The Fed is still leaning toward a December rate cut

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Holiday shopping season is off to a good start

- The Fed is still leaning toward a December rate cut

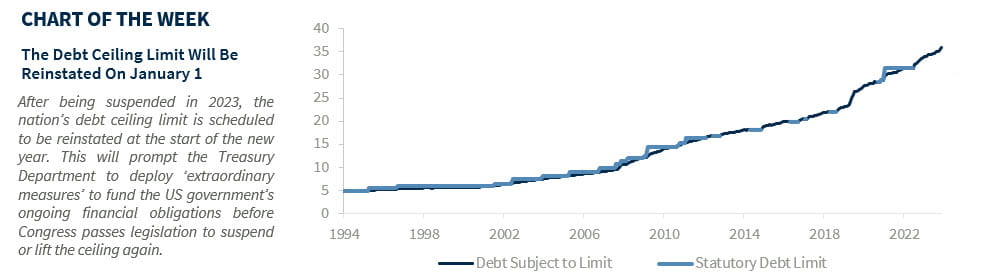

- The debt ceiling reinstatement is rapidly approaching

What a year it has been. The markets sure had a lot to process this year – from surprisingly resilient economic data, to the Fed kicking off its easing cycle to an unprecedented presidential election season. Let’s not forget another year of 20+% gains from the S&P 500, 56 new record highs and massive U.S. equity outperformance relative to the rest of the world. And as we peer out on the horizon, 2025 is shaping up to be another pivotal year. But with 2024 quickly coming to an end, there are several key events on the immediate horizon that are on our radar. Below we list our latest insights on the consumer, the economy and the Fed, the upcoming debt ceiling reinstatement and politics – as each have the potential to shape the outlook. For more insights and commentary on these topics and more, please join our monthly webinar this Monday, December 9 at 4 p.m. EST titled Wrapping Up 2024 – which you can register for here.

- The 2024 Holiday Shopping Season Is Off To A Good Start – The holiday shopping season is the biggest of the year. This year’s holiday shopping season was expected to be strong, with the National Retail Federation expecting spending to rise to a record high of $984 billion – representing 3% growth vs. last year. With both Black Friday and Cyber Monday behind us, the initial strength has played out thus far. Credit card company Mastercard estimated that spending on Black Friday rose 3.4% YoY, with most of the strength coming from online spending, which rose 15%, while in-store spending climbed a meager 1%. The strength online continued through Cyber Monday, with Adobe estimating that online sales were up ~7.3% vs. 2023. Of note: the increase in online shopping highlights a discerning consumer shopping for deals; some of the categories that had the steepest discounts (such as apparel) were among those that had the most activity. Overall, consumer spending should remain healthy, driven by promotional activity – further supporting the disinflationary process.

- The Fed Is Still Leaning Toward A December Rate Cut – The Federal Reserve is holding its final meeting of the year in less than two weeks (December 17-18). While the market is still expecting the Fed to deliver its third consecutive rate cut, the outlook for rate cuts in 2025 has become more clouded given the economy’s resilience. In fact, the Atlanta Fed’s 4Q24 GDP estimate has perked up to 3.3%—significantly higher than the Fed’s growth estimates last quarter. All eyes will be on the Fed’s Summary of Economic Projections which provides updates to the policymakers’ growth, inflation, unemployment, and interest rate outlook. While Fed officials have recently signaled that they are not in a hurry to cut rates as the economy remains in a good place, market participants will closely scrutinize any changes in the upcoming dot plot. The biggest focal point: the Fed’s expected rate outlook and its estimate for the longer-term neutral rate (a policy rate that neither stimulates or restrains growth). Both are likely to be nudged higher from the Fed’s prior estimates.

- Debt Ceiling Reinstatement Is Rapidly Approaching – With the national debt crossing $36 trillion just two weeks ago, the fiscal trajectory of the US government is ringing some alarm bells these days – particularly now that net interest costs are the second largest line item in the budget. With the election behind us, the market will increasingly start to focus on the debt ceiling that is set to be reinstated on January 1. That means the new Congress will have to vote to suspend or lift the statutory limit (which was last set at $31.4 trillion) before the government can issue new debt to pay its obligations. In the meantime, the Treasury Department will deploy a series of extraordinary measures that include spending down its huge cash pile (~$800 billion) and other accounting measures to keep current. The bond market is increasingly worried about stronger growth, the economic impacts (e.g., higher growth and/or inflation) of the new administration’s policy initiatives and the potential for greater Treasury issuance. However, in the near term, the technical backdrop of no new issuance and an injection of liquidity in early 2025 should keep a lid on interest rates and potentially drive them lower in the months ahead.

- New Congress Needs To Get Off To A Fast Start – While there has been a Red Sweep, the new Congress will need to hit the ground running as President-elect Trump will potentially only have a limited window to push through his agenda before the mid-term elections in 2026. Why? Because historically, it has been notoriously difficult to maintain control for four straight years. In fact, in 11 out of the last 13 elections, at least one chamber of Congress or the White House flipped. And despite winning one-party control in all three chambers, it may still be challenging to get things done. That’s because Republicans have razor thin majorities in both the House and Senate. Case in point: The Senate has a 6-seat majority – but that falls well short of the 60 votes needed to pass major legislation, and the House will likely be left with the smallest majority in over 90 years. Bottom line—this could limit some of President-elect Trump’s more ambitious agenda.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.