The Curve is Flat… Not So Fast

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

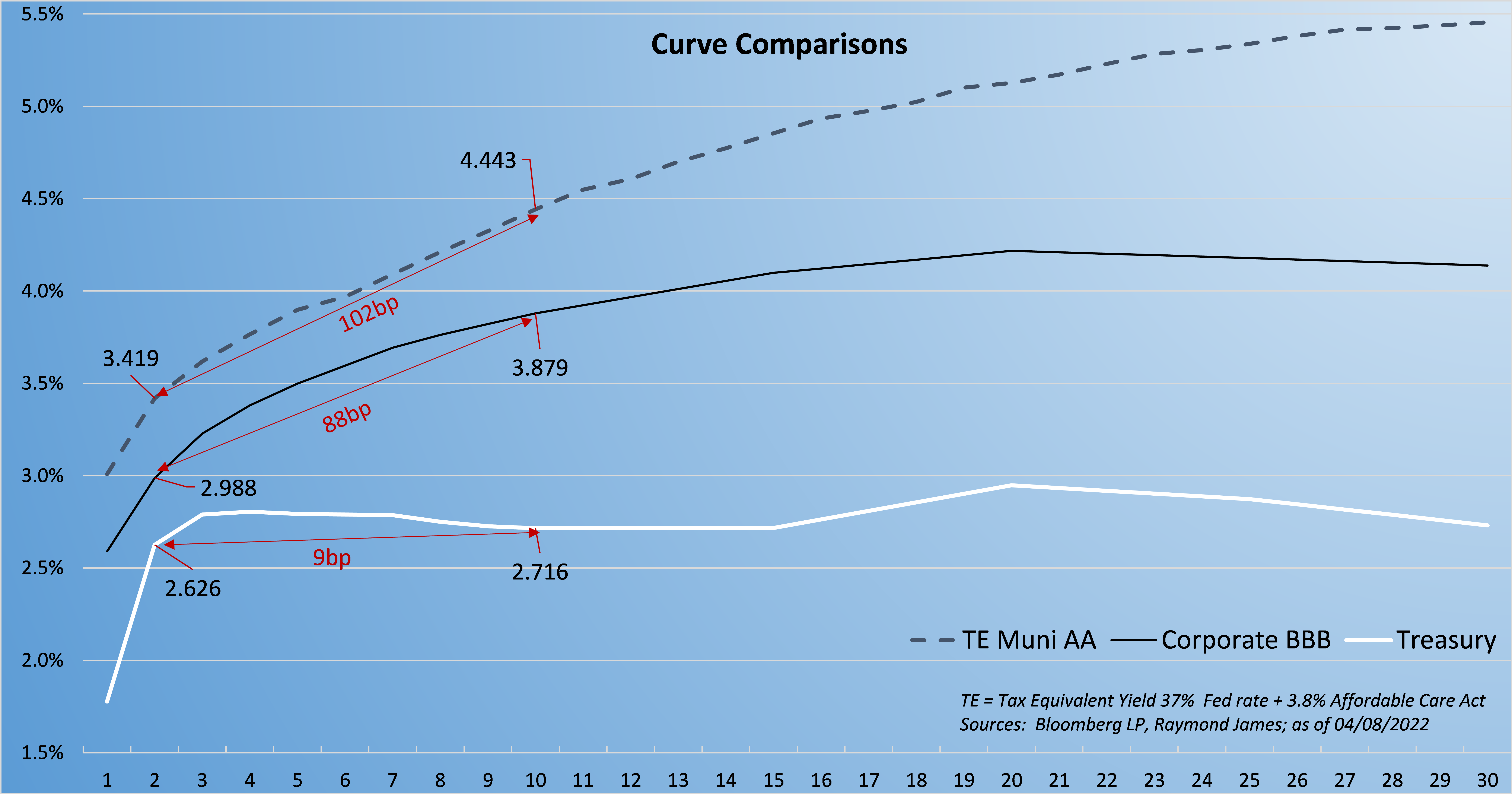

Sometimes the way data is presented or the story around it resonates in a way that can give you an “aha” moment. This week, Mike Petersen, corporate bond trader and managing director, stated the simple truth that fixed income experts have been accentuating for weeks but one that can get drowned out by generic mass media messages: The yield curve is flat. Wait a second. The Treasury yield curve is flat but the corporate and municipal curves not so much.

When the media talks about the curve, they generally are speaking about the Treasury curve; however, many Raymond James’ investors look to the spread markets to provide for their portfolios’ fixed income needs. An examination of the graph below highlights Mike’s point in visual format. Although the curve (Treasury) is indeed flat, the spread curves (corporate and municipal) have significantly greater slope, specifically in the short to intermediate range. What this means to investors is that short to intermediate corporate and municipal individual bonds are providing yields worthy of consideration.

Two significant points. First, corporate bonds are spread to Treasuries. A 10 year corporate bond is typically quoted as the 10 year Treasury yield plus a spread. Municipal bond relative value is typically quoted as a percentage of the Treasury rate. Although expressed differently, both relationships have improved year-to-date. The BBB 10 year corporate index has widened from 121 basis points (bp) to 156bp over the 10yr Treasury. The AAA 10 year municipal index has increased from 69% to 89% of the 10 year Treasury rate.

Second, the Treasury curve itself has gone up significantly. The two year Treasury started the year at 0.73% and is now ~2.51%, a 178bp increase. The 10 year Treasury started the year at 1.51% and is now ~2.70%, a 119bp increase. So a twofold benefit for spread products has transpired: higher Treasury rates and better spreads/relationships to those Treasuries.

Your financial advisor can illustrate how individual bonds are providing outstanding income generating and principal protecting opportunities which haven’t been possible in decades. Ask for a personalized proposal that can demonstrate this fixed income value.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Stocks are appropriate for investors who have a more aggressive investment objective, since they fluctuate in value and involve risks including the possible loss of capital. Dividends will fluctuate and are not guaranteed. Prior to making an investment decision, please consult with your financial advisor about your individual situation.