Tariffs and the Fed

The partial government shutdown, poor weather, and the late Easter appeared to dampen the underlying pace of growth in the first quarter. However, April data on retail sales, industrial production, and durable goods orders suggest the softness will be longer lasting. Tariffs distorted activity in 2018, pulling forward imports and adding to inventory growth. However, tariffs were already taking a toll on domestic demand, even before the May 10 escalation. Some fed officials will fear the inflationary implications of higher costs. However, the negative impact on demand should be more of a concern.

The Federal Reserve Bank of New York released a report that indicated last year’s tariffs had an annual cost to the typical household of $419 (or about 0.7% of the median household income). President Trump raised the 10% tariff on $200 billion in Chinese goods to 25% on May 10. The New York Fed estimates that this will impose an additional annual cost to the typical household of $831 (or about 1.3% of the median household income). President Trump has threatened to impose a 25% tariff on the remaining $300 billion or so in remaining imports from China (mostly consumer goods).

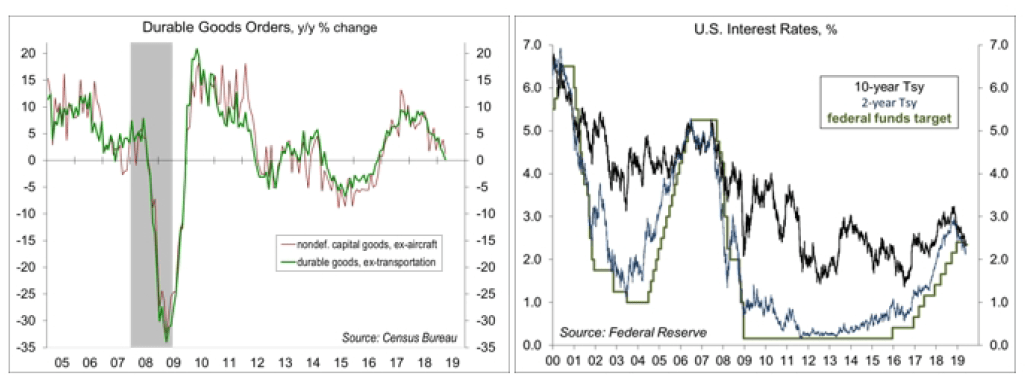

Tariffs are paid by the U.S. importer, not China, and are passed along to U.S. consumers and businesses. Tariffs raise costs, invite retaliation, disrupt supply chains, and dampen business investment by increasing uncertainty. Durable goods orders fell sharply in April, reflecting a pullback in aircraft orders (which had spiked in March). However, excluding transportation, orders were flat and March figures were revised lower. Orders for nondefense capital goods ex-aircraft fell 0.9%. Unfilled orders are edging lower. None of this implies that the U.S. economy is in a recession, but growth is slower than it would be otherwise, and signals are flashing yellow.

Fear of tariffs led to a stockpiling of industrial supplies and materials in the first half of last year, raising pipeline inflationary pressures. However, inflation in prices of raw materials moderated considerably in the second half of 2018, partly reflecting a slowing in the global economy. This latest round of tariffs should put some upward pressure on input costs in the near term, but any impact would be short-lived. The threat to impose tariffs on the remaining imports from China would fall mostly on consumer goods and would hit lower-income households the hardest. Margins are generally low in retail, limiting the ability of firms to reduce the impact. Recent research from the Federal Reserve showed that, while households were generally better off financially in 2018, “many adults are financially vulnerable and would have difficulty handling an emergency expense as small as $400.”

The Fed has long had a wait-and-see attitude on the impact of tariffs. Last year, the impact seemed modest, but that may be because activity was pulled forward in fear of further tariff increases. Some Fed officials are likely to fear higher inflation. However, the inflationary impact of higher tariffs should be temporary. We’re unlikely to see wage inflation rise in response to higher consumer prices and lower real earnings will dampen consumer spending growth. The downside risks to growth should be more of a concern.

“Patience” was in order at the April 30-May 1 Federal Open Market Committee meeting, and we may not see much of a shift into the next policy meeting (June 18-19). Despite Fed officials’ indications that rates aren’t going to be changed anytime soon, the federal funds futures market has priced in a greater chance (about 75%) of one or more Fed rate cuts by the end of the year. Longer-term interest rates usually fall before the Fed starts easing – and that is the case currently. President Trump has called for the Fed to lower short-term interest rates by a full percent. The Fed isn’t going to act on political pressures. However, monetary policy affects the economy with a long and variable lag. With inflation running low, one could argue for an insurance move in the near term. Still, the risks are centered on whether we will see Trump’s threatened further round of tariffs.

