The Hectic Week Ahead

Chief Economist Scott Brown discusses current economic conditions.

The economic calendar is as busy as it can get this week. Reports on consumer confidence, real GDP growth, employment, and manufacturing could alter the near-term outlook. Senior Fed officials have been divided on the appropriate course of monetary policy, but on Wednesday the Federal Open Market Committee is expected to lower the federal funds target range for the third time this year. Chair Powell should signal that this will be it for a while. Future Fed policy decisions will remain data dependent, but central bank officials are likely to view this year’s cuts as providing sufficient insurance against downside risks to the growth outlook in 2020. Still, this week’s figures on the job market, consumer spending, and manufacturing will play a major role in setting near-term expectations for the economy.

Nothing recedes like recession. The key issue in the debate is not whether we are in a downturn; it’s whether we’ll enter one next year. In August, the yield curve had suggested about a 40% chance of entering a recession in the next 12 months. That has fallen to around 30% more recently, a little too high for comfort, but no sure thing. The Fed’s rate cuts, meant partly to insure against the downside risks from slower global growth and trade tensions, have helped, and a third rate cut would further reduce the odds of a recession.

The ISM Manufacturing Index fell into contraction in August and September, and the headline figure is expected to remain below the breakeven level (50) in October. However, it was clear that the factory sector has been in a mild downturn since December. Manufacturing output fell 1.6% in the first seven months of 2019. Figures for August and September were mixed. Still, this isn’t the kind of downturn one would see in a recession. There has been a contraction in energy exploration, which is capital intensive, but nothing like we saw in 2015. U.S. manufacturing receives parts and supplies from around the world, and tariffs have disrupted supply chains, added to input costs, and increased uncertainty. Ongoing problems at Boeing and the strike at General Motors have dampened output, but the trend in new orders has been relatively flat otherwise. Business Fixed Investment fell at a 1.0% annual rate in 2Q19, subtracting 0.14 percentage point from GDP growth. We may see a similar result for 3Q19.

Consumer spending (68% of GDP) rose at a 4.6% annual rate in 2Q19 — strong, but that followed +1.4% in 4Q18 and +1.1% in 1Q19. Spending is expected to have been moderately strong in 3Q19, but monthly figures should show a loss of momentum closing out the quarter. It’s not unusual for consumer spending growth to be uneven over time. However, the weakness at the end of 2018 and into early 2019 is tough to explain away. Presumably, a falling stock market, trade tensions, and the government shutdown reduced holiday shopping last year. Spending picked up after the government shutdown ended, tariffs were postponed, and Chair Powell signaled that the Fed would be “flexible.” The rise of online shopping has made gift buying easier, but a lot of holiday sales were traditionally driven by people walking through the mall and seeing items that they wouldn’t have thought of buying otherwise (ask any dad). In any case, we may be seeing a change in the seasonal pattern of spending.

In its monthly Strike Report, released a week ahead of the employment report, the Bureau of Labor Statistics recorded 46,000 striking workers at General Motors. These will disappear from the nonfarm payroll total in October (returning when the strike is settled). There may be some secondary effects on payrolls, reflecting the loss of production. Adjustments for the school year could add noise and we may see some temporary hiring for the 2020 census (which has lagged where we were in 2009). Accounting for these anomalies, the underlying trend in nonfarm payrolls should slow further. Bear in mind that we currently need less than 100,000 jobs per month to absorb new entrants into the workforce. That pace will slow further over time (a 70,000 monthly average over the next 10 years). Firms continue to report difficulties in hiring skilled workers. Claims for unemployment benefits continue to trend at a low level. Corporate layoff announcements have been trending higher, but remain low by historical standards. Job openings have been trending lower since late last year, but are still elevated.

On October 11, the Fed announced Treasury bill purchases at least into 2Q20, which will expand the Fed’s balance sheet, and conduct overnight repurchase agreement operations (repos) at least through January. The Fed stresses that “these actions are purely technical measures,” and are not to be confused with the Fed’s Large Scale Asset Purchases (LSAP or QE). That hasn’t stopped speculation that there may be something rotten in the credit markets. Chair Powell should try to set that straight this week.

