The May Employment Report

The May job market report disappointed, but it was hardly a disaster. Nonfarm payrolls were reported to have risen by 75,000 in the initial estimate, following a 224,000 gain in April. Still, downward revisions to the two previous months suggests that the underlying trend in job growth is slowing. Trade policy appears to have something to do with that. Despite the “dismal” job market data, stock market participants were encouraged by increased prospects that the Fed will lower short-term interest rates this summer. Fed action is likely to be conditional on a further escalation of trade tensions, but there’s a good argument to be made for an “insurance” move.

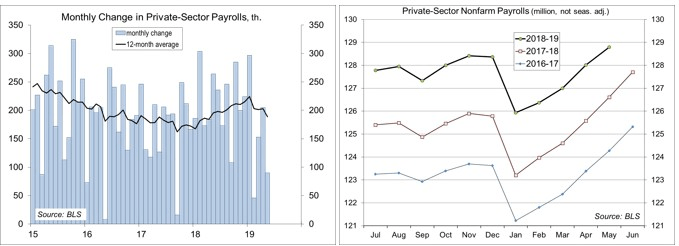

There is a lot of noise in estimates of the monthly change in nonfarm payrolls (reported accurate to ±110,000). Large swings are common. Seasonal adjustment can be tricky. It looks like some of May’s strength was pulled into April. Private-sector payrolls averaged a 149,000 gain in the last three months, a +158,000 average for the first five months of 2019 (vs. +215,000 in 2018 and +172,000 in 2017).

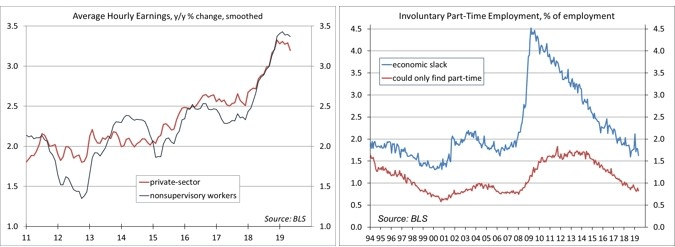

Average hourly earnings rose 0.2% in May (+3.1% y/y), although somewhat stronger for production workers (+0.3% m/m, +3.4% y/y). Still, with the unemployment rate remaining at 3.6% (2.9% for those aged 25-54), it’s surprising that wage growth hasn’t been stronger.

working part-time do so voluntarily. These could be students or someone taking care of child or other family member. The percentage working part-time for economic reasons has been trending lower. However, the Fed’s Beige Book noted that “solid hiring demand was noted for retail, business services, technical, manufacturing, and construction jobs and by staffing agencies in general.” However, “stronger employment growth continued to be constrained by tight labor markets, with districts citing shortages of both high- and low-skill workers.” Competition for workers resulted in some wage pressures across a wide range of occupations, according to the Beige Book, “and induced improvements in benefits to attract more workers and to improve retention of existing employees.”

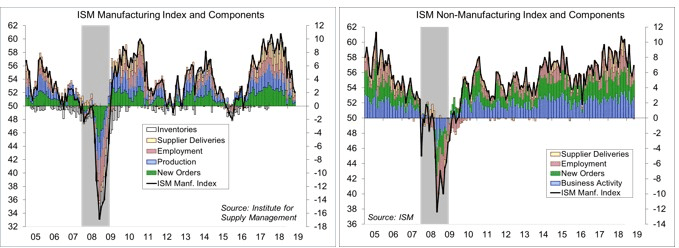

It’s difficult to determine how much of the recent slowing in job growth is due to trade tariffs. Manufacturing payrolls have been little changed over the last four months, consistent with the softening seen in new orders and industrial production. There is no such thing as “U.S. manufacturing.” Our firms get parts and supplies from around the world. Tariffs, and even the threat of tariffs, are disruptive to supply chains.

The pass-through of tariffs to consumer prices has been relatively limited, but the May 10 escalation of tariffs against China will have a more significant impact. However, the inflation effect of tariffs should be short-lived. The bigger impact will be a slowing in consumer spending growth. Tariff actions to date are likely to impose an annual cost of a little over 2% of average household income. However, the impact will fall more heavily on those in the lower half of the income scale. Further tariffs on China (a proposed 25% on the remaining $300 billion or so in imports from China) would likely double that drag, putting the U.S. economy on the cusp of a recession. Tariffs on imports from Mexico would also be disruptive.

How should the Fed respond? Some slowing of growth is welcome as it puts the economy on a more sustainable path. A further escalation of trade tensions would likely require an offsetting response from the central bank. However, we’ve seen President Trump back off on escalating trade tensions in the past (often to follow through on a later date). Still, with rates currently low, the threat of hitting the zero-lower-bound implies that the Fed should be more aggressive in lowering rates than it would be otherwise.

While there is currently some chance that the Fed will cut rates on June 19, that’s not the most likely scenario. The markets currently see a July 31 cut as more likely, and will be disappointed if Powell doesn’t signal so. At the same time, if the Fed expects to cut in July, why not just move now? More aggressive near-term action might be misinterpreted as signaling that the economy is in worse shape than the financial markets believe. Getting the communications right will be critical.

