Strike-related wage deals not likely to sway the Fed

Review the latest Weekly Headings by CIO Larry Adam.

- Strike activity remains muted by historical standards

- Strike-related wage deals not likely to sway the Fed

- Corporate margins have room to absorb wage increases

Record-breaking heat waves dominate the news headlines, with 2023 shaping up to be one of, if not the hottest year on record. Extreme temperatures are shattering records across the U.S., Europe and in parts of Asia – not just on land, but also in the sea. And temperatures are not the only thing heating up these days. With the historically strong job market and very low unemployment rate, labor market disputes are on the rise. Just look at the number of strikes and wage negotiations going on right now – from the Writers and Screen Actors Guilds, to the Teamsters to the United Auto Workers Union. In fact, UPS (one of the nation’s largest package carriers) reached a tentative deal with the Teamsters Union, averting the biggest labor walkout since the 1950s and any potential negative impacts on the economy. While labor unrest is building, we do not expect the uptick in strike activity to have a meaningful impact on the Federal Reserve (Fed), the economy, or the markets. Here’s why:

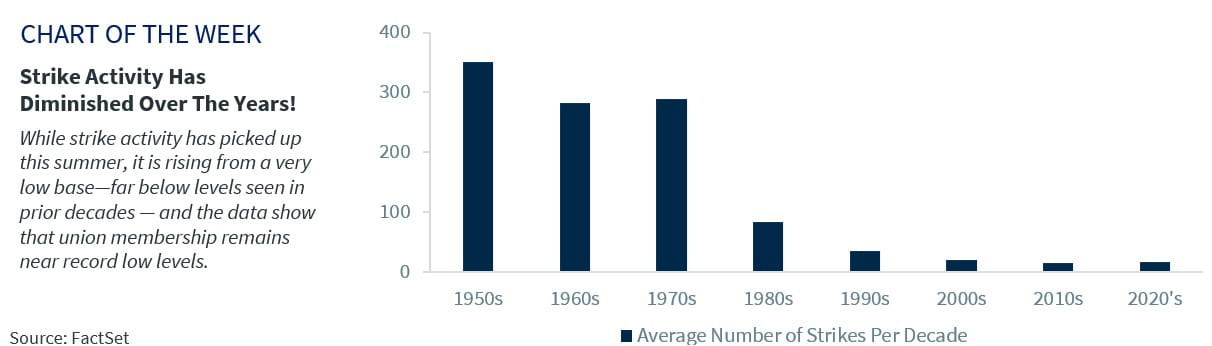

- Headline risks ‘steamier’ than actual impact | The ominous-sounding headlines about strikes and disruptions are not as bad as they appear. Yes, it is true that the Bureau of Labor Statistics (BLS) reported that strike activity is up 44% from 2022 and on pace to be the highest since 2000. But beneath the headlines, there have only been 16 strikes with more than 1,000 workers this year, which pales in comparison to prior decades. For example, the average number of strikes from 1950 through 1980 was over 300 per year. In addition, the total combined number of current workers on strike (~213k) is a tiny fraction of the total workforce (~0.1% of total employment). A big reason: union membership has been halved – down from over 20% of the total workforce in 1983 to ~10% today.

- ‘Hot’ strike activity uncorrelated with wage growth | Fed officials have been outspoken about the need to bring the labor market into balance as the historically low unemployment level has been driving up wages, which are running at a 4.4% annual rate. And with the eye-popping wage increases that some of the labor negotiations have secured this year (i.e., United Airline Pilot’s 40% pay increase over the next four years), many wonder whether the recent uptick in strike activity could cause the Fed to tighten policy further. Our analysis of prior strikes suggests that strike-related wage increases have historically been one-off occurrences and have not led to sustained, broad-based inflation. In fact, years with the largest strike activity have shown no correlation between either the number of strikes or the number of workers striking with nominal and real wage growth. While there are concerns that inflation could re-accelerate as it did in the 1970s (not our base case), we do not expect these one-off increases to meaningfully lift overall wage pressures in the broader economy, particularly if labor market conditions soften as we expect.

- Labor negotiations unlikely to derail ‘hot spell’ in margins | The tight labor market has led to concerns that rising wages could negatively impact corporate earnings and margins. Rightfully so, as labor costs typically represent the biggest expense for companies and, over the last thirty years, corporations have benefitted as profits have increased at nearly double the pace of compensation. This trend has reversed over the last 12 months though, as a robust labor market and slowing earnings have led to compensation growth outpacing earnings growth. But that should be a temporary phenomenon. The good news for corporations is they have increased selling prices to partially offset increased wages. And moving forward, as inflationary pressures subside further, wage pressures should as well. In addition, technology solutions will gradually replace some workers to support cost containment and margins. However, one area that could see a bigger risk to margins is the industrials sector. Why? Most of the recent/upcoming strikes are within the industrials sector (e.g., UPS, United, American Airlines, Boeing) that has the second lowest margin of any sector and wages make up the third highest percentage of operating expenses. The above-average wage increases seen from some of the labor agreements could pressure margins for some of these large cap companies and are one reason we are neutral on industrials.

- Dampening of ‘red-hot’ job market should provide some relief | Fed policymakers had hoped that job gains would taper off, but labor market conditions have been resilient up to this point. In fact, the unemployment rate is surprisingly at the same level (3.6%) it was when the Fed began its tightening cycle last March. However, labor conditions are in the process of easing as job openings have dropped, the quits rate has fallen, and the pace of job growth has moderated. This cooling has alleviated some upward pressure on wages, which have declined from a peak of 6% last March to 4.4% currently. And as the Fed’s restrictive policy slows both growth and inflation, workers’ leverage may diminish even further, particularly as the economy likely slips into a mild recession late this year.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.