Two FOMC members dissented in favor of no change in rates at the policy meeting in mid-September. These two (and other non-voting Fed officials) believed that policy was already accommodative and that rate cuts could add to financial imbalances. Needless to say, they probably aren’t going to be too happy with another rate cut this week. However, while trade tensions have stopped escalating, global economic concerns remain and inflation continues to trend below the Fed’s 2% goal (September figures arrive the day after the FOMC decision). Another rate cut would further help to insure against downside risks. As in September, the financial markets have mostly factored in another move and the Fed rarely acts against such expectations. Investors will pay close attention to the wording of the policy statement and to Powell’s press conference, where the Fed chair is expected to signal that further cuts are unlikely for a while. The consumer spending data and the employment report will help set expectations for the economy and Fed policy. (M19-2794336)

Data Recap – The economic calendar was thin and the data reports were not market-moving. There was progress ahead of the October 31 deadline, but Brexit appeared headed for another extension. Earnings reports were mixed, but generally positive.

Treasury reported a $984 billion Federal Budget Deficit (4.6% of GDP) for FY19, vs. $586 billion (3.1% of GDP) in FY16.

Boris Johnson reached a Brexit deal with the European Union, but the prime minister failed to secure fast-track approval through Parliament.

The University of Michigan Consumer Sentiment Index was 95.5 in the full-month assessment for October, down slightly from the 96.0 mid-month reading, but up from 93.2% in September and 89.8 in August. The focus of consumers has been on income and job growth, according to the report, while largely ignoring other news. Negative references to tariffs fell to 27%, from September’s 36% (this is consistent with a decrease in news coverage of trade tensions). Only 2% mentioned the impeachment inquiry and 5% mentioned the GM strike.

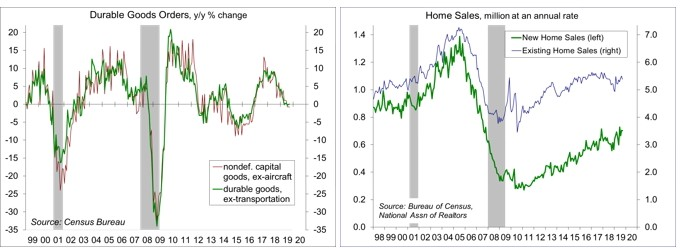

Durable Goods Orders fell 1.1% in the initial estimate for September, reflecting the General Motors strike and ongoing problems at Boeing. Ex-transportation, orders fell 0.3%, with mixed results across industries (primary metals +0.3%, fabricated metals -1.5%, machinery +0.2%, computers and electronics -0.9%, electrical equipment and appliances +0.9%). Orders for nondefense capital goods ex-aircraft fell 0.5% (median forecast: -0.2%), with a downward revision to August. Shipments for this category fell 0.7%: a 0.4% annual rate in 3Q19 (vs. -1.2% in 2Q19 and +1.1% in 1Q19), and down 0.8% from 3Q18.

New Home Sales fell 0.7% (±16.1%) in September, to a 701,000 seasonally adjusted annual rate (+15.5% y/y). Unadjusted sales for 3Q19 were up 13.8% y/y (Northeast +25.0%, Midwest -8.7%, South +21.3%, West +6.2%).

Existing Home Sales fell 2.2%, to a 5.38 million seasonally adjusted annual rate in September (+3.9% y/y). The pace was restrained by low inventories, according to the National Association of Realtors. Unadjusted sales for 3Q19 were up 2.7% from the same period in 2018.

The European Central Bank left short-term interest rates unchanged. In his final press conference as ECB President, Mario Draghi said that “the incoming data since the last Governing Council meeting in early September confirm our previous assessment of a protracted weakness in euro area growth dynamics, the persistence of prominent downside risks, and muted inflation pressures.” However, Draghi also noted that “at the same time, ongoing employment growth and increasing wages continue to underpin the resilience of the euro area economy.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.