Data Recap – Trade policy remained the primary concern for financial market participants, but inventors were encouraged by the increased likelihood that the Fed will lower short-term interest rates this summer. Economic data reports were consistent with a slower pace of growth in the near term, but not a recession. However, a lot hinges on whether we’ll see a further escalation in trade tensions.

In his opening remarks before the Fed’s Conference on Monetary Policy Strategy, Tools, and Communications Policies, Chairman Powell said that officials don’t know how or when trade negotiations and other issues will be resolved, but “we are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2% objective.”

The Fed’s Beige Book noted that “economic activity expanded at a modest pace overall from the previous period.” Reports on consumer spending were “generally positive but tempered.” Most Fed districts reported “modest or moderate” job growth. “Solid hiring demand” was noted for retail, business services, technical, manufacturing, and construction jobs, and by staffing agencies in general. However, “stronger employment growth continued to be constrained by tight labor markets, with districts citing shortages of both high- and low-skill workers.” Competition for workers reportedly applied some wage pressures across a wide range of occupations and induced improvements in benefits to attract more workers and to improve retention of existing employees. However, “overall wage pressures remained relatively subdued given low unemployment rates.” Prices rose “modestly,” while “the ability of firms to pass increased input costs on to consumers was mixed.”

The May Employment Report was disappointing, but hardly a disaster. Nonfarm payrolls rose by 75,000 (median forecast: +185,000), with a net

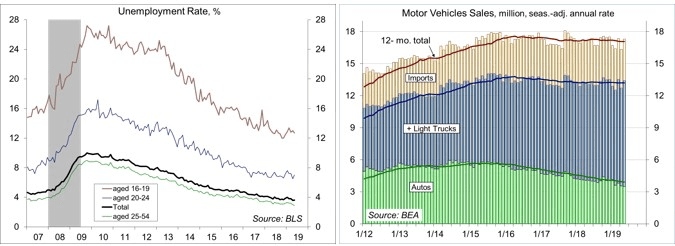

downward revision of 75,000 to the two previous months. Seasonal adjustment issues likely shifted some of May’s strength into April (+224,000), but the underlying trend appears to have slowed. Manufacturing and construction showed modest gains, while retail employment continued to fall (likely reflecting the shift toward online sales). The unemployment rate held steady at 3.6%, but for the key age cohort (those aged 25-54), it fell to 2.9%. Average hourly earnings rose 0.2% (+3.1% y/y), up 0.3% for production workers (+3.4% y/y).

Unit Motor Vehicle Sales rose to a 17.3 million seasonally adjusted annual rate in May, vs. 16.3 million in April and 17.2 million a year ago. Sales of domestically built vehicles rose to a 13.4 million pace, vs. 12.7 million in April.

The ISM Manufacturing Index edged down to 52.1 in May (the lowest since October 2016), vs. 52.8 in April and 55.3 in March. Growth in new orders edged higher (still slow). Production rose more slowly. Employment growth picked up. Input price pressures were modest. “Respondents expressed concern with the escalation in the U.S.-China trade standoff, but overall sentiment remained predominantly positive,” according to the report.

The ISM Non-Manufacturing Index edged up to 56.9 in May, vs. 55.5 in April and 56.1 in March. Growth in business activity picked up. Growth in new orders remained strong. Employment growth improved. Input price pressures were moderate. Respondents were mostly optimistic about overall business conditions, but remained concerned about tariffs and employment resources.

The U.S. Trade Deficit narrowed to $50.8 billion in April, vs. $51.9 billion in March. Imports and exports each fell 2.2%. The merchandise trade deficit slipped to $71.7 billion, vs. $72.7 billion. The surplus on services edged up to $20.9 billion, vs. $20.8 billion.

Factory Orders fell by 0.8% in April (+1.0% y/y), reflecting a 25.2% drop in civilian aircraft orders. Orders for nondefense capital goods ex-aircraft fell 1.0% (+1.2% y/y), while shipments were flat (+3.0% y/y). Results were mixed across industries.

The ADP Estimate of private-sector payrolls rose by 27,000 in the initial estimate for May, following a 271,000 gain in April. Small firms (less than 50 employees) shed 52,000 jobs.

The Challenger Layoff Report showed announce corporate layoff intentions rising to 58,577 in May, vs. 40,023 in April and 31,517 a year ago. The total for the first five months of 2019 was up 39% from the same period in 2018 – still low, but bears watching.

The European Central Bank left short-term interest rates unchanged, but extended its forward guidance. President Draghi, who will step down in October, said that the ECB “is determined to act in case of adverse contingencies and also stands ready to adjust all of its instruments, as appropriate, to ensure that inflation continues to move towards the Governing Council’s inflation aim in a sustained manner.”

The opinions offered by Dr. Brown should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your financial advisor or use the convenient Office Locator to find our office(s) nearest you today.

All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates (RJA) at this date and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the foregoing report is accurate or complete. Other departments of RJA may have information which is not available to the Research Department about companies mentioned in this report. RJA or its affiliates may execute transactions in the securities mentioned in this report which may not be consistent with the report’s conclusions. RJA may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this report. For institutional clients of the European Economic Area (EEA): This document (and any attachments or exhibits hereto) is intended only for EEA Institutional Clients or others to whom it may lawfully be submitted. There is no assurance that any of the trends mentioned will continue in the future. Past performance is not indicative of future results.