Swapping for yield?

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

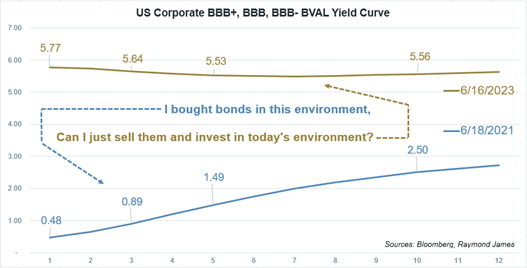

You bought bonds when interest rates were lower. Now rates are considerably higher – so why not sell the bonds and reinvest in the better yields?

You have the right idea… for investing new money – and, for solidifying the core fixed income allocation of the portfolio. For seasoned holdings… you also have the right idea – but, execution may or may not be practical. The strategy must include how the bond is priced in today’s market and whether this swap of bonds is mathematically sound.

Say you bought a 5-year corporate bond in 2021 yielding 1.49%. Now two years later, you can sell the bond and buy a 3-year bond yielding 5.64%. On $10,000, you will produce $415 more in income ([.0564-.0149]*10000) in each of the next three years, or a total of $1,245. However, you also need to make up the loss taken by selling the bond. If the loss is less than $1,245, then the swap makes numerical sense. You need to account for a loss when reinvesting (given a loss, there will be less than $10,000 available).

The takeout yield, or the market yield on the bond being sold, will identify the rate needed on the purchased bond for the swap to make mathematical sense. I use this term because there are other reasons to or not to execute a swap: taking gains/losses for tax purposes, extending/minimizing duration, increasing/decreasing credit quality, etc. In this illustration, we are focusing solely on the income. Your Raymond James financial advisor can review low-yielding portfolio holdings to see if exchanging them make sense for your particular situation.

Last week, the Federal Reserve (Fed) announced its intention to keep short-term rates (Fed funds) unchanged; however, they also announced their intent to hike rates as many as four more times in their battle against inflation. This could mean that rates stay elevated a while longer, giving investors more of a window to lock into higher yields. It has been more than a decade since we have seen rates this high and being able to lock into higher levels of income should be a welcome bonus to the principal protective qualities embedded with individual bond purchases. Often investors wait until the year’s end to tax plan and look for tax swaps. It is never too early to explore and the timing could be right given market rates. Whether for tax reasons, income benefits or strategic positioning, have the fixed income portion of your portfolio reviewed for this window of opportunity.

(Raymond James is not a tax consultant… therefore it can be beneficial to consult a tax attorney or tax expert before conducting any strategies that may affect your tax situation)

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.