Tech sector emerged as 2023’s first half MVP

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Tech sector the MVP of the first half

- Tech likely to maintain All-Star status in the second half

- Energy, financials and health care poised to rebound

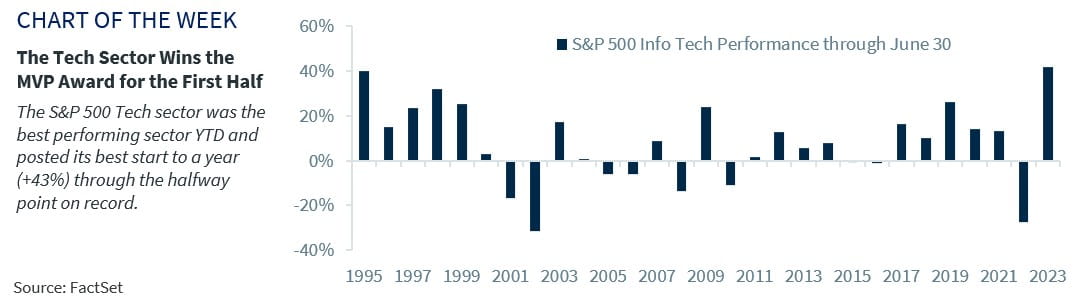

With the baseball season halfway completed, Seattle, Washington will host the All-Star Game and Home Run Derby next Monday and Tuesday, respectively. These events are put on to celebrate and acknowledge the best performing players and homerun hitters throughout the season to date. Personally, it has been an exciting season thus far, as my hometown Baltimore team surprisingly holds the fourth best record in the league thus far. But much like baseball, it has also been an exciting year for the equity markets, as the S&P 500 is off to its second-best start to a year over the last 25 years. The Tech sector has been the clear ‘home run hitter’ and earned the ‘most valuable player’ award as it is the best performing sector year-to-date – up 43%. As we move into the second half of the year, we address whether Tech can continue its positive performance and which other sectors could step up to become second half all-stars.

• Tech the clear first half MVP | The performance by the Tech sector to-date was one for the record books. The sector posted its best first half of a year on record and is outpacing the S&P 500 by the widest margin over a six-month basis since 1999. Like a batter hitting .400, it is unlikely to sustain this level of performance, but expect the Tech sector to remain an all-star for four reasons:

- Not as expensive as it appears – After the ~30% decline last year, Tech remains ~1% off its all-time high set at the end of 2021. But with its earnings having increased ~5% over that time period, it has become more attractive on a PE basis. While the sector trades at a 42% premium to the S&P 500 on a next 12-month basis – the highest of any sector – it has beaten its earnings estimates by the largest amount in aggregate over the last ten years, making it less expensive than current estimates suggest.

- High margin businesses – After a dismal 2022, many tech companies shifted their focus from hyper-growth to cost cutting to maintain margins. This effort has paid off, as Tech maintains the strongest margins (24%) of any sector and far outpaces the S&P 500 (12%). As we enter a period where returns will be more challenging as we likely enter a mild recession in 4Q23, an emphasis on maintaining the bottom line will be a key focus for investors (something that tech companies have proven capable of doing).

- Tech dominates investment – The excitement about artificial intelligence has been a key driver of Tech’s outperformance to date. In fact, over 200 companies mentioned AI in their 1Q23 earnings calls, and a recent McKinsey survey suggested that ~65% of companies are planning to invest in AI going forward. Already, tech spending accounts for ~62% of total corporate fixed investment (up from 35% in 2000). A continuation or acceleration of this trend will continue to support Tech earnings.

- Not a one-tool player – Tech’s healthy outperformance has drawn parallels to the ‘not-so-favorite pastime’ of the dot-com bubble. But today’s major tech companies are far different from two decades ago as they are significantly more diversified. In fact, for mega-cap tech, less than 50% of revenues come from tech-related products. Rather, the bulk of their earnings are more service oriented and derived from the consumer discretionary, communication services, financials and health care spaces.

• Laggards poised for an All-Star second half finish | The Energy, Health Care and Financials sectors are three of the worst performing S&P 500 sectors year-to-date. However, we believe they should have an All-Star second half finish.

- Energy to receive a boost from ‘juiced’ oil prices – The Energy sector has been weighed down by falling oil prices, which are down ~12% year-to-date. This headwind should dissipate in the second half if, as we expect, supply concerns boost oil prices to ~85/bbl by year end. This, combined with oil executives shifting their focus from capex to returning cash to shareholders (Energy has the highest dividend and buyback yield of any sector) should propel the sector higher in the second half of the year.

- Health care ‘defense’ to shine – As the economy begins to weaken in the second half of the year, investors will likely look to a more defensive player. Health Care has not only exhibited above trend earnings and sales growth, but it also has a beta below the S&P 500 which should allow it to outperform in a weaker economic environment. This, combined with below-average valuations and aging demographics should provide a backdrop for Health Care to outperform in 2H23.

- Financials breaking out of their deposit ‘slump’ – Financials were plagued by fears emanating from the regional banking turmoil. However, as loan growth and deposit outflows have stabilized, it appears that much of the slump is behind the sector. As the Fed’s stress tests gave the sector a clean bill of health, expect increased dividends from the sector in the second half. This, combined with rebounding EPS and revenue growth should allow for the Financials sector to regain its positive form.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.