Simplify Your Play Against Inflation

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

The Fixed Income Solutions team has received many enquiries regarding Treasury Inflation-Protected Securities (TIPS) largely as a result of the propagating fear of inflation. TIPS offer minimal credit risk because they are U.S. government-backed Treasury securities and they are structured to increase or decrease in principal value based on increases or decreases in inflation (CPI index), thus protecting holders from a change in their purchasing power affected by inflation. Their protective benefits can be appealing but the question is whether there is too big a price to pay for these benefits in today’s market?

The current prices on TIPS reflect negative yields across the entire available maturity range. In essence, purchasing TIPS is “betting” on the future. An investor is attempting to protect against a much higher inflation on an ongoing basis which may or may not come to fruition. This is not an endorsement to buy or not buy TIPS, it simply means an investment is starting out in negative territory with the hope that inflation will be high enough to outpace investments that don’t make inflationary adjustments.

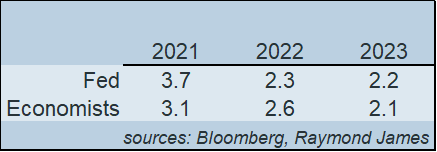

Let’s look at an example. If you purchased a 5-year TIPS, it would be yielding about -1.72%. By comparison, the 5-year Treasury offers about a 1.15% yield. Over the 5 year period, inflation would need to average 2.81% in order for the TIPS to break even with the bond. Although the CPI Index is currently elevated coming out of the 2020 recession, the one year CPI average is 2.1%. Charted on the right are the forward estimates of inflation from the Federal Reserve and pools of economists. The Fed and economists are not predicting runaway inflation or a sustained elevated inflation level. Should inflation average below 2.81% over the next five years, an investor will benefit more by purchasing the 5-year Treasury. Should inflation average >2.81%, then TIPS will perform better.

Another way to protect yourself from rising inflation (rising interest rates) may be as simple as a laddered strategy. By laddering (layering) your investment maturities, a portion of your portfolio matures at regular intervals. This provides regular cash flow accrual that can periodically be reinvested into the market. If interest rates rise, this intermittent cash flow can be reinvested into these higher rates along the way, increasing income and offsetting the inflationary rise.

There are many ways to design laddered strategies allowing for a great deal of flexibility in meeting your personal objectives. Please contact your advisor to discuss how to best build your individualized strategy.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.