Rate Expectations

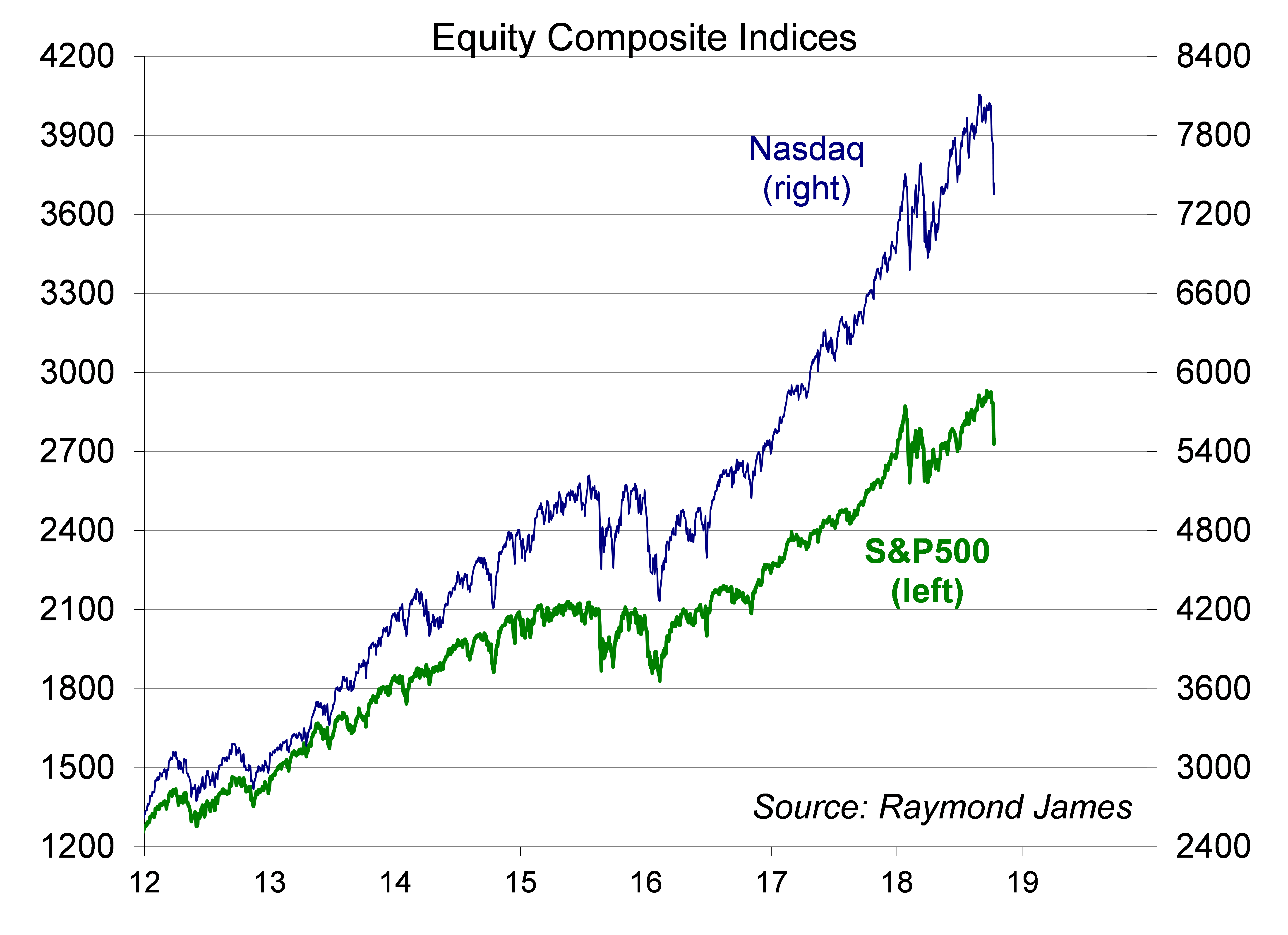

It was the best of times, it was the worst of times. Why did the stock market fall? No reason, and every reason. There doesn’t need to be a catalyst. Sometimes the market is simply going to do whatever the market is going to do, but the list of worries was already there. Going forward, investors will weigh near-term optimism about the economy against fears of the future – and those fears currently appear to be overdone. Expect further volatility (upside and downside) in the near term.