Stock market participants are still generally holding out hope for a U.S./China trade deal. There should be enormous pressure on the White House to get trade policy uncertainty behind us. However, trade tensions have entered a new phase, where individual companies are being targeted. This creates added uncertainty, further disrupts supply chains, and undermines capital investment. Growth expectations for 2019 have come down somewhat, but the risks are tilted even more to the downside.

Data Recap – With a continued focus on trade policy, the markets did not react much to the economic data. FOMC minutes noted “patience.” Chair Powell noted riskier business lending, but said he didn’t think that was a “notable” risk to the financial system (but still promised to be vigilant). The headline durable goods figures for April were close to expectations, but downward revisions to March and further weakness in capital goods orders suggested that tariffs are taking a toll. Research from the Federal Reserve Bank of New York indicated that tariffs are having a more substantial impact on the household sector.

Fed Chair Powell said that “business debt is near record levels, and recent issuance has been concentrated in the riskiest segments.” However, “business debt does not appear to present notable risks to financial stability.” Still, he added that the Fed “cannot be satisfied with our current level of knowledge about these markets, particularly the vulnerability of financial institutions to potential losses and the possible strains on market liquidity and prices should investors exit investment vehicles holding leveraged loans.”

The FOMC Minutes from the April 30-May 1 policy meeting showed that officials “generally agreed that a patient approach to determining future adjustments to the target range for the federal funds rate remained appropriate.” Many felt that “the recent dip in PCE inflation as likely to be transitory.” A few officials felt that higher rates might be needed if the economy improved. A few thought that there might be more slack in the economy than the low unemployment rate would suggest. Several commented that a low trend in inflation could reduce inflation expectations, making it harder for the Fed to reach its 2% goal.

Durable Goods Orders fell 2.1% in April, reflecting a drop in aircraft orders (which had spiked in March). Transportation orders fell 5.9% (motor vehicles -3.4%, civilian aircraft -25.1%, defense aircraft -2.4%). Ex-transportation, orders were flat, but March was revised from +0.3% to -0.5%. Orders for nondefense capital goods ex-aircraft fell 0.9%, following a 0.3% gain in March (revised from +1.4%). Shipments for this category were flat, following a 0.6% decline in March. Unfilled orders continued to edge down (not a good sign).

The Chicago Fed National Activity Index, a composite of 85 economic indicators, fell to -0.45 in the initial estimate for April. At -0.32, the three- month average was consistent with below-trend growth (a level below -0.70 is consistent with an increased likelihood that the economy has entered a recession).

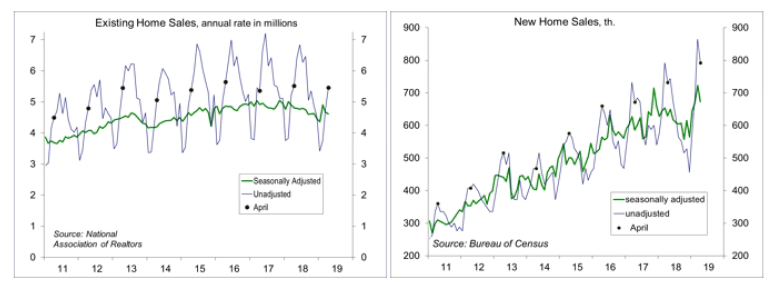

Existing Home Sales fell 0.4% in April, to a 5.21 million seasonally adjusted annual rate (-4.4% y/y). Results were mixed across regions. The National Association of Realtors noted that strong fundamentals (strong job growth, low mortgage rates) were supporting demand, but higher prices had contributed to affordability issues. A moderation in home pricing and an increase in the number of homes for sale should fuel improvement in the near term.

New Home Sales fell 6.9% (±14.0%) in April, to a 673,000 seasonally adjusted annual rate (+7.0% ±12.4%). Unadjusted sales for February-April were up 7.7% y/y (Northeast -11.1%, Midwest +4.3%, South +8.0%, West +10.2%). Higher mortgage rates in 2018 dampened activity. Lower mortgage rates and pent-up demand from last year have fueled recent strength.

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.