The Fed is still in charge – fixed income rates are still high

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Everyone loves a story. Let’s face it. With an overload of media outlets competing for an audience, nearly every angle from each economic event is covered by someone. Every plausible, and sometimes improbable viewpoint is cast, providing listeners with options to gravitate toward personal views or ponder alternative outlooks.

The way I see it, there has been one constant throughout the last year plus of market volatility – the Fed. The Fed has been transparent throughout and I see no reason to think they will be anything but the same going forward into 2023. Yes, I believe the Fed is driving the (economic) ship despite plenty of contradicting speculation. I’m not suggesting their actions are agreeable with everyone, only that their movements have been publicized.

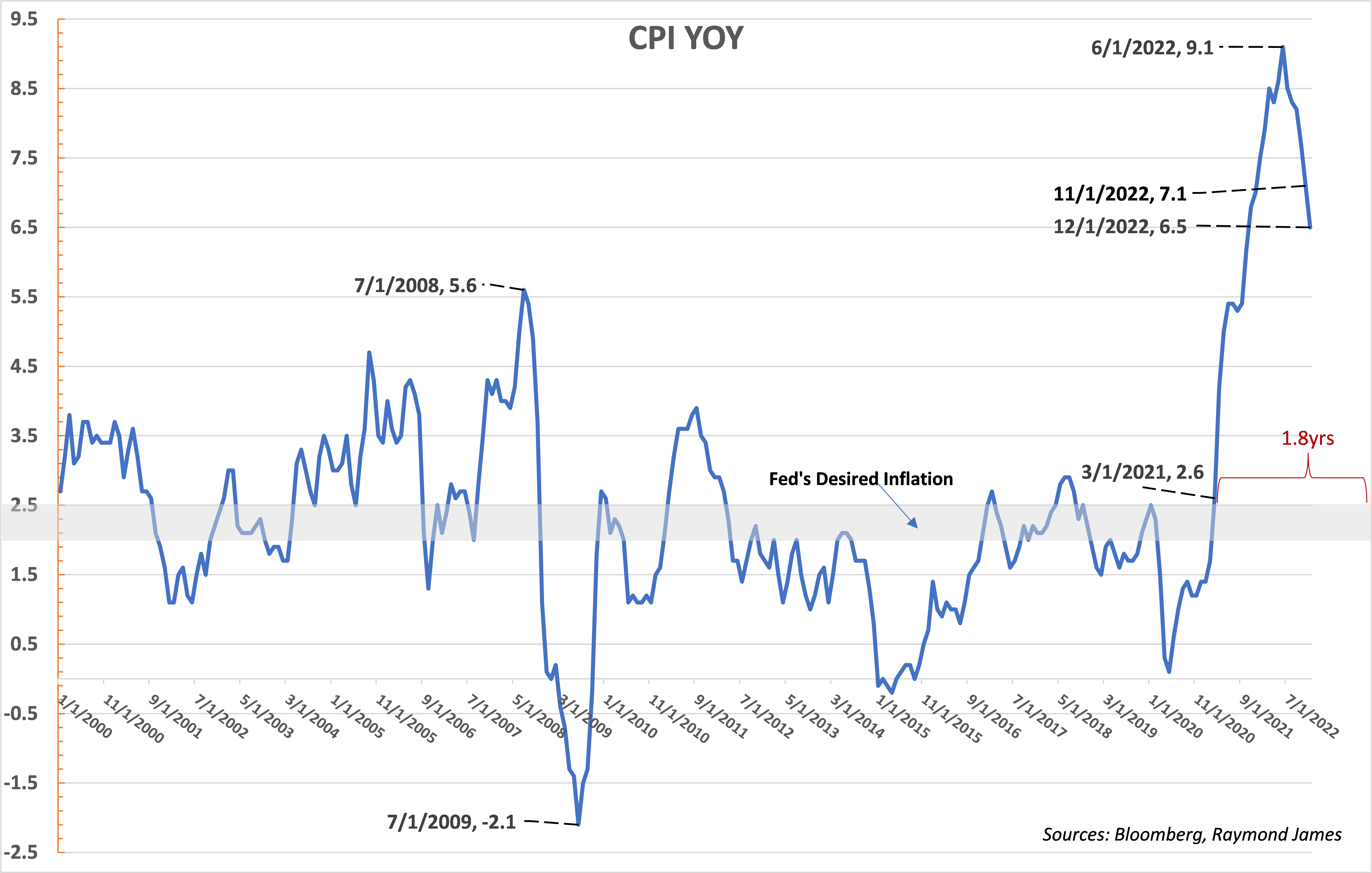

Chairman Powell has signaled his legacy aversion to being labeled the chair that couldn’t control inflation. Inflation is still high. The markets have been and continue to be sensitive to market data or news related to inflation and/or a recession. Last week, the Consumer Price Index (CPI) came at 6.5%, much lower than the previous month’s 7.1% yet much higher than the Fed’s desired 2.0% to 2.5%. It marked the 6th consecutive month of decline since last June’s peak 9.1%. Directionally this is great news; however, inflation remains 4% to 4.5% higher than the desired level. In fairness, the Fed is challenged by two major components to which monetary policy may have little to no effect: the supply chain issues and labor costs.