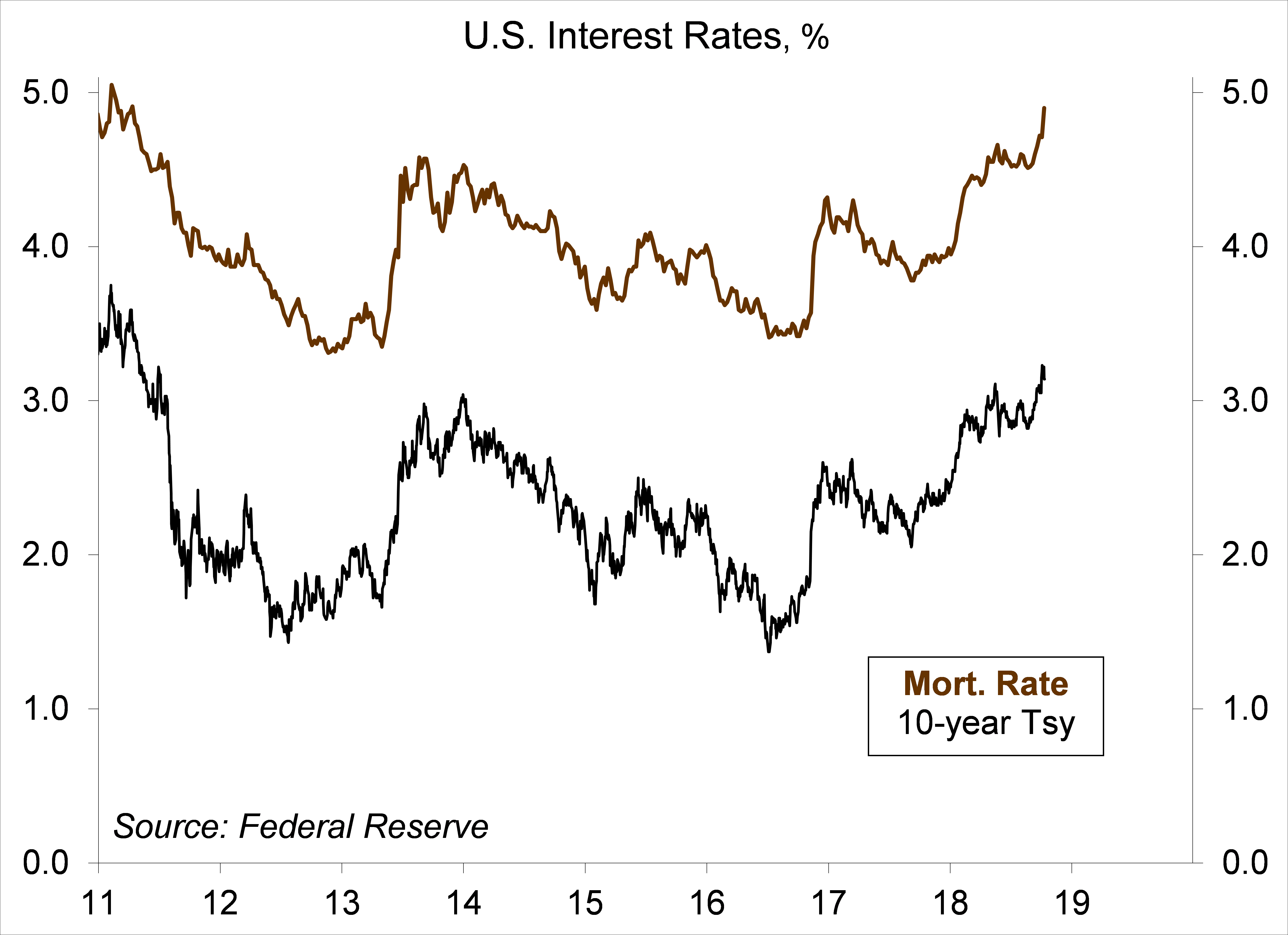

The economy is in excellent shape. Growth remains strong, the job market continues to tighten, and inflation is expected to remain moderate. But there has been a long list of worries: tighter Fed policy; higher long-term interest rates; trade policy disruptions; demographic constraints; and global economic risks. In the bond market, there have been upward pressures on yields: strong economic growth; tighter monetary policy; sharply rising government borrowing; and the unwinding of the Fed’s balance sheet. However, long-term interest rates abroad have remained low, limiting the increase in U.S. bond yields. Inflation, while a bit higher in 2018, is expected to remain moderate – hence, unlikely to drive yields up sharply. Until recently, bond market volatility had been extremely low (the calm before the storm), which typically results in a sharp revaluation. All else equal, higher interest rates are a negative for the stock market, but a weaker stock market is a positive for the bond market (higher bond prices, lower yields).

The strongest argument for slower economic growth is demographic constraints. Labor force growth has slowed. Slow labor force growth and moderate productivity growth imply that long-term potential GDP growth ought to be in the 1.5-2.0% range. We’ve exceeded that this year, boosted by fiscal policy (tax cuts and increased spending), which will continue into 2019. However, growth has been fueled by a further decline in the unemployment rate – and the unemployment rate can’t fall forever.

Productivity growth could pick up. Growth in output per worker has been relatively lackluster since the recession, in part because of a slower pace of capital investment. The tighter job market could lead to a more efficient use of labor. Technology changes (robotics) have helped boost factory output per workers, but partly at the expense of jobs (it’s estimated that up to half of the manufacturing job losses since 2000 have been due to technology). Foreign trade has been a significant factor in U.S. productivity growth in recent decades, as the loss of low-end jobs has been offset by the addition of higher-end jobs.

Egged on by the financial press (the cover of the Economist magazine asks “The next recession – How bad will it be?”), investors have begun to focus ahead to the eventual downturn. There are no signs that the U.S. economy will enter a recession anytime soon. Most of the concern is for later in 2019 and in 2020. In looking at past recessions, the table is set by misallocation of capital fueled by excessive leverage. Global shocks or sharply higher oil prices could be a trigger. The Fed could overdo it, raising short-term interest rates too much (or by raising them too slowly, and then having to raise them more rapidly later on).

While the odds of a recession in the next two years have increased, they remain relatively limited. However, the bigger fear is the limited policy options to deal with a downturn. In a typical recession, the Fed lowers short-term interest rates by 500 basis points – there’s less than half of that room to maneuver currently. The Fed does not want to embark on another round of large-scale asset purchases (quantitative easing). With trillion dollar federal budget deficits as far as the eye can see, stimulative fiscal policy is likely to be out of the question. Factor in a shakier global financial system, and you really have something to worry about.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.