One of our senior corporate bond traders Mike Petersen dubbed a category of investors as, “should’ve, could’ve, would’ve…” reflecting those that might miss existing opportunities waiting for the unknown. He also shared some graphs that speak for themselves by exposing the current yield opportunities in hand.

Five and 10 year corporate and municipal yields have trended up all year, providing yields to investors that have not been seen for a long time. The Fed last met on June 15. Corporate and municipal yields peaked on June 14. In other words, waiting until after an anticipated Fed hike will not guarantee that you will see higher rates after the announcement. Market moves are often built into the markets prior to the actual data or policy releases.

For investors interested in long term fixed income strategies that secure principal protection with solid income and cash flow, “now” looks pretty good!

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Securities Industry and Financial Markets Association’s Project Invested website and Investor Guides at www.projectinvested.com/category/investor-guides, FINRA’s Investor section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.