Take-Home Income

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

Anyone who has ever put together a household budget is likely familiar with the concept of take-home pay. Essentially, take-home pay is what is left from your paycheck after “non-negotiables” are taken out on the front end, which for most people is taxes and probably the cost of any benefits, such as health insurance. It is the money that hits your bank account. This is an important number to know when putting together a household budget, as it is the money that you actually have to spend. For example, if you make $100,000 per year and your annual income taxes and healthcare coverage total $35,000, your take-home pay for the year is $65,000. If you were to create a spending plan based on your quoted salary of $100,000 instead of your take-home pay of $65,000, things will likely get messy quickly.

This same idea applies to investing in fixed income and is equally as important to have a grasp of. When you purchase a bond, your annual income and cash flow is known, just like your salary. And just like your salary, the quoted yield and cash flow number can differ from your take-home income depending on the product type and your personal tax situation. At the end of the day, the number that should be factored into your product selection and investment decisions is take-home income, just like take-home pay, this is going to tell you what you will be left with at the end of the day, after non-negotiables (taxes) are accounted for. Optimizing the yields currently being offered by various product types with your personal tax situation allow for a fully informed investment decision.

Tax-exempt municipal bonds typically offer a lower yield than comparable corporate bonds. This is because high-tax bracket investors are willing to accept a lower nominal yield in return for owning a product that does not require them to pay income taxes on the income that it produces. Oftentimes, the “take-home income” that is received is higher in a lower yielding, tax-exempt investment than it would be on a higher yielding, taxable investment. An investor in the 37% federal tax bracket will only take home 63% of the yield offered by the taxable investment, whereas they can take-home 100% of the income produced by the tax-exempt investment. As investors shift into lower tax brackets, the advantage in take-home income tends to shift over to taxable products. If the investor is in the 22% tax bracket, they still receive 100% of the tax-exempt income, but for the taxable product, they take-home 78% of the income. As markets are generally fairly efficient, the difference between comparable tax-exempt yields and taxable yields will usually differ just enough to make the tax-exempt investment advantageous for those in top tax brackets.

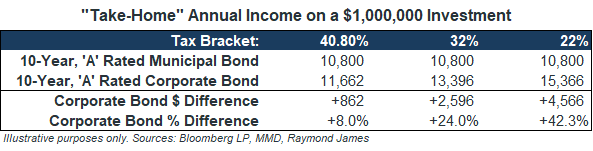

All too often, investors seek out a portfolio of tax-exempt municipal bonds simply because they don’t want to pay any taxes. Oftentimes, for investors who might not be in a top tax bracket, this results in a less than optimal portfolio because they are focusing on the amount of money they would have to pay in taxes instead of focusing on their take-home income. The table below illustrates this idea by showing what the “take-home income” would be for investors in a range of tax brackets for a $1 million investment in both a 10-year A-rated corporate bond and a 10-year A-rated tax-exempt municipal bond. Using current index yields for the illustration, the corporate bond yields 1.97% and the municipal bond yields 1.08%. Using the 22% tax bracket column as an example, the municipal bond would provide $10,800 in income, all of which would be tax-exempt, resulting in take-home income of $10,800. The corporate bond would provide $19,700 in income, but as corporate bonds are taxable, the investor would have to pay $4,334 in taxes, leaving them with “take-home income” of $15,366. So even after paying taxes, the 22% tax-bracket investor earned an additional $4,560 than they would have had they invested in the municipal bond, which is over 42% more in annual income.

As you would expect, the difference is much smaller for investors in higher tax brackets. Also, keep in mind that this illustration only uses federal taxes, so for high-tax bracket investors who also pay state income taxes, the advantage shifts further towards municipals bonds assuming additional tax benefits from purchasing in-state bonds.

So what can we take away from this? For top tax bracket investors, the current market environment is providing similar take-home incomes across both taxable and tax-exempt investments, so high tax bracket investors who have traditionally only considered municipal bonds, might benefit from expanding their criteria to include taxable products as well. Additionally, lower tax bracket investors should let the “take-home income” guide their investment decisions rather than an avoidance of paying taxes. Most of the time, even accounting for taxes that will have to be paid, investing in a taxable investment will yield the most take-home income for lower tax bracket investors.

Neither Raymond James nor the author of this article are tax professionals and cannot give tax advice. Please consult a tax professional prior to making any investment decisions and to receive tax-related advice.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.