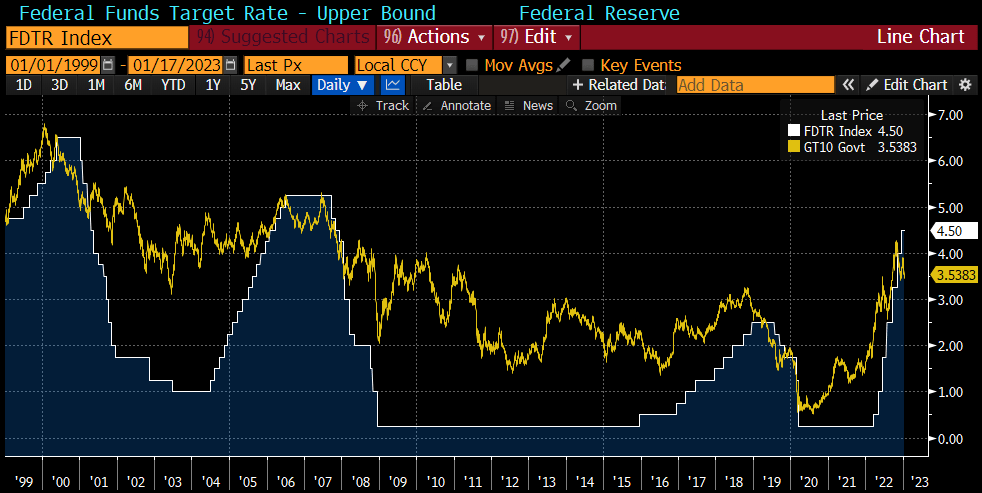

The World Interest Rate Probability published by Bloomberg suggests that the Fed will hike Fed Funds by 25 basis points (bp) during their February 1 meeting and again another 25bp during their March 22 meeting bringing the Fed Funds upper bound rate to 5.0%. The Fed’s desire is to adequately slow the economy down and reduce inflationary pressures. The risk is that by doing so, or by going too far, the pace of the economy will slow too much and push us into a recession.

The employment levels have been resilient despite the Fed’s continued hikes now totaling seven since January 2022, raising the Fed Funds range from 0.0%-0.25% to 4.25%-4.5%. The economy has not gone completely unscathed as the change in Real Average Hourly Earnings has been negative for 21 consecutive months. It is highly likely in this author’s opinion, that the Fed will indeed continue to raise the Fed Funds rate. Why? Because they said so, but also because inflation remains sticky even though some outlets celebrate the current 6.5% CPI level.

It would be easy to argue that we already are in a recession. Forget what you hear and recollect on your recent visits to the grocery store or gas pump. In my opinion, an official recession is inevitable as the Fed continues to push rates and restrict activity. Why is this so important to outline?

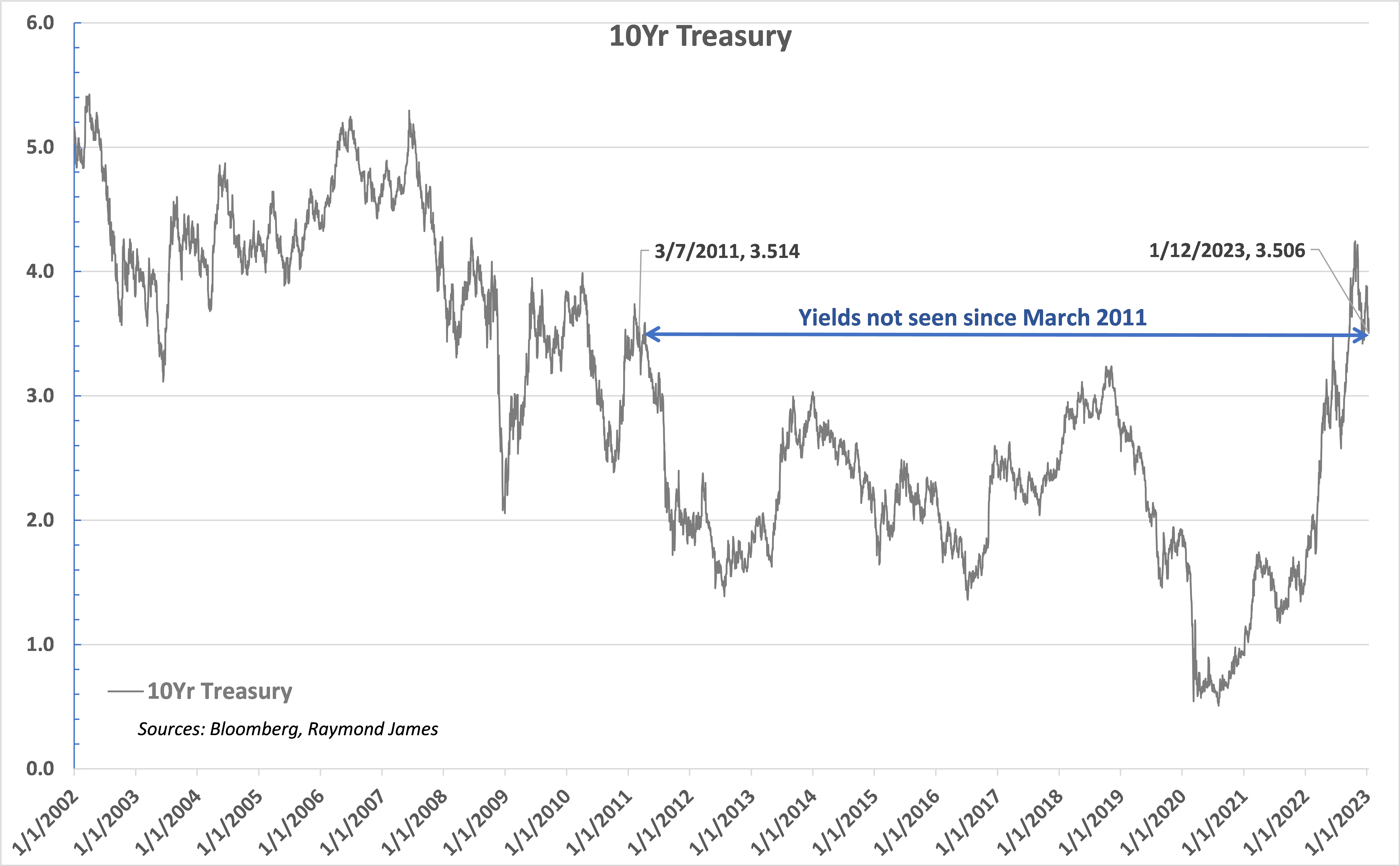

Historically, before or when the Fed tops out short term rates, longer term rates tend to fall. In each of the Fed cycles (white line shaded blue), note that the 10 year Treasury rate (yellow line) falls meaningfully. Fixed income yields are currently at high levels not seen in more than a decade. Take advantage of these rates now while the window of opportunity remains open because when the cycle turns, it may be that interest rates decline and these yields are no longer available.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.