The Fed remains confronted with a difficult juggling act

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Positive signals on debt ceiling negotiations

- Disconnect between the Fed and bond market continues

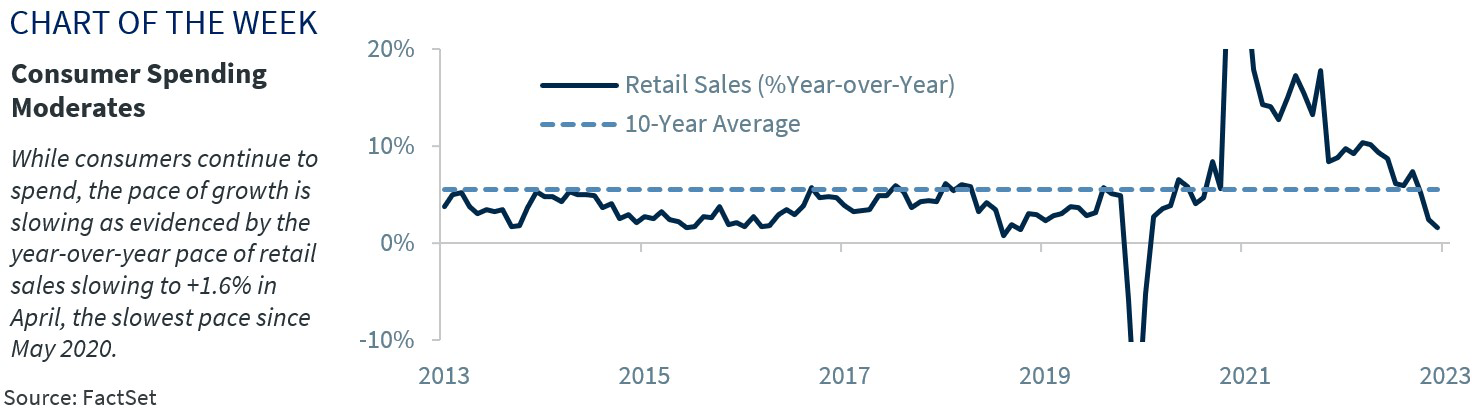

- Continued pullback in discretionary spending

The Ringling Brothers formed their first song-and-dance variety show to entertain enthusiastic crowds across America in 1882. But on this day in 1884, they grew into a one-ring circus act by adding a bear and a trick horse to their show. With its popularity soaring, the five brothers transported their circus across America via the railways. And years later, with the merger of Barnum & Bailey Circus in 1919 – the ‘greatest show on earth’ emerged! Over the next century, the big top tents, flashy costumes, exotic animals, and mesmerizing acrobats captivated audiences worldwide before the final curtain on May 21, 2017. Now when it comes to investing, there are times when the scary news headlines, twists and turns of the market and non-stop political discord feel a bit like a circus. But we’re here to help cut through the chatter to provide insights on where the economy and markets may head. Here’s what we’re focused on this week:

- Debt ceiling circus captures the market’s attention | The political drama around the debt ceiling and the all too often brinkmanship that has resulted from a 1917 law that essentially created the debt ceiling was originally intended to make Congressional leaders’ lives easier, not harder, never seems to end. But alas, here we are again. While both parties agree that defaulting on our debt is not an option, politicians appear to be playing with fire as we rapidly approach the June 1 ‘x’ date. Remember that the ‘x’ date is only an estimate and that there may be some wiggle room around the actual date that the Treasury officially cannot meet its financial obligations. Regardless, with the Treasury’s General Account balance dwindling to ~$68 billion, time is of the essence. The good news is that we are starting to get some positive signals as the negotiations progress, but an agreement remains elusive. The ultimate shape of the deal still needs to be fleshed out, but signs point to some form of compromise, such as rescinding unused COVID relief funds, energy permitting reforms and some yet to be decided spending caps. We remain optimistic a deal will be reached (at least in principle) by May 30 to avoid the worst-case scenario of a default.

- The Fed is still confronted with a difficult juggling act | Fed Chair Jerome Powell (aka ‘the Ringmaster’) opened the door for a pause at the Fed’s June policy meeting without fully conceding that the Fed is done with its tightening cycle. However, there seems to be diverging opinions, with some officials hinting they are leaning toward a wait and see approach after the 500 basis points of tightening, particularly in light of the recent banking sector stresses, while others suggest more rate hikes are needed to see more progress on inflation. But the one area where policymakers’ comments are consistent is that they universally agree that it is too early to be talking about rate cuts. Richmond Federal Reserve President Barkin noted that Fed officials do not want to repeat the mistake of the 1970s and ease interest rates too soon and risk a reacceleration in inflation. While the Fed remains concerned about sticky core inflation, which has teetered around 5.5% for the past five months, we expect inflation to fall sharply on a year-over-year basis in the next few months due to favorable base effects. But despite improving inflation dynamics on the horizon, Fed officials will likely tread carefully to not reignite the ‘animal spirits’ of inflation fears, particularly as growth continues to hold up better than expected, the jobs market remains historically healthy, and the housing market is showing signs of stabilizing. Our economist believes the Fed is likely done raising rates and agrees that market expectations of rate cuts this year are premature.

- Consumers are walking on a tight rope | Consumers have been a pillar of strength during the post-pandemic recovery, buoyed by government stimulus, record low interest rates, a strong labor market and the highest wage gains in over 25 years. But the consumer’s resilience is starting to waver. Yes, consumers are still spending as confirmed by the recent retail sales report, but consumption, particularly in discretionary areas, is starting to soften. This theme was echoed by a few retailer earnings reports this week, with Home Depot, Target and Walmart mentioning consumers continue to pull back on their discretionary spending and have become more price conscious, trading down to lower cost options and waiting for promotions. While increased borrowing has provided a near-term tailwind to support consumption, tighter credit conditions and a softening labor market will likely slow spending in the second half of this year. And speaking of increased borrowing, the New York Fed’s Q1 report on household debt showed that consumers amassed a record $17 trillion in debt, a $148 billion increase from last year and a $2.9 trillion surge since 2019! With more households falling behind on their credit card, auto loans and mortgages, and consumer credit card balances not declining as they typically do in the first quarter of the year, consumer stresses are mounting. A deceleration in consumer spending, which fell to its slowest pace since May 2020, is a key driver behind our expectation of a short and shallow recession later this year